Author: Wenser; Editor: Hao Fangzhou

Produced by: Odaily Planet Daily

Original Title: 4 Key Keywords, Playing the Four Seasons Song of 2025 Crypto

The year 2025 is about to pass. Standing at the end of the "Year of Crypto Mainstreaming," it is time to summarize the four quarters of this year with some keywords and glimpse how the current world has been gradually penetrated and transformed by cryptocurrencies.

The crypto world in 2025 experienced many twists and turns, with sudden rises and falls: from Trump's inauguration as U.S. President in early January to the U.S. launching a tariff trade war in April; from Strategy leading the DAT treasury company trend with floating profits of tens of billions of dollars, to ETH, SOL treasury listed companies, and even altcoin treasury companies blooming and then fading; from stock tokenization platforms being regarded as "the best combination of DeFi and TradFi," to the Nasdaq exchange revolutionizing itself by joining the stock tokenization热潮; from Hyperliquid and Aster on-chain Perp DEX to prediction market duopolies Polymarket and Kalshi with valuations exceeding tens of billions; from the GENIUS stablecoin regulatory bill to the stablecoin热潮 where everyone talks about PayFi; from crypto IPOs to the normalization of crypto ETFs... In the process of countless funds, attention, and regulatory forces clashing, fighting, and compromising, in countless wealth-creating projects, meme jokes, and hacker incidents, in狂热 FOMO, new highs, and争先恐后 buying, in extreme fear, big crashes, and black swans, the annual ring of the cryptocurrency industry's mature tree has added another circle.

Behind the永不眠 money are the浮沉 of meme coin players, the撸毛 people's inability to make ends meet, Wall Street's large-scale co-optation, and the U.S. regulators'抬手放行. Such a year is slightly complex—it is neither a complete bull market nor a冰冷 bear market; compared to the crypto market of the past with clear冷热 and sector rotations, the crypto industry in 2025, under the influence of Trump and many authoritarian government forces,更像是一只上蹿下跳的猴子; some fell from the altar, some rose with the trend, as for success or failure, perhaps our upcoming "2025 Crypto Investment Memoir" (https://wj.qq.com/s2/25044020/b03c/) will reveal more answers.

In this article, Odaily Planet Daily will review crypto 2025 with 4 quarterly keywords.

Crypto Spring: Trump Effect Continues, TRUMP Creates Wealth, Crypto Regulatory Framework Becomes Clearer

In January, Trump officially took office as U.S. President.

Continuing the hot momentum after Trump won the election last year, the crypto market experienced a brief consolidation before BTC prices approached the $100,000 mark again.

And just three days before Trump took office as president, TRUMP, crowned as the "official Trump meme coin," brought the first wave of wealth creation热潮 of the year to many crypto participants.

I still clearly remember that morning when a colleague first shared the TRUMP token contract, its total market capitalization (FDV) was only about $4 billion, but amid质疑 such as "Was Trump hacked?", "The U.S. President dares to issue coins?", "Does Trump want to make a last profit before becoming president?", TRUMP's total market capitalization soared, quickly breaking through $10 billion, $30 billion, and finally reaching over $80 billion.

In this astonishing wealth creation热潮, many Chinese meme players made huge profits, including individuals with profits as high as millions of dollars or even over $20 million. For the list of TRUMP profitable traders, it is recommended to read "Who Made Over a Million Dollars from TRUMP? Winning KOLs and Disappointed ETH Maxis" (https://www.odaily.news/zh-CN/post/5201247).

This was also a "second spring" where the crypto market reignited its upward momentum due to Trump's personal influence after he was elected U.S. President in November 2024.

Soon, the crypto market also offered its own "tribute" to Trump's inauguration as U.S. President—on January 20, after a month, BTC broke through its historical high again (https://www.odaily.news/zh-CN/post/5201277), with the price rising to $109,800.

At that time, everyone regarded Trump as the undisputed "first crypto president." Perhaps many people did not realize at the time that "water can carry a boat but also overturn it." What Trump brought to the crypto market was not only宏观 policy and regulatory environment benefits, but also a series of controversies, harvests, and反复摇摆 brought by his family's crypto projects.

