2025 年第四季度,比特币在跌破 9 万美元关口后持续下挫,累计跌幅达到 30%。尽管这一幅度符合牛市回调的典型特征,但此次调整同时击穿了关键支撑位,致使不少知名分析师对中期走势转向看跌。

这就引出了一个核心问题 —— 比特币需要跌至何种水平,才会满足熊市的判定条件?当前市场是否已经步入熊市?

对于化名分析师 Jackis 而言,即便价格进一步下探至 7 万美元,也不构成 “典型熊市”,而是属于 “2025 年的宏观震荡区间”。他认为,当前市场的疲软表现,只是宏观趋势的阶段性停顿。他进一步补充道:

“但与 2022 年熊市或 2025 年第一季度调整不同,此次下跌并非由基本面恶化或系统性风险因素驱动,本质是原始持有者与机构之间的筹码交换。”

比特币在关键支撑位下方挣扎

不过从价格图表来看,当前比特币的走势已远超月度震荡范畴。历史数据显示,50 周指数移动平均线(EMA,蓝线) 一直是牛市行情的核心支撑。而价格持续运行在 50 周 EMA 下方,正是过去几轮熊市的重要特征。

11 月中旬那场跌破 10 万美元的深度回调,直接让币价跌穿了这一牛市关键支撑位。如果后续无法重新收复该位置,整体看涨趋势或将面临实质性风险。

由此来看,若比特币跌至 6-7 万美元区间,结合 50 周 EMA 的失守状态,大概率会标志着一轮 “熊市” 级别的筑底或趋势反转。从历史走势来看,该区间曾是多轮深度回调的重要支撑位与后续上涨的突破位。就连方舟投资前负责人 Chris Burniske,也认同这一观点。

链上数据显示:比特币亏损程度接近熊市状态

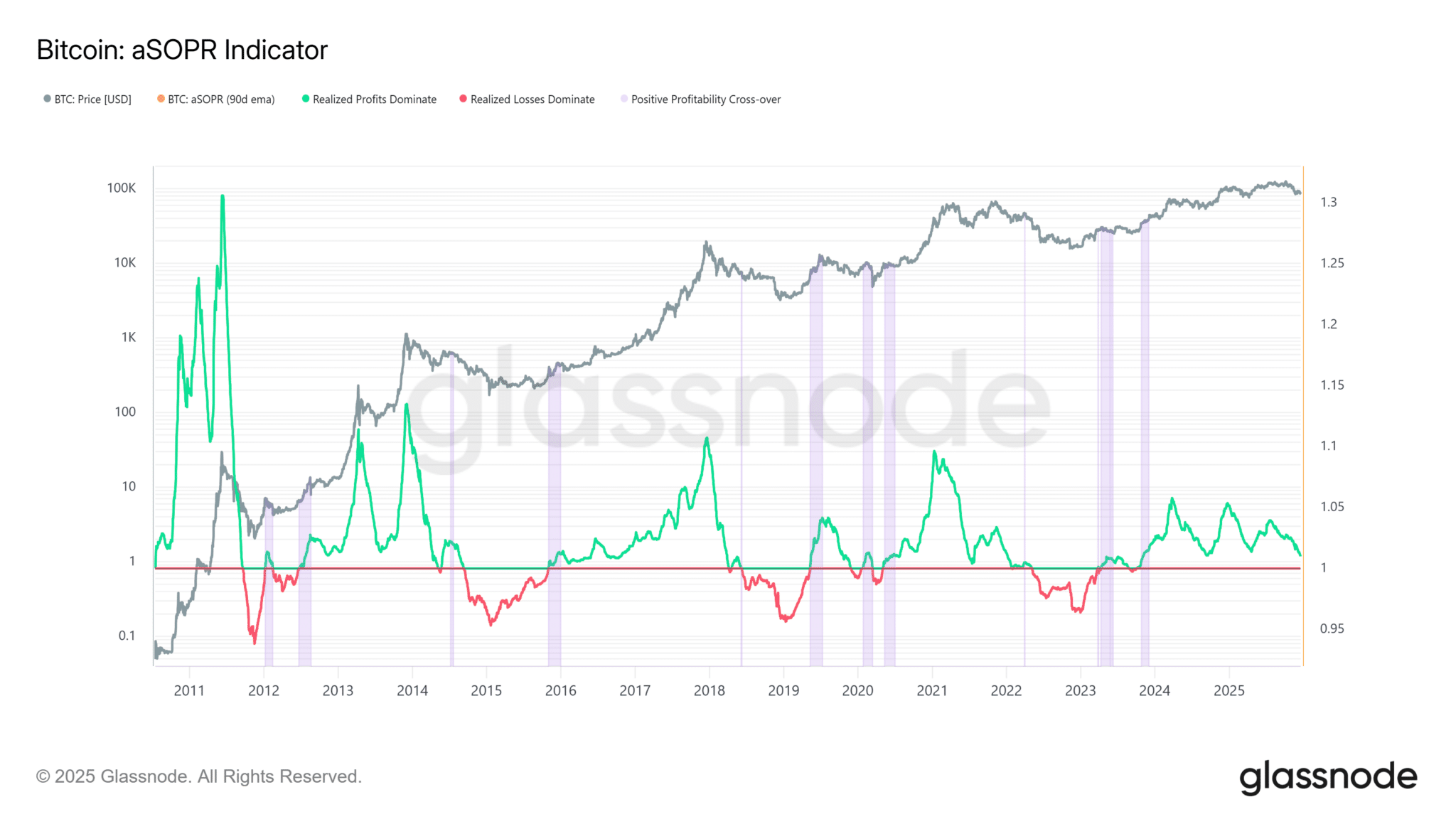

从链上数据维度分析,当前市场状态已逼近全面熊市的恐慌阈值。衡量代币盈亏情况与市场情绪的aSOPR 指标,正濒临跌破 1 的关键分水岭。回顾历史,该指标每一次跌破 1,都会进一步加剧熊市恐慌情绪,同时也往往标志着市场即将迎来趋势反转。

