Author: Bitget

Today's Outlook

1. Cointelegraph reports that the Chicago Board Options Exchange (CBOE) has approved the listing and registration of the 21Shares XRP ETF.

2. Sygnum survey: 60% of high-net-worth respondents in Asia plan to increase their cryptocurrency purchases.

3. Cointelegraph reports that Japan's Financial Services Agency (FSA) has released a report planning to shift the regulation of crypto assets from the Payment Services Act (PSA) to the Financial Instruments and Exchange Act (FIEA), regulating them as investment products.

Macro & Hot Topics

1. On December 10 local time, the Federal Reserve announced a 25 basis point cut in the benchmark interest rate, reducing it from the current 3.75%–4% range to 3.5%–3.75%. This marks the Fed's third consecutive rate cut, with a cumulative reduction of 75 basis points. Additionally, Trump criticized the Fed for its weak rate cuts, and "another Kevin" is undergoing a final interview today.

2. "Fed Whisperer": Three rate cuts fail to resolve internal disputes; beware of "stagflation risks."

3. Powell: The Fed is shifting to a wait-and-see strategy; rate hikes are not the baseline expectation for now.

4. Analyst Ali: Six out of the seven FOMC meetings this year have led to a pullback in BTC prices.

Market Trends

1. Over the past 24 hours, the cryptocurrency market saw $423 million in liquidations, with long positions accounting for $286 million. BTC liquidation volume was $153 million, and ETH liquidation volume was $125 million.

2. U.S. Stocks: The Dow Jones rose 1.05%, the S&P 500 fell 0.67%, and the Nasdaq Composite rose 0.33%. Additionally, Nvidia (NVDA) fell 0.64%, Circle (CRCL) fell 0.53%, and Strategy (MSTR) fell 2.3%.

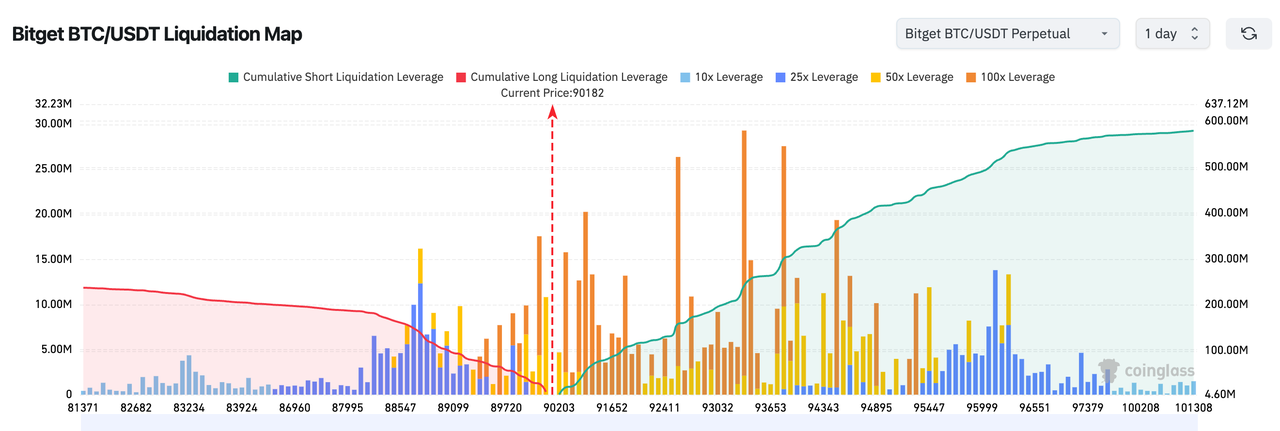

3. Bitget BTC/USDT liquidation map shows: The current BTC price (around $90,182) is the most concentrated liquidation point for high-leverage long positions (50–100x). A drop could trigger significant cascading long liquidations. However, the cumulative short liquidation volume below is much larger than the long liquidation volume above, meaning that if the price continues to rise, short liquidations could provide stronger upward momentum.

