Author:Miles Deutscher

Compiled by: Jiahuan, ChainCatcher

In this article, I will break down my top 10 cryptocurrency predictions for 2026 in detail. These include my price prediction for $BTC, top altcoin narratives, the prospects of crypto and AI integration, and more. This is an exercise I do every year, and it really helps me calibrate my direction for the new year. Even if you don't agree with all the predictions here, I hope this will inspire your thinking and prompt you to create your own list to prepare for this year and capture the greatest upside potential.

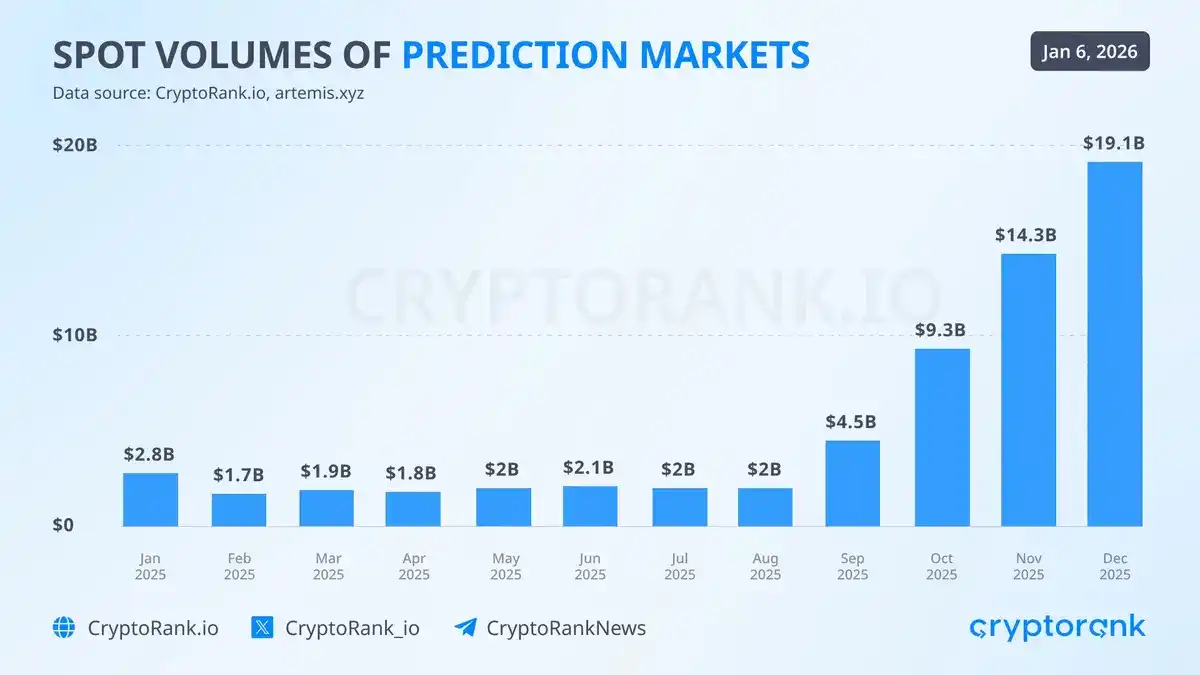

10. Prediction Market Trading Volume to Grow 5x

From January 2025 to today, the trading volume of prediction markets has grown by about 10 times. I believe this trend will continue, and in 2026, we will see at least one month where the volume reaches 5 times the current level. A 5x increase from the current trading volume would equate to approximately $95 billion per month. Another factor to consider is the rise of "adjacent protocols" built on top of prediction markets. For example, @intodotspace is building the first leveraged prediction market. This trend will further amplify trading volume.

9. Explosive Growth in Stock/Metal Perpetual Contracts

The argument here is simple: we will continue to see the proliferation of perpetual contracts in the mainstream—not just limited to crypto token trading. 2025 was the year perpetual futures technology exploded in the crypto space—instant settlement, excellent UI/UX, decentralization, etc. Secondly, gold/metals/stocks are in a fierce bull market. Typically, as the cycle nears its peak, people move further down the risk curve in pursuit of returns (perpetual contracts are well-suited to benefit from small-cap/emerging markets).

