Bitcoin miners, which can acquire the cryptocurrency at below-market costs, could be in the best position to shape corporate adoption as accumulation by crypto treasury companies slows, says BitcoinTreasuries.NET.

Bitcoin (BTC) treasury companies are projected to buy 40,000 BTC in the fourth quarter, the lowest since Q3 2024, BitcoinTreasuries.NET President Pete Rizzo said in a corporate adoption report released on Thursday.

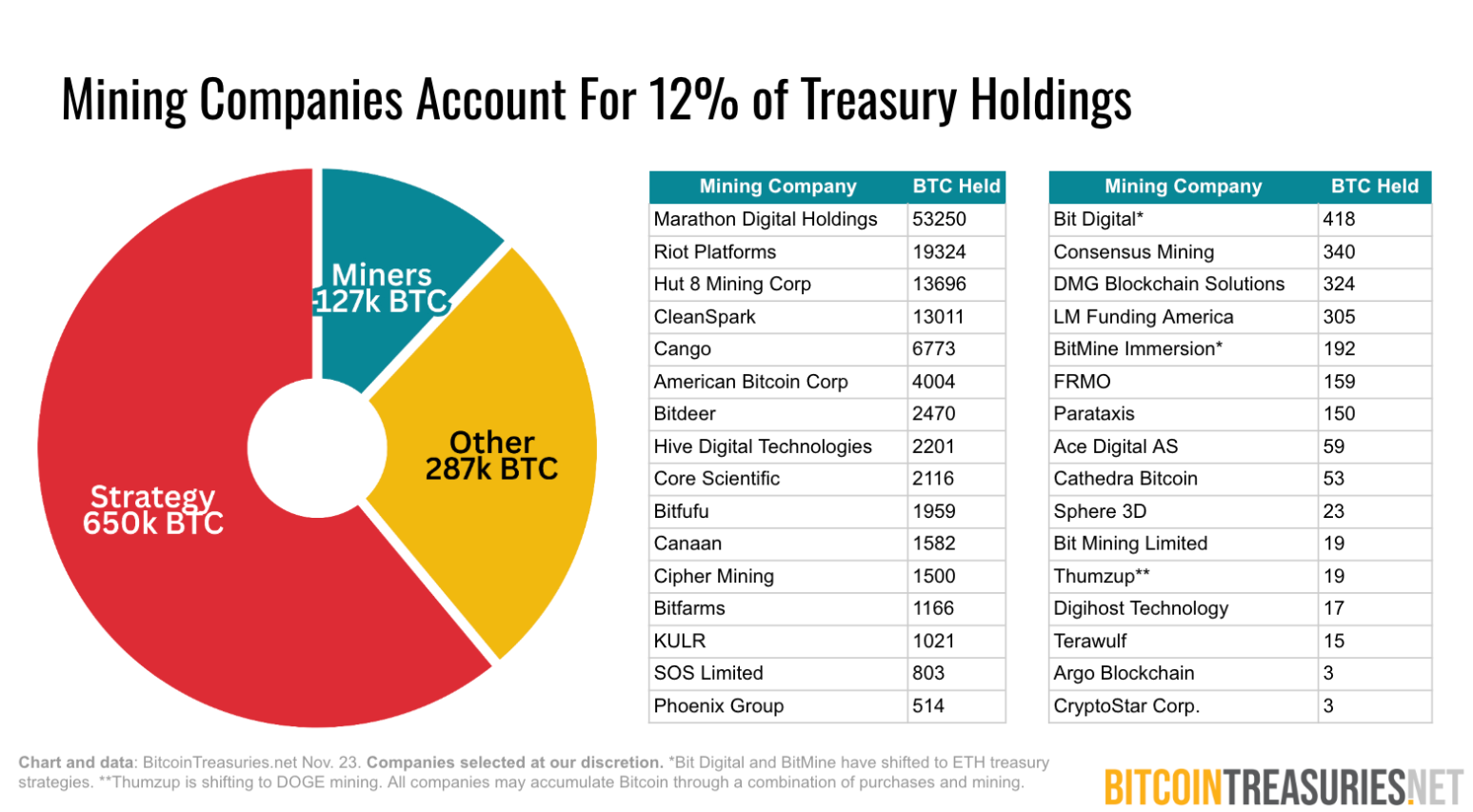

Despite the slowdown, Rizzo said Bitcoin mining companies continue to “anchor public‐market Bitcoin holdings” and accounted for 5% of new additions and 12% of aggregate public company balances in November.

“Because miners can acquire BTC at an effective discount to spot markets via block production, their balance sheets may become increasingly important in supporting corporate adoption, especially if other treasuries pause or slow purchases,” he said.

Miners already among top Bitcoin holders

On average, miners generate about 900 Bitcoin per day, according to Bitbo and MARA Holdings has the second largest Bitcoin stash among public companies, with a stash of 53,250 Bitcoin.

Riot Platforms is the seventh largest public Bitcoin holder, with 19,324, while Hut 8 Mining is ninth with 13,696.

Rizzo said that the “summer buying frenzy” from crypto treasury companies has eased, but “demand has not vanished.”

“Public corporations appear to be normalizing to a slower, more selective cadence as they digest recent purchases and reassess risk,” he added.

November a stress test for treasury companies

In November, Bitcoin’s price sank below $90,000 for the first time since April, which created one of the first true stress tests for the Bitcoin capital markets era, Rizzo said.

Roughly 65% of buyers purchased Bitcoin above current market prices and now have unrealized losses.

Related: Businesses are absorbing Bitcoin 4x faster than it is mined: Report

“Bitcoin’s late‐November drawdown pushed spot prices toward $90,000, dragging many 2025 buyers into the red. For the 100 companies where cost basis could be measurable, about two‐thirds now sit on unrealized losses at current prices,” he said.

“This does not yet point to widespread distress, but it does force risk committees and boards to confront the downside of averaging into elevated prices and relying on long-term upside to validate treasury decisions.”

Magazine: Mysterious Mr Nakamoto author — Finding Satoshi would hurt Bitcoin