文章来源:公众号静静看趋势

加密货币市场在过去24小时内下跌了1.81%,反映了技术面疲软、衍生品交易活动减少以及监管不确定性等多种因素。尽管月度涨幅(+4.2%)保持不变,但今天的下跌与传统市场普遍的避险情绪相符。

技术分析– MACD 看跌,3.93T 美元上限支撑失效

衍生品市场降温——永续合约交易量暴跌 35.6%,融资利率接近中性

监管警告——SEC 2025 年议程和稳定币规则制定磋商

Aster 代币迁移——早期持有者在互换后抛售压力

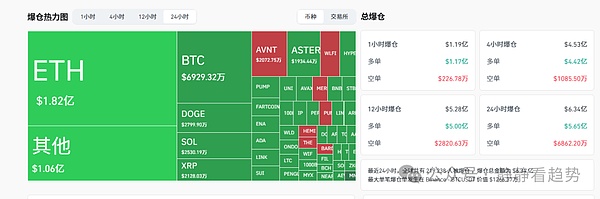

最近24小时,全球共有 219,238 人被爆仓 ,爆仓总金额为 6.34 亿美元,其中多单爆仓5.65亿亿美元,空单爆仓6862.20万万美元。

以下是主要加密资产的最新行情与动态分析:

1.比特币(BTC)

比特币当前价格为$114,268.96,过去24小时内下跌 0.92 %,近7天下跌0.82 %。24小时成交量达 284.4 亿美元,流通供应量为 1,991 万 BTC,当前市值为 2.28 万亿美元。

2.以太坊(ETH)

以太坊当前价格为$4,288.18,过去24小时内下跌 3.35 % ,近7日下跌 6.45 %。24小时交易量为 260.4 亿美元,流通供应量为 1.207 亿ETH,总市值为 5205.4 亿美元。

3.瑞波币(XRP)

瑞波币当前价格为$2.8902,过去24小时下跌 2.42 %,近7日下跌 4.34 %。24小时交易量达到 41.8 亿美元,流通供应量为 1637.3 亿瑞波币,总市值为 1737.9 亿美元。

4.币安币(BNB)

币安币当前价格为$1,030.41,过去24小时下跌 3.71 %,7天内上涨 11.55 %。24小时交易量达到 39.9 亿美元,流通量为 1.3928 亿BNB,总市值为 1437.8 亿美元。

今日加密市场:

加密货币总市值:3.97万亿美元 ;24小时总交易量:2398.6亿美元

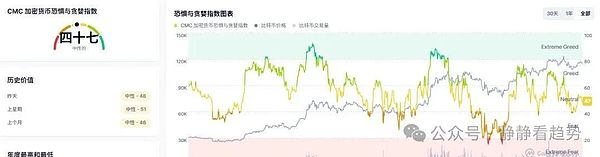

恐惧与贪婪指数:中性停滞

概述:CMC 恐惧与贪婪指数为 47(中性),较昨日下跌 1 个点,较上周下跌 4 个点。这标志着该指数已连续 12 天处于中性区域,为 2025 年 3 月以来持续时间最长的一次。

这意味着:该指数呈现中性,因为尽管月度市值上涨(+4.2%),但交易员仍保持谨慎。缺乏方向性信心与 ETF 流入低迷和监管消息喜忧参半(SEC 2025 年春季计划)相符。

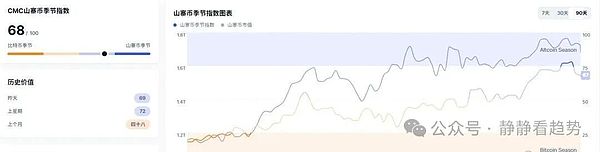

BTC 主导地位及山寨币季度指数

尽管山寨币季度指数维持在 68/100,但 BTC 的主导地位仍升至 57.42%(24 小时上涨 0.35 点)。这种背离表明,在近期山寨币上涨之后,资金正在回流比特币,而 ETH 的主导地位则降至 13.17%(24 小时下跌 0.22 点)。

这意味着:由于宏观不确定性持续存在,交易者可能正在从山寨币(例如 SOL 的 5% 周涨幅)中获利,并回归 BTC。

今日涨幅最大的币子

1.DeXe (DEXE)

价格:US$11.12,24小时上涨 7.97 %

2.Story (IP)

价格:US13.27,24小时上涨 3.96 %

3.World LibertyFinancial(WLFI)

价格:US$0.2338,24小时上涨 3.63 %

今日跌幅最大的币子

1.Aster (ASTER)

价格:US$1.38,24小时下跌 14.56 %

2.SPX6900 (SPX)

价格:US$1.09,24小时下跌 11.51 %

3.Aerodrome Finance (AERO)

价格:US$1.08,24小时下跌 10.48 %

其他主流币种表现

1.Solana(SOL)

价格:US$231.76,24 小时收益:-3.68%

2.USD Coin(USDC)

价格:US$1.00,24 小时收益:0.04%

3.狗狗币(DOGE)

价格:US$0.2470,24 小时收益:-7.83%

4.波场(TRX)

价格:US$0.3387,24 小时收益:-2.10%

5.艾达币(ADA)

价格:US$0.8545,24 小时收益:-4.44%

6.Hyperliquid(HYPE)

价格:US$49.28,24 小时收益:-8.53%

7.恒星币(XLM)

价格:US$0.3693,24 小时收益:-4.51%

8.Sui(SUI)

价格:US$3.49,24 小时收益:-4.57%

9.Chainlink(LINK)

价格:US$22.04,24 小时收益:-5.67%

10.Hedera(HBAR)

价格:US$0.2255,24 小时收益:-6.66%

11.比特现金(BCH)

价格:US$586.42,24 小时收益:-1.92 %

12.Avalanche(AVAX)

价格:US$31.45,24 小时收益:-4.51%

13.Shiba Inu(SHIB)

价格:US$0.00001244,24 小时收益:-3.87%

14.莱特币(LTC)

价格:US$110.50,24 小时收益:-3.35%

15.LEO Token(LEO)

价格:US$9.51,24 小时收益:0.36%

16.Toncoin (TON)

价格:US$2.98,24 小时收益:-3.60%