On the other hand, the key point of the "Trump Effect" was whether he could directly improve the U.S. crypto regulatory environment after taking office—

First, whether he could bring法案 and administrative orders with clearer boundaries and more friendly rules for crypto regulation. In this regard, Trump gradually fulfilled some of his promises, including replacing the SEC chairman with Paul Atkins, appointing David Sacks as White House AI and Crypto Director, and promoting the passage of the GINUS stablecoin regulatory bill.

Second, the "BTC national strategic reserve" that the crypto market and many crypto-friendly political figures were concerned about. In early March, Trump signed an executive order to promote the establishment of a U.S. Bitcoin strategic reserve using previously confiscated BTC assets. He特别强调: "Will not increase the burden on taxpayers." For details, it is recommended to read the article "Trump Establishes BTC Strategic Reserve as Promised, but Funding Source Relies Solely on Confiscation?" (https://www.odaily.news/zh-CN/post/5202164).

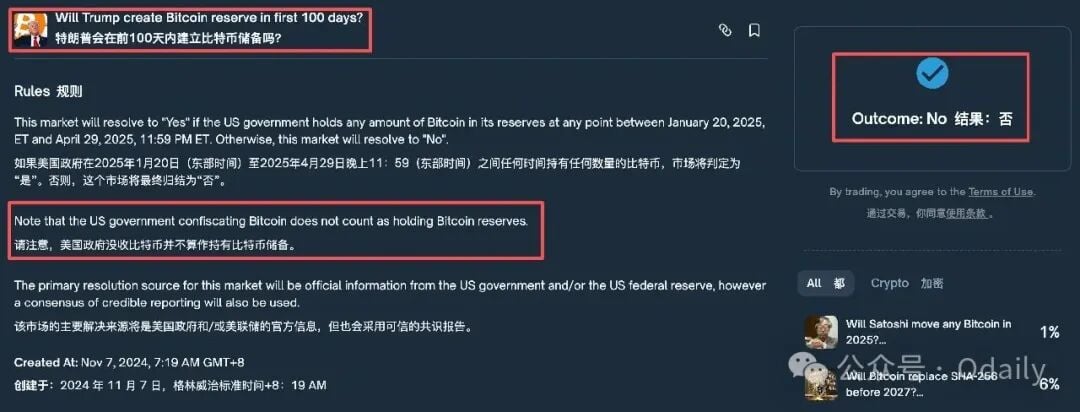

Nevertheless, the final判定 result of "Trump establishes a BTC national strategic reserve within 100 days of taking office" on Polymarket was "No" (Odaily Planet Daily Note: The reason is that the押注 event rules mentioned that U.S. government confiscated assets do not belong to the BTC reserve), which depressed many people, and some even shouted "scam website" in the event comment section.

Polymarket押注 event rule information

At that time, the "insider whales" had already begun to show their prowess. The "50x leverage insider" on Hyperliquid made millions of dollars in profits based on消息 such as "Trump establishes a cryptocurrency reserve." For details of the event, refer to the article "Reviewing the Hyperliquid Contract 'Insider's' Flashy Operations, Accurate Long and Short Open and Close Positions" (https://www.odaily.news/zh-CN/post/5202163).

During this period, there were also many events that plunged Trump into controversy, including the "MELANIA token event" after TRUMP (https://www.odaily.news/zh-CN/post/5201261) and the political celebrity coin LIBRA event triggered by Argentine President Milei (https://www.odaily.news/zh-CN/post/5201715), which were considered the "black幕 masterpiece" of Trump's coin issuance group. In addition, the crypto market in the first quarter also witnessed a series of "historic events," including:

-

Hyperliquid's "most generous airdrop of the year" (https://www.odaily.news/zh-CN/post/5200155) made many on-chain players envious;

-

Bybit was suddenly attacked by the North Korean hacker group Lazarus Group, with $1.5 billion in assets stolen (https://www.odaily.news/zh-CN/post/5201839);

-

The much-criticized Ethereum Foundation underwent a change of guard, with former executive director Aya promoted to chairman (https://www.odaily.news/zh-CN/post/5201952).