In many cases, accessing through crypto channels is easier and faster than buying stocks/gold through traditional finance (TradFi) channels. Due to this combined effect, I believe we will see explosive growth in the trading volume of stocks/metals on perpetual DEXs, and perpetual contract trading will extend far beyond crypto tokens.

8. The "Renaissance" of ICOs Continues

Due to a major shift in the regulatory environment, the public now has unprecedented access to participate in token sales. ICO participation is at an all-time high, and I expect this overall upward trend to continue. If you're interested in profiting from ICOs, I recently published a complete tweet thread and a free Notion template to help you stay organized in this space—you can check it out below.

7. Altcoins with Strong Revenue Models Will Win

The market sentiment has clearly shifted, favoring real businesses over pure speculation and hype. Of course, the latter will always have a place in the market, but more and more investors (both large and small) are looking for real "flywheels" to support token prices (amid a sea of token dilution).

I believe protocols that genuinely generate revenue will continue to dominate. Simply put, protocols with real revenue mechanisms will perform better than those without. Keep an eye on companies/projects/teams that are actually generating revenue.

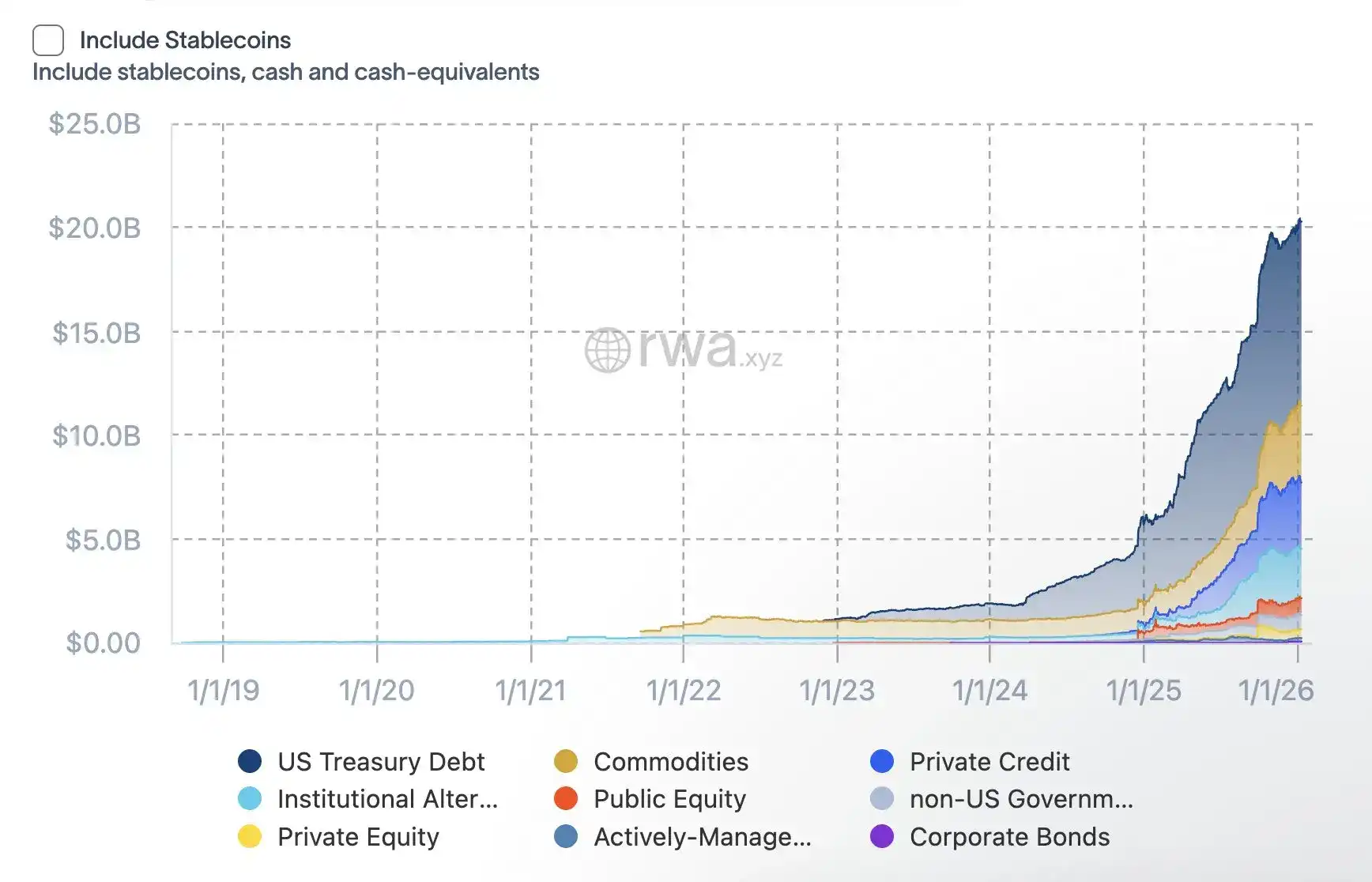

6. RWA Will Have Its Second-Biggest Breakout Ever

I’d love to say RWA will have its biggest year ever. However, technically, it’s hard to beat the $14 billion growth in 2025. I think liquidity will continue to flow into this space, and it will be another fruitful year, but the percentage increase might be smaller than in 2025. 2026 may bring many yield/tokenization opportunities and numerous altcoin trading setups in this field.

5. Neobanks Become the Most Exponentially Growing Sector in Crypto

It feels like we’ve finally reached a tipping point for crypto/stablecoin banking. The infrastructure has finally caught up with demand, and we’re seeing explosive growth in the adoption of many products. Being able to easily convert between cryptocurrency and fiat is a much-needed solution. This sector has the largest total addressable market (basically the entire financial world) and is actively solving problems in developing countries and regions where traditional financial systems are less accessible. This is a huge market, and I expect we will finally (truly) crack it this year.

