Original | Odaily Planet Daily(@OdailyChina)

Author|Azuma(@azuma_eth)

Early last year, considering readers' increasing demand for stablecoin financial management opportunities, Odaily Planet Daily launched the column "A More Suitable Lazy Man's U-based Financial Management Guide," aiming to cover relatively low-risk yield strategies in the market primarily involving stablecoins (and their derivative tokens), helping users who wish to gradually amplify their capital scale through U-based financial management to find relatively ideal interest-earning opportunities.

This series was updated 29 times in total, introducing nearly a hundred yield windows with relatively high returns during different periods. In addition to pure U-based returns, the attached points and additional rewards also captured "big airdrops" such as Plasma, Ethena, Huma, Avantis, Falcon, etc.

However, the sudden black swan event on October 11 led to a sharp contraction of on-field liquidity. Coupled with the occurrence of several security incidents in succession, we judged at that time that the risk transmission of on-chain DeFi had not yet ended, so we suspended the update of this column. Recently, market sentiment and liquidity have shown obvious signs of recovery, so we decided to restart this column.

Simplest Strategy: Deposit Activities on Major CEXs

Currently, the simplest financial management opportunities are obviously the deposit activities launched by major CEXs.

First is the hottest Binance USDⓈ deposit activity, with an APR of 20.06%, a limit of 50,000 USDⓈ. The activity will last until 7:59 on January 24th, leaving about half a month of the yield window. Although USDⓈ currently has a slight premium compared to USDT (and is expected to have a certain discount after the activity ends), the returns are enough to cover the wear and tear.

In addition, the OKX Pay account's USDG holding interest-earning activity also has a maximum annualized yield