And the industry did not expect at the time that Trump, this catfish, would soon let the market witness an American version of "success also Xiao He, failure also Xiao He."

Crypto Summer: DAT Treasury Companies, ETH Breaks New High, Stablecoins Become the Protagonist

At the beginning of the second quarter, the crypto market suffered a heavy blow—in early April, Trump launched a "tariff trade war" worldwide, and the global economic situation became tense for a while. The U.S. stock market and crypto market suffered consecutive heavy blows.

On April 7, on "Black Monday" (https://www.odaily.news/zh-CN/post/5202776), the U.S. stock market lost nearly $6 trillion in market value in a week, including the "U.S. stock seven giants" such as Apple and Google, whose market value evaporated by more than $1.5 trillion. After experiencing nearly a month of震荡行情, the crypto market's暴跌虽迟但到—BTC once fell below the $80,000 mark,最低至 $77,000; ETH fell to a最低 of $1,540, hitting a new low since October 2023; the total crypto market capitalization fell to $2.6 trillion, with a single-day drop of over 9%. Recommended reading: "Deep Dive into the 'Mastermind' Behind the Tariff War, Over $6 Trillion Evaporated Overnight Because of Him?" (https://www.odaily.news/zh-CN/post/5202798)

It was also from then on, after months of market decline打击 and foundation organization reforms, ETH finally generated some momentum and possibility for a触底反弹. Recommended reading: "New官上任三把火, Ethereum Foundation's New Executive Director Reveals Where EF Is Heading?" (https://www.odaily.news/zh-CN/post/5203815)

At the same time, with the east wind of Circle's U.S. stock IPO (https://www.odaily.news/zh-CN/post/5202825), stablecoins and PayFi也逐渐走入了 the mainstream视野 of the crypto market,被视为 by countless people as the "best way for crypto mass adoption." Recommended reading: "10 Years of Stablecoin Wind and Rain, Finally Becoming the U.S. Officially Designated 'Peer-to-Peer Electronic Cash'" (https://www.odaily.news/zh-CN/post/5203857), "The Golden Age of Stablecoins Begins: USDT to the Left, USDC to the Right" (https://www.odaily.news/zh-CN/post/5204268)

In late May, with the order of Ethereum co-founder, Consensys and MetaMask founder Joseph Lubin, the U.S. listed company Sharplink (https://www.odaily.news/zh-CN/newsflash/432311) transformed from a sports marketing company into the first "ETH treasury listed company." Since then, the DAT热潮 has swept the entire cryptocurrency market, and the price of ETH finally walked out of the quagmire of跌跌不休, and successfully broke through the previous historical high of $4,800 a few months later, jumping to a high of nearly $5,000.

Subsequently, "Wall Street神算子" Tom Lee also joined the "DAT treasury热潮" with the U.S. listed company Bitmine. Since then, ETH treasury listed companies have become another "scenery line in the crypto world" after the BTC treasury listed companies led by Strategy.

