Ethereum appears headed toward a fourth consecutive monthly decline in December, creating pressure on large investors who accumulated throughout the year. The Coinbase Premium Index turned negative during December’s third week, signaling selling pressure from U.S.-based traders.

The indicator measures the percentage difference between ETH prices on Coinbase Pro’s USD pair versus Binance’s USDT pair. Negative readings indicate lower prices on Coinbase, reflecting institutional selling activity. After applying a 30-day exponential moving average filter, the index has remained negative for over one month.

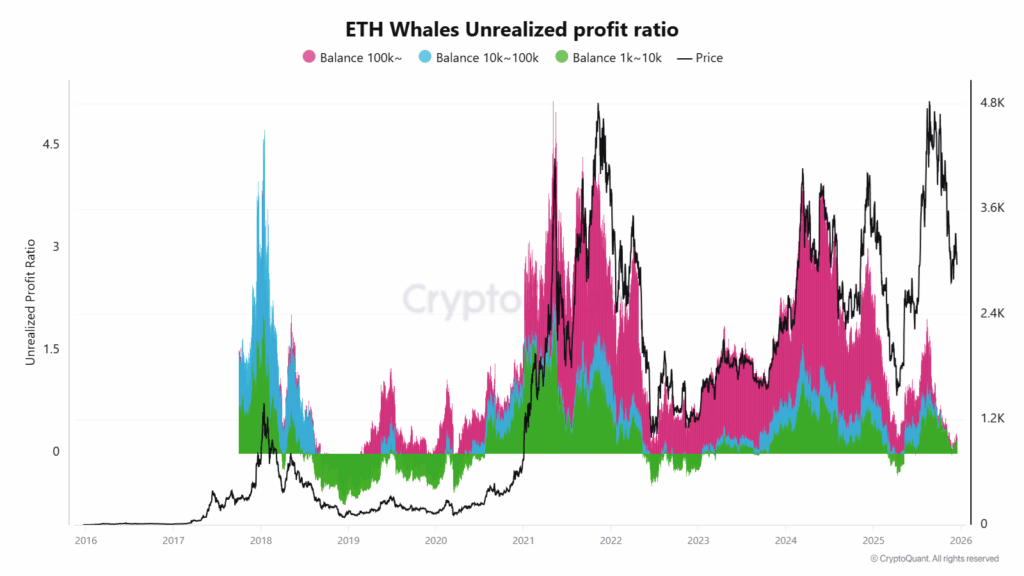

Whale Investors Approach Breakeven Threshold

Data from the ETH Whale Unrealized Profit Ratio tracking addresses holding between 1,000 and over 100,000 ETH shows steady decline over four months. The ratio has approached zero, indicating large investors now hold average cost basis near current market prices with minimal unrealized profit.

CryptoQuant analyst CW8900 stated that these holders did not take profits during this cycle and are increasing positions. This suggests the current price range offers an opportunity to acquire ETH at favorable levels. Continued accumulation at these prices could indicate a potential bottom formation zone.

However, bearish analysis raises questions about outcomes if the four-month downtrend continues. Whale investors would face actual losses in that scenario. Two factors suggest this possibility remains viable heading into year-end.

Active sending addresses for ETH reached the lowest level of 2025 in December. The metric displays a clear downward trend as network activity has cooled. Without retail buying pressure, ETH struggles to generate momentum needed for price breakouts even with institutional demand present.

CryptoOnchain analyst noted that lack of retail participation can limit short-term upside as retail flow typically drives momentum during early recovery phases. The realized price for ETH accumulation addresses serves as key support around $3,000.

These conditions place whale investors in a position requiring action. Selling to recover capital or limit losses could intensify downward pressure. Such movements could potentially trigger panic selling at institutional scale if support levels fail to hold through December close.