DeFi数据

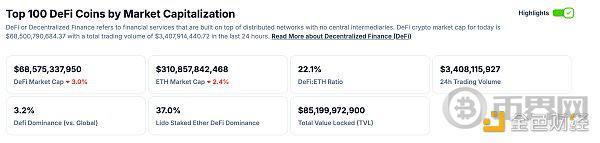

1.DeFi代币总市值:685.75亿美元

DeFi总市值 数据来源:coingecko

2.过去24小时去中心化交易所的交易量34.08亿美元

过去24小时去中心化交易所的交易量 数据来源:coingecko

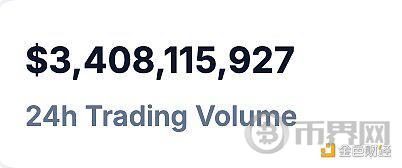

3.DeFi中锁定资产:840.26亿美元

DeFi项目锁定资产前十排名及锁仓量 数据来源:defillama

NFT数据

1.NFT总市值:227.09亿美元

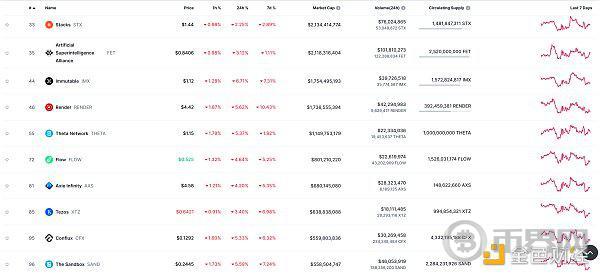

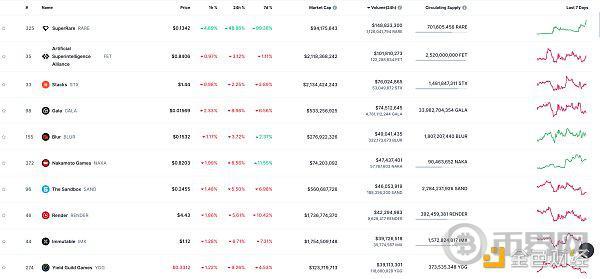

NFT总市值、市值排名前十项目 数据来源:Coinmarketcap

2.24小时NFT交易量:15.72亿美元

NFT总市值、市值排名前十项目 数据来源:Coinmarketcap

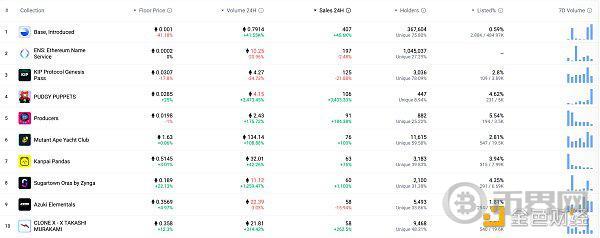

3.24小时内顶级NFT

24小时内销售涨幅前十的NFT 数据来源:NFTGO

头条

迪拜法院承认加密货币为有效的工资支付方式

阿联酋对加密货币的司法方法进行了重大更新,迪拜初审法院承认以加密货币支付的工资在雇佣合同下有效。阿联酋律师事务所NeosLegal的合伙人Irina Heaver解释说,2024年第1739号案件的裁决表明,法院与2023年早些时候的立场有所不同,当时类似的索赔被驳回,因为所涉及的加密货币缺乏准确的估值。Heaver认为,这表明了将数字货币融入国家法律和经济框架的“进步方法”。 Heaver最近提到的案件涉及一名员工,该员工因雇主未支付其工资、非法解雇补偿及其他福利而提起了诉讼。案件的特别之处在于,这名员工的劳动合同中不仅包括传统的法定货币工资,还规定了每月应支付5,250枚EcoWatt代币作为部分薪资。争议的核心在于,雇主在六个月内未能按照合同支付EcoWatt代币部分的工资。2023年,法院首次承认了这份合同中EcoWatt代币的有效性,但由于员工未能提供一个明确的方法将代币转换为法定货币计价,因此法院并未强制要求雇主以加密货币形式支付。然而,在2024年,法院在这一问题上“迈出了重要一步”。它做出了有利于员工的裁决,明确要求雇主按照劳动合同的约定,直接以加密货币形式支付工资,而无需将其转换为法定货币。Heaver表示,这一裁决不仅反映了法院对加密货币在劳动合同中日益增长的接受度,也强调了法院对Web3经济中金融交易变革性质的认可。