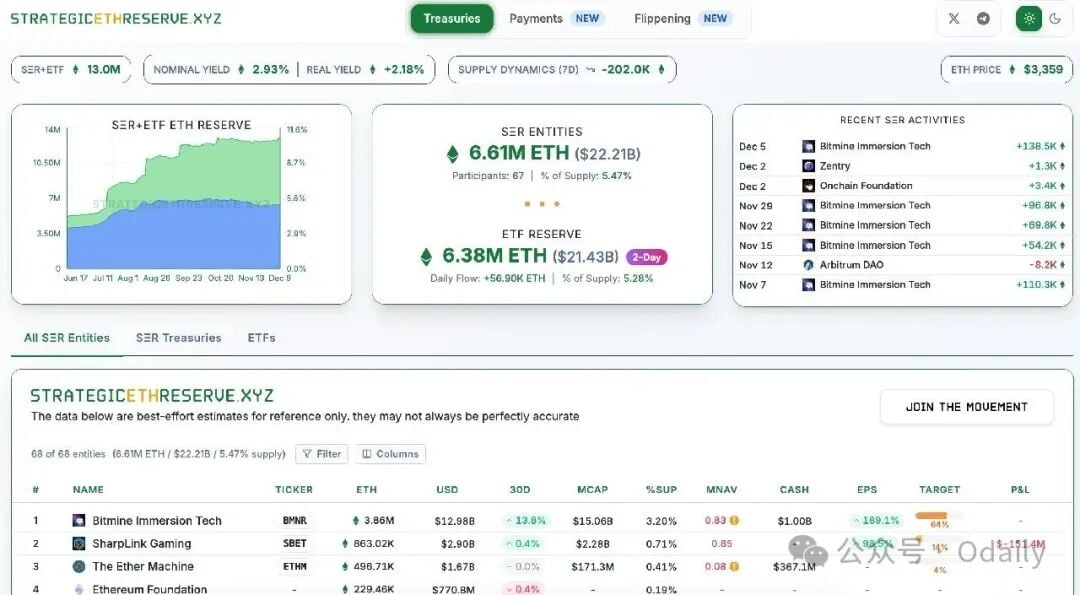

ETH treasury company information at a glance

As of the time of writing, according to strategicethreserve website data, the total number of ETH treasury companies has increased to nearly 70, among which,

-

Bitmine (BMNR) ranks first with 3.86 million ETH holdings;

-

Sharplink (SBET) ranks second with over 860,000 ETH holdings;

-

ETH Machine (ETHM) ranks third with over 490,000 ETH holdings.

It is worth mentioning that the ETH holdings of the above three DAT companies significantly exceed the holdings of the Ethereum Foundation (less than 230,000 ETH).

With ETH treasury companies leading the way, SOL DAT companies, BNB DAT companies, and a series of altcoin DAT companies also sprang up like mushrooms after rain, and their stock prices rose and fell like a roller coaster in the喧闹声 of不甘人后.

In the current冷静期 of the crypto market after passing the狂热 FOMO stage of the early transformation period, ETH DAT companies represented by Bitmine are now facing tens of billions of dollars in账面浮亏, and包括众多 BTC reserve companies在内的 DAT treasury companies, due to the lack of real business support, have even seen an inversion between their market capitalization and crypto assets, with the mNAV (i.e., crypto assets/company market cap) of dozens of DAT companies falling below the level of 1.

The DAT companies in the加密盛夏 were一片欢欣鼓舞, not yet understanding what Zweig meant by "all the馈赠 like gifts in fate have their prices marked in secret," and this price is the一蹶不振 stock price.

Of course, just as death often孕育着新生, in the狂飙突进 of DAT like烈火烹油, the east wind of stock tokenization也逐渐吹到了 the crypto market, and subsequently became an irresistible trend. Even the U.S. stock exchange Nasdaq could not ignore it and could only join this "capital饕餮盛宴" in a self-revolutionary way.

Crypto Autumn: Stock Tokenization, On-chain Perp DEX and Stablecoin Public Chain "Duel for Supremacy"

After experiencing the milestone achievement of Circle (CRCL)强势登陆 the U.S. stock market and achieving a "10-fold stock price surge" at the end of June, the enthusiasm of the crypto market and the traditional financial market for stablecoins and crypto concept stocks升温到了无以复加的地步.

Affected by related利好消息, the Hong Kong stock stablecoin sector and brokerage sector rose one after another, and many Internet giants including京东 and蚂蚁集团 also高调 announced that they即将进军 the stablecoin track, attracting countless side glances. Recommended reading: "Hong Kong Stock山寨季来袭, Can Crypto Concept Stocks Support the Bull Market Backbone?" (https://www.odaily.news/zh-CN/post/5204726)

With this east wind, the RWA track finally迎来 a huge拐点—stock tokenization was正当时.

In early July, exchanges Kraken and Bybit先后 announced the opening of stock tokenized trading through the xStocks platform, supporting dozens of tokenized U.S. stocks including热门美股 such as AAPL, TSLA, and NVDA. Since then, xStocks, which主打 the concept of "on-chain U.S. stock tokenized trading platform," became the only focus under the market spotlight, and MyStonks (now renamed MSX.com) also乘势 attracted a large number of users and investors' attention.

