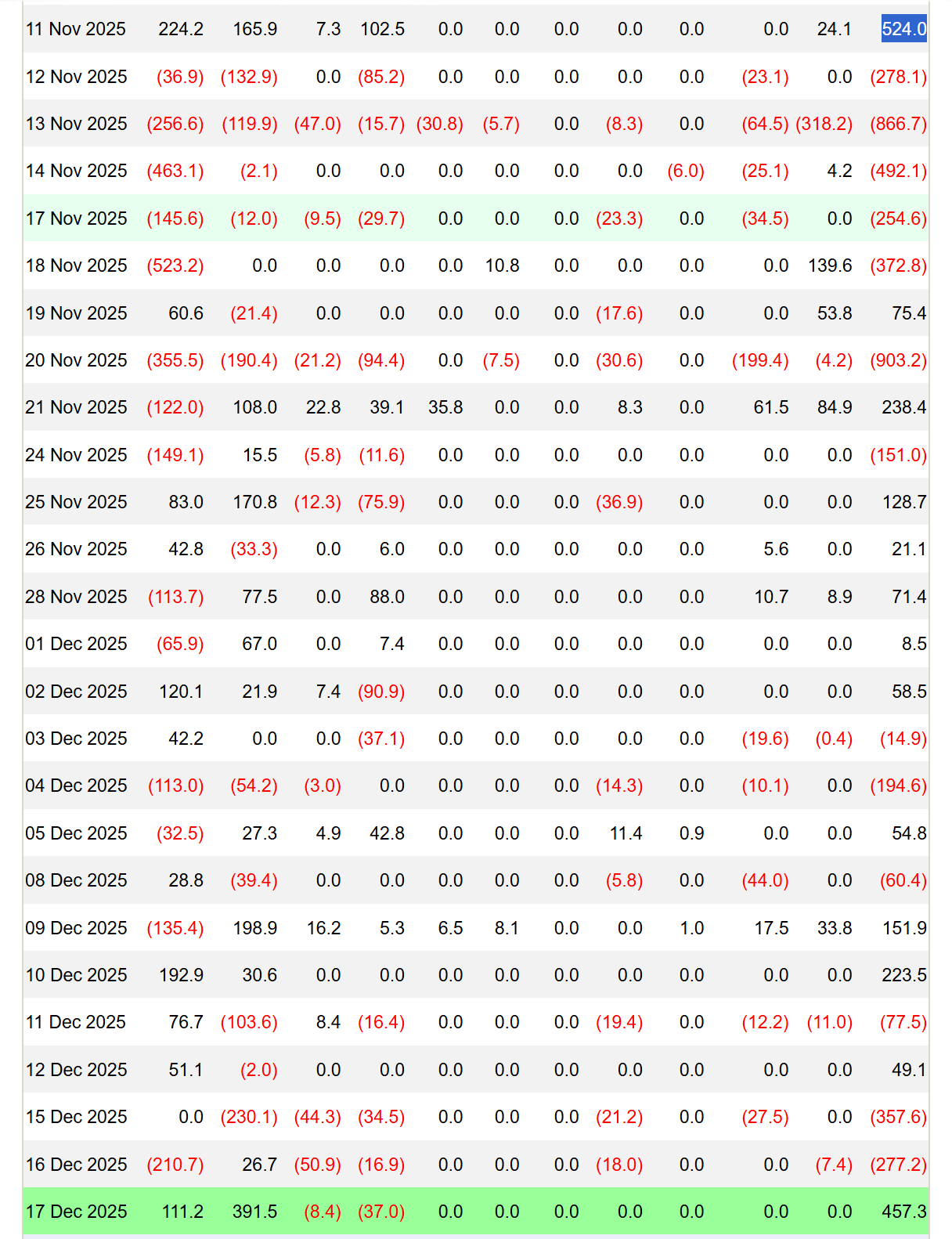

Spot Bitcoin exchange-traded funds (ETFs) recorded $457 million in net inflows on Wednesday, marking their strongest single-day intake in more than a month as institutional demand showed signs of re-acceleration.

Fidelity’s Wise Origin Bitcoin Fund (FBTC) led the inflows, recording the largest daily intake at roughly $391 million, accounting for the majority of the day’s net inflows. BlackRock’s iShares Bitcoin Trust (IBIT) followed with around $111 million, according to data from Farside Investors.

The inflows lifted cumulative net inflows for US spot Bitcoin (BTC) ETFs to more than $57 billion, while total net assets climbed above $112 billion, equivalent to around 6.5% of Bitcoin’s total market capitalization.

The rebound followed a choppy stretch in November and early December, when flows alternated between modest inflows and sharp outflows. Spot Bitcoin ETFs last saw inflows above $450 million on Nov. 11, when funds pulled in roughly $524 million in a single day.

Related: Crypto ETPs to enter ‘cheesecake factory’ era in 2026: Bitwise

Bitcoin ETF inflows show early macro positioning

Vincent Liu, chief investment officer at Kronos Research, said the renewed interest appears to reflect early positioning rather than late-cycle enthusiasm. “ETF inflows feel like early positioning,” Liu said. “As rate expectations soften, BTC becomes a clean liquidity trade again. Politics sets the mood, but capital moves on macro.”

However, Liu cautioned that while momentum could continue, it is unlikely to be smooth. “Momentum likely holds, but expect it to be uneven,” he said. “Flows will track liquidity and price action. As long as BTC remains a clean macro expression, ETFs stay the path of least resistance.”

On Wednesday, US President Donald Trump said he plans to appoint a new Federal Reserve chair who strongly supports cutting interest rates. Speaking during a national address marking the first year of his second term, Trump said he would announce a successor to current Fed Chair Jerome Powell early next year, adding that all known finalists favor lower rates than current levels. Lower rates are usually considered bullish for risk assets like crypto.

Related: Spot Bitcoin ETFs see $358M outflow: Are investors really abandoning BTC?

Around 6.7 million BTC sitting at a loss

Bitcoin has returned to price levels last seen nearly a year ago, leaving behind a dense supply cluster between $93,000 and $120,000 that continues to cap recovery attempts. This top-heavy structure has pushed the amount of Bitcoin held at a loss to 6.7 million BTC, the highest level of the current cycle, according to Glassnode.

The report said demand remains fragile across both spot and derivatives markets. Spot buying has been selective and short-lived, corporate treasury flows episodic, and futures positioning continues to de-risk rather than rebuild conviction. Until sellers are absorbed above $95,000 or fresh liquidity enters the market, Bitcoin is likely to remain caught between structural support near $81,000, per Glassnode.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more