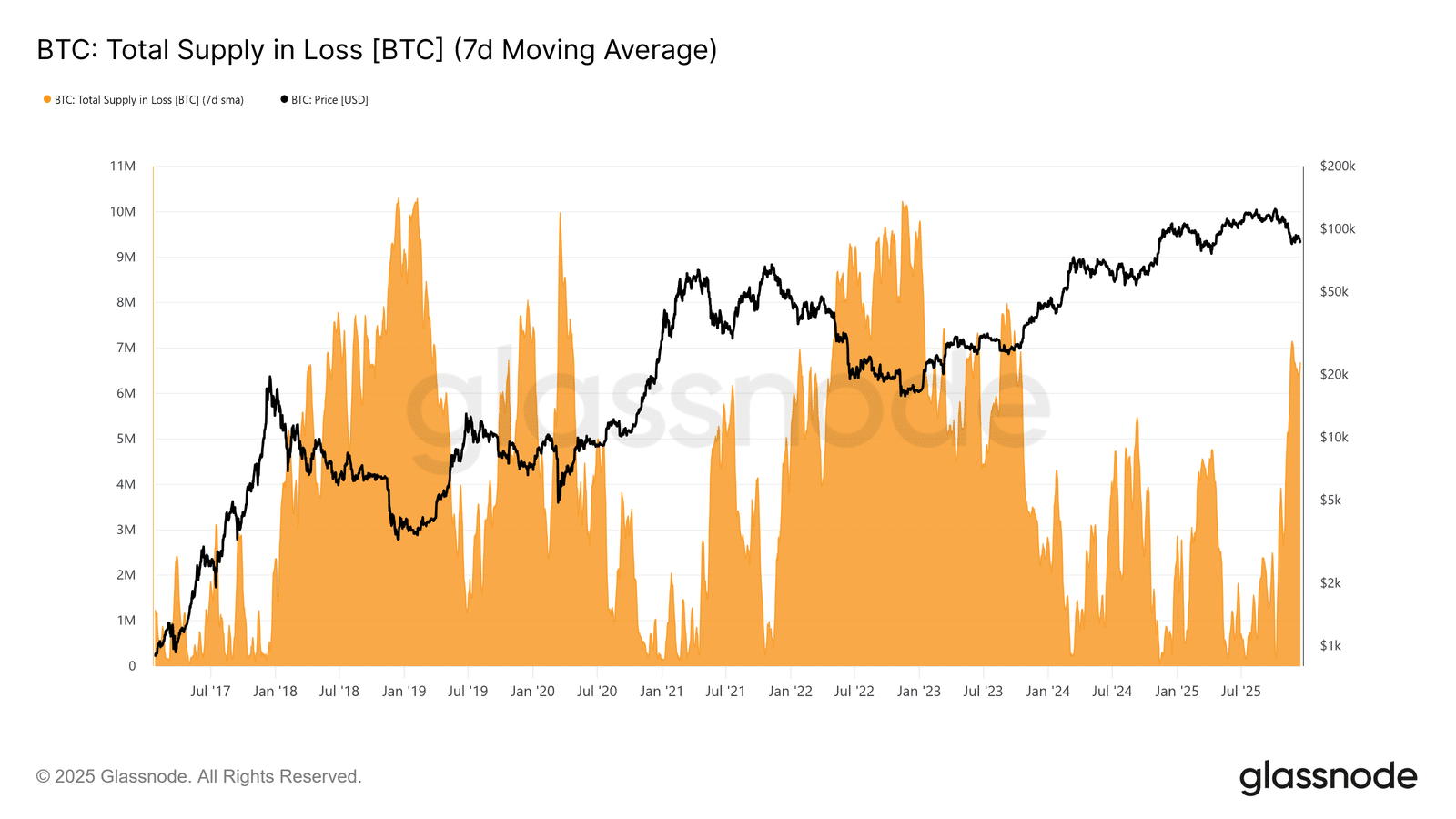

总亏损供应量的数据也印证了这一判断。目前,全网已有约 700 万枚比特币处于亏损状态,创下本轮牛市周期以来的新高。Glassnode 指出,这一数值已十分接近以往熊市周期中 800-1000 万枚的亏损区间。

“这种模式与牛市向熊市过渡的早期阶段高度吻合 —— 投资者的挫败感不断积累,先于明确的熊市特征显现,也先于更低价格区间下的恐慌性抛售加剧。”

总体而言,当前比特币在 8.8 万美元价位承压,叠加 30% 的累计跌幅,市场正承受巨大压力。若后续价格进一步下探至 6-7 万美元区间,很可能会触发与历史熊市相当的大规模恐慌性抛售。

核心观点

若比特币跌至 6-7 万美元区间,或将触发具备历史熊市特征的恐慌性抛售。

若能重新收复 9.8-10 万美元区间,或是站稳 50 周 EMA 上方,将有效强化牛市看涨趋势。