If the successive launches of the BTC spot ETF in early 2024 and the ETH spot ETF in July of that year gave cryptocurrency traders the尊称 of "尊贵的美股交易员," then the emergence of stock tokenization platforms this year truly打通了 "the last mile of on-chain U.S. stock trading," and also allowed包括我这个"臭炒币的" to have the possibility of diversified asset allocation through on-chain tokenization platforms for the first time.

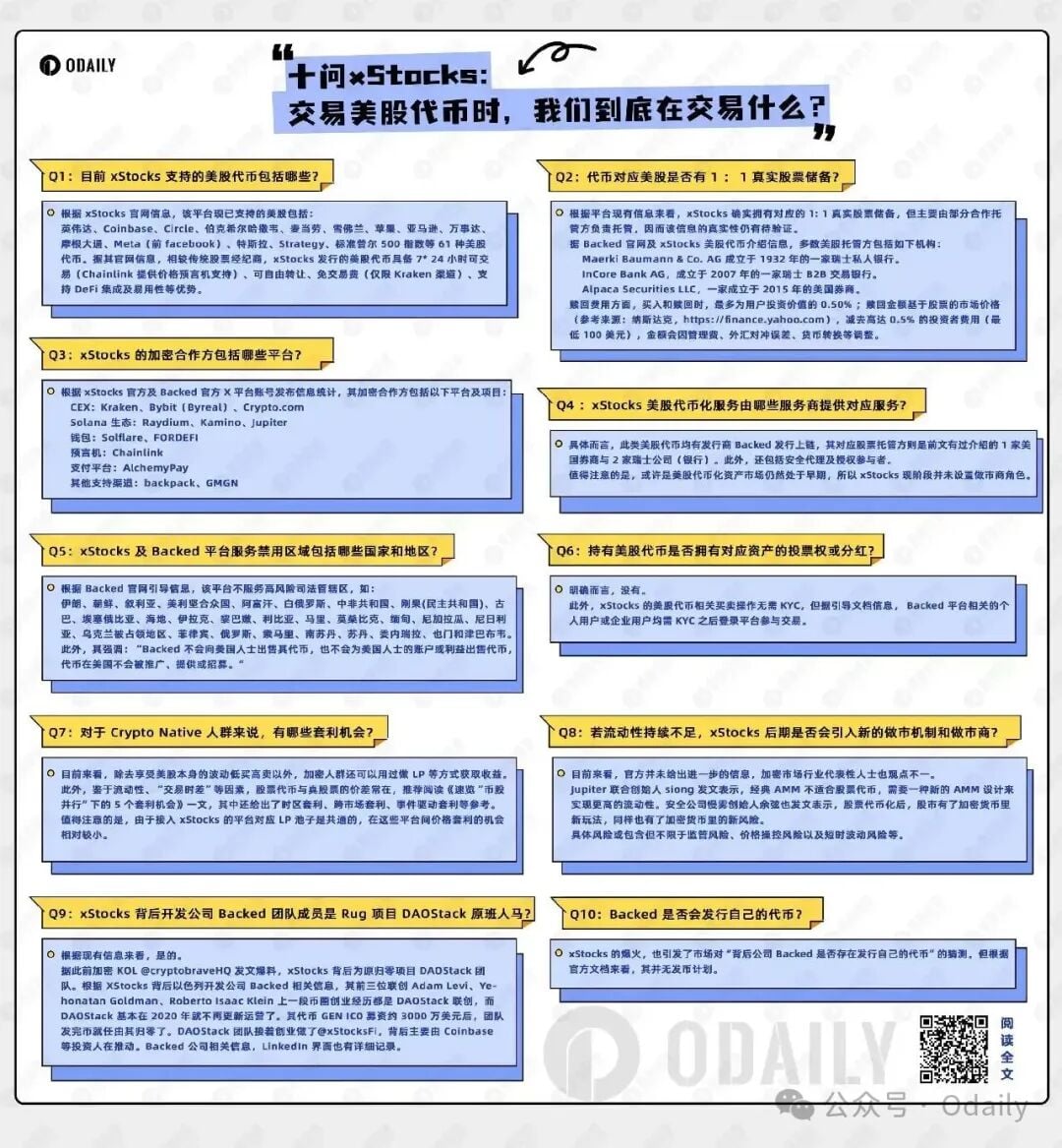

Odaily Planet Daily once introduced the mechanism behind xStocks and tokenized U.S. stock trading platforms in detail in the article "10 Questions for xStocks: What Are We Actually Trading When Trading Tokenized U.S. Stocks?" (https://www.odaily.news/zh-CN/post/5204775). Looking back now, its basic principles and asset management model have not changed much. The difference is that after众多美股代币化平台, traditional giants have also begun their own awakening journey.

10 Questions for xStocks梗概

First, crypto asset management giant Galaxy主动 conducted stock tokenized issuance (https://www.odaily.news/zh-CN/post/5205536); later, the U.S. stock exchange Nasdaq, with quarterly trading volume as high as 10 trillion,主动向 the U.S. SEC submitted a "tokenized stock trading application" (https://www.odaily.news/zh-CN/post/5206200). On the broad track of asset issuance and trading, the嗅觉 of traditional giants is丝毫不差.

At the same time, the feast of the crypto native market belonged to 2 major sectors:

First, the "on-chain Perp DEX war" after Hyperliquid—Aster in the BNB Chain ecosystem contributed another wealth creation奇迹 to the crypto market with a暴力至极的"拉盘," and many people直言 "sold飞 millions of dollars";

