B4Bit

2023/02/26 05:04

How to Short Bitcoin and Other Cryptocurrencies?

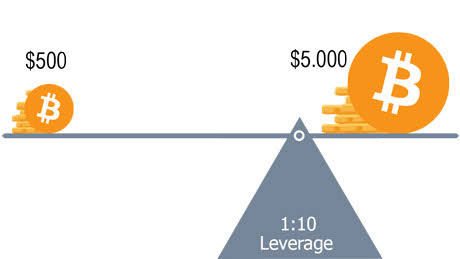

The second role for shorting Bitcoin is the option to hedge a cryptocurrency portfolio. For example, if the crypto portfolio consists of 5 Bitcoin and we want to hedge against the risk of a possible Bitcoin’s decline, a 10X leveraged short position could be opened, and it would be equivalent to 40% of that Bitcoin portfolio.

To open the position, the amount required is only a tenth of it (10 times leverage). That means that we need to hold only 0.2 Bitcoin on the margin exchange in order to hedge 40% of a portfolio valued 5 Bitcoins. Another advantage is the fact that only a small amount is stored on the exchange itself. As you might notice, from security reasons, it’s better to store the least amount possible on crypto exchanges.

56分享

全部評論0最新熱門

暫無記錄