NFT热点

1.特朗普从NFT中获利超过700万美元

报道,根据道德监督机构“公民道德”获得的个人财务披露,特朗普申报持有价值100万至500万美元的基于以太坊的加密资产。 此外,特朗普透露,他从三个NFT收藏中赚取了超过715万美元,其中包括针对刑事起诉的“Mugshot”项目和两个独立的唐纳德·特朗普交易卡系列收藏。

DeFi热点

1.以太坊关键支撑区域在2300美元至2380美元之间

报道,据Into TheBlock数据,有约162万个地址在2300美元至2380美元之间购买超过5000万枚ETH,因此如果以太坊继续呈下降趋势,在上述价格区间币价有关键支撑。

2.Worldcoin与马来西亚MIMOS合作

报道,马来西亚官方应用研究与开发机构 MIMOS Berhad 已与 Worldcoin 基金会、Tools for Humanity (TFH) 和电子政府服务提供商 MyEG 签署了一份谅解备忘录,以将 Worldcoin 技术整合到该国的数字基础设施中。 作为谅解备忘录的一部分,Worldcoin 在马来西亚的新运营将为个人提供使用 TFH 为 Worldcoin 项目开发的最先进虹膜成像技术进行人类身份验证的机会。

3.TON网络当前已质押TON 6.499亿枚

报道,据tonscan数据信息,TON网络当前共质押6.499亿枚TON,此外,当前质押APY为3.3%,网络共有387个验证节点。

4.EtherFi、Renzo和AltLayer空投的500万美元代币已出售约三分之一

报道,据Lookonchain监测,此前EtherFi、Renzo和AltLayer向EigenLabs员工空投了价值约500万美元的代币。 EtherFi向44个地址各空投了10,491个ETHFI,总计461,600个ETHFI(峰值为369万美元),其中31.2%的ETHFI已售出。 AltLayer向37个地址各空投了46,512个ALT,总计172万个ALT(峰值为116万美元),其中32.4%的ALT已售出。 Renzo向27个地址各空投了66,667个REZ,总计180万个REZ(峰值为50万美元),其中33.6%的REZ已售出。

5.LI.FI集成跨链交易协议THORChain

报道,跨链桥协议LI.FI集成去中心化跨链交易协议THOR Chain,以实现比特币在EVM链上的无缝交换。此外,THOR Chain已被添加到LI.FI支持的跨链中,并为用户提供代币交换和跨链转账的最优费率。LI.FI还计划扩大对比特币L2解决方案的支持。

6.Symbiotic将于9月推出主网,Frax、EtherFi等14个网络加入共享安全框架

8月16日消息,再质押基础设施提供商Symbiotic宣布首批14个网络加入其共享安全框架生态系统,包括Frax、EtherFi、RedStone、Arrakis、Stride、Capx、Primev、Router、Pragma、Hinkal、Inference Labs、Ditto、RollChains和Leaf。这些项目将利用Symbiotic的技术来增强各自领域的安全性和去中心化程度,涵盖DeFi、预言机、跨链桥接、AI资源匹配、MEV优化、隐私解决方案等多个方面。 此外,Symbiotic计划于9月推出主网,此次合作伙伴的加入显示了市场对其共享安全方案的认可。 此前消息,再质押协议Symbiotic完成580万美元种子轮融资,Paradigm和CyberFund领投。

游戏热点

1.Web3游戏平台GAMEE完成新一轮融资,TON Ventures参投

报道,Web3游戏平台、Animoca Brands的子公司GAMEE宣布完成新一轮融资,TON Ventures参投,新资金将为GAMEE的WAT Coin生态系统(包括WatBird Mini App项目)提供支持。 据悉,GAMEE将进一步将基于TON的数字资产(例如由TON支持的代币和NFT)集成到GAMEE的Telegram Mini App中以增强用户参与度。

2.Epic Games:预计到年底将拥有1亿用户

报道,据市场消息,Epic Games 在欧洲推出 iOS 商店,并在全球范围内推出 Android 商店。Epic Games 预计到年底将拥有 1 亿用户。欧盟以外的 iOS 用户将无法访问商店。

免责声明:作为区块链资讯平台,所发布的文章内容仅供信息参考,不作为实际投资建议。请大家树立正确投资理念,务必提高风险意识。