Second, the 2 major wealth creation奇观s of the stablecoin track: one was the generous airdrop provided by the "wealth management deposit activity" (https://www.odaily.news/zh-CN/post/5206488) initiated by Plasma, which顶着 the name of "stablecoin public chain supported by Tether CEO." Some people even deposited $1 and received an XPL token airdrop worth over $9,000, with a return rate of over 900 times; the other was the official launch of the Trump family crypto project WLFI. With the momentum of its stablecoin USD1, people received收益回报 of up to over 6 times the public offering price of $0.05 and $0.15.

Looking at the prices of XPL and WLFI now, it is难免让人唏嘘. According to Coingecko data, the price of XPL is temporarily reported at $0.17, down nearly 90% from the high of $1.67; the price of WLFI is temporarily reported at $0.15, down nearly 50% from the high of $0.33.

At that time when countless people sighed that opportunities were unlimited, little did they know that what awaited the crypto industry would be an "epic级清算" far exceeding any暴跌 in history.

Crypto Winter: After the 10·11 Great Crash, TACO Trading Is Verified Again, Prediction Market Welcomes Two Ten-Billion Valuation Giants

After experiencing BTC's price hitting a new high of $126,000 in early October, people were expecting the crypto market to continue the往年 "Uptober" trend. However, an "epic级大清算" on October 11 shattered illusions and hopes.

And the trigger this time still pointed to Trump—on the evening of October 10, Trump announced that he would impose 100% tariffs, and the panic index soared. The three major U.S. stock indices fell to varying degrees. The Nasdaq index fell nearly 3.5%, the S&P 500 fell 2.7%, and the Dow Jones index fell 1.9%.

The crypto market encountered exchange system problems,叠加 the market's惊弓之鸟般的脆弱心理, BTC最低 touched $101,516, with a 24-hour drop of 16%; ETH最低 touched $3,400, with a 24-hour drop of 22%; SOL had a 24-hour drop of 31.83%. For a time, altcoins were血流成河.

The losses caused by this epic清算 far exceeded previous大暴跌 events such as 3·12, 5·19, 9·4, etc. The real爆仓 scale of the crypto market was at least around $30 billion to $40 billion.