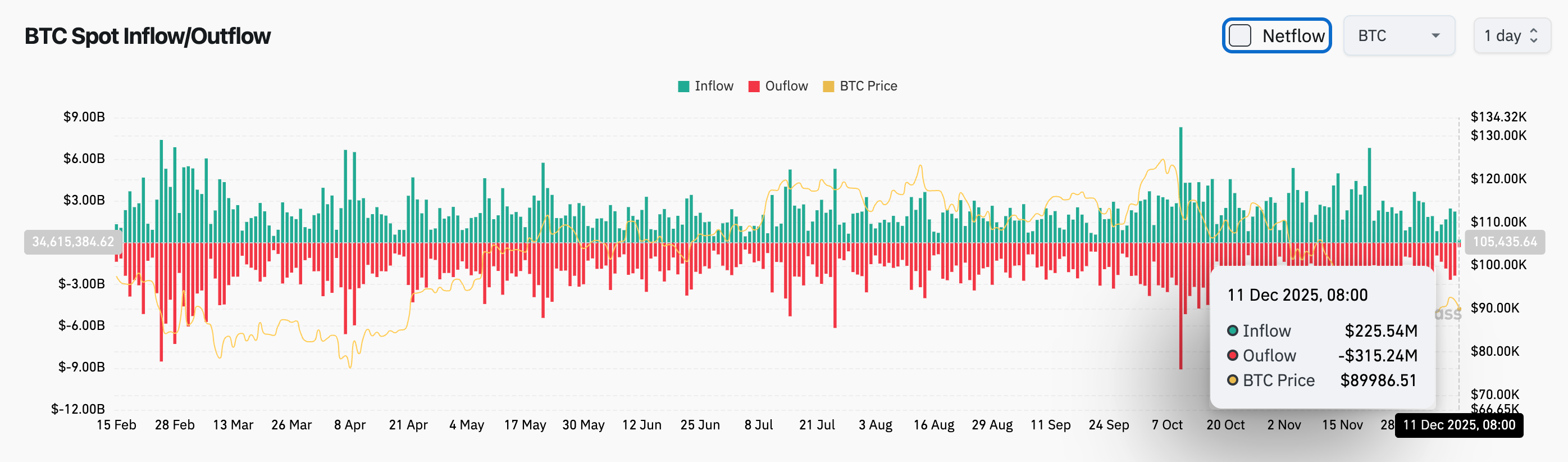

4. Over the past 24 hours, BTC spot inflows were approximately $225 million, outflows were approximately $315 million, resulting in a net outflow of $90 million.

News Updates

1. Michael Saylor criticized MSCI's plan to exclude companies with high cryptocurrency holdings from its indices.

2. GameStop (stock code GME) holds Bitcoin worth $519.4 million, with a Q2-Q3 holding loss of $9.2 million.

3. SpaceX plans to raise over $30 billion in its IPO, potentially the largest in history. Bloomberg reports that if SpaceX goes public in 2026 with a $1.5 trillion valuation, Elon Musk's net worth would jump from the current $460.6 billion to approximately $952 billion, with his SpaceX stake alone valued at $625 billion.

Project Developments

1. Figure plans to introduce the securitized stablecoin YLDS to Solana. YLDS is a securitized stablecoin designed to maintain a fixed dollar price and provide continuous yield through U.S. Treasury bonds and repo agreements.

2. The U.S. government transferred 1,934 WETH and 13.58 million BUSD from the seized FTX Alameda funds to a new wallet.

3. State Street Bank and Galaxy plan to launch a tokenized liquidity fund in early 2026. The fund will use stablecoins to enable round-the-clock investor liquidity, expanding the use of public blockchains in institutional cash management.

4. VanEck has renamed its Gaming ETF to "Degen Economy ETF," focusing on new business models in the digital economy.

5. Crypto AI platform Surf raised $15 million in funding, led by Pantera Capital.

6. Sei will partner with Xiaomi to pre-install the Web3 payment app on new phones globally.

7. ETHZilla acquired a 15% stake in digital mortgage platform Zippy for approximately $21 million.

8. SpaceX transferred 1,021 BTC to a new wallet, worth $94.48 million.

9. Bitmine purchased an additional 33,504 ETH from FalconX, worth $112 million.

10. Yesterday, global asset management giant Invesco filed an 8-A form with the U.S. Securities and Exchange Commission (SEC) for its Invesco Galaxy Solana ETF. This step typically occurs just before a product's official launch, with trading often starting the next day.

Disclaimer: This report is generated by AI, with human verification for information only. It is not intended as investment advice.