4. AI / AI Agents Make a Real Comeback

Last January, we either experienced a crazy AI hype season that drove up the prices of Crypto x AI protocols—the only problem was that the technology hadn’t caught up yet. Entering 2026, things are different; the technology can actually deliver on the hype. For me, 2026 is undoubtedly the most critical year for AI so far (just like every year), and as people speculate on AI’s upside, retail interest can easily spill over into the crypto space. Crypto x AI is the perfect synergy. Crypto brings the freedom of financial rails, and AI brings automation, which I believe is the future of finance. I think this will create opportunities in many AI sub-sectors, including x402, robotics, agentic workflows, AI data/infrastructure, etc.

3. Stablecoin Supply to Grow by Over 50%

Last year, the total stablecoin supply grew by 50% (from $200 billion to $300 billion). I believe this year we will see similar growth in stablecoin supply, further catalyzed by the U.S. Clarity Act for stablecoins.

2. Institutional Driving Force in Crypto Market to Surpass Retail

This entire cycle has been institutionally driven (DATs, ETF pushes, etc.). I expect this shift toward institutionally driven markets to continue—which is why I focus on tokens/protocols that can attract institutional interest (back to my point about focusing on real revenue projects).

1. BTC Year-End Price Will Be Higher Than Year-Start

Whether $BTC will experience a crazy "blow-off top" above $150,000 this year depends on many factors: fund flows/buyer demand, DATs, macro background, etc.

Frankly, I’m not sure if the market can gather all the right conditions to trigger that most extreme疯牛见顶 mode. However, I think Bitcoin will close with a bullish price candle at the end of 2026. This means $BTC must close above the $90,000 range.

To summarize my long logic on this (I may go into more detail in a later post): we are likely in the final year of the business cycle, and we’re seeing price bottoming behavior similar to previous years, which makes me believe we will at least close green this year—I’ll dive deeper into my exact thesis on this in the coming weeks, stay tuned.