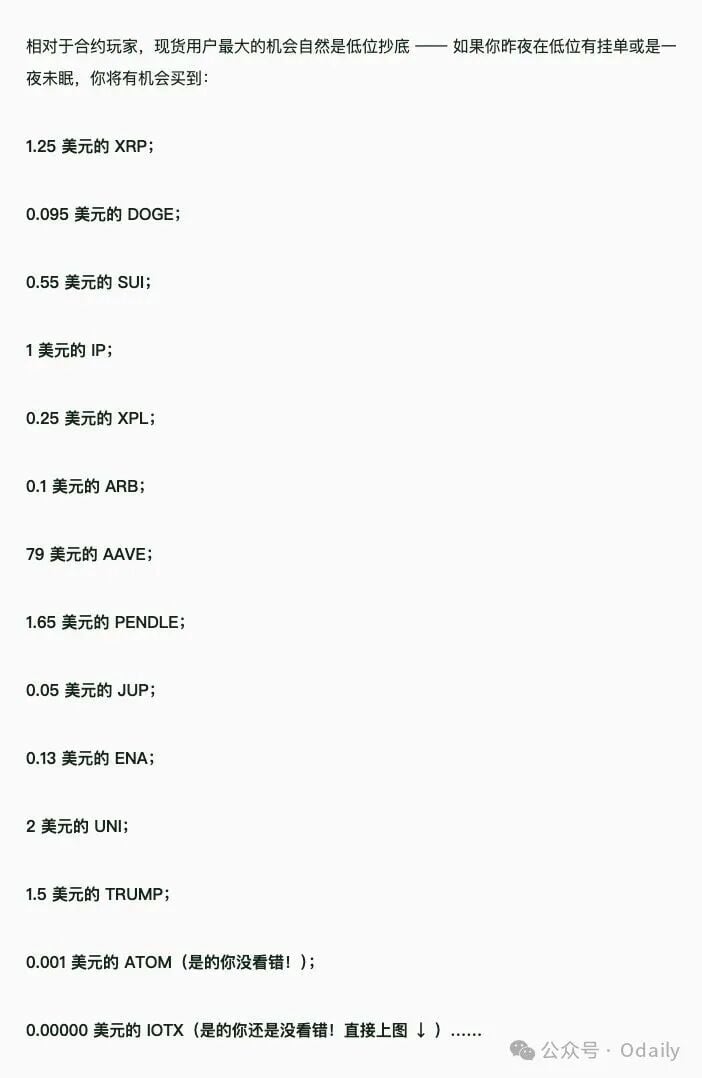

Of course, opportunities are hidden in risks. As Odaily Planet Daily mentioned in articles such as "In the Great Crash, Who 'Licked Blood from the Knife' and Made Hundreds of Millions? What Wealth Opportunities Are Right in Front of Us?" (https://www.odaily.news/zh-CN/post/5206774) and "The Whale Dagger War Behind the Largest Liquidation Day in Crypto History: Shorts Full,提刀离席" (https://www.odaily.news/zh-CN/post/5206772)—whether it was high-leverage shorting or buying the dip, many people made a lot of money from this chaos.

Risk also represents opportunity

And when the "TACO" trading style (Trump Always Chicken Out) was verified again, the crypto market finally began a slow self-repair. Unlike before, many traders had lost most of their assets in that "Black Friday," became一蹶不振, and黯然退场.

It was also in such a糟糕的市场环境下 that prediction market platforms represented by Polymarket and Kalshi gradually became one of the few hotspots and trading stages in the crypto market. Their valuations continued to rise rapidly in just a few months. After completing the latest Series E $1 billion financing led by Paradigm, Kalshi's valuation soared to $11 billion; Polymarket, after completing the previous $2 billion financing led by ICE Group, the parent company of the New York Stock Exchange, is seeking a new round of financing with a valuation of $12 billion to $15 billion.

兜兜转转, the crypto market returned to Polymarket, the prediction market platform that successfully predicted Trump's election in the "2024 U.S. Presidential Election" event. And after going through the four seasons, the mainstreaming and popularization process of the cryptocurrency industry continues.

Where is the future heading? U.S. regulation and traditional finance still largely determine the direction of the tide and the length of spring and winter. And we, these crypto gold diggers, can only follow the waves and审时度势, perhaps to find our own wealth treasures.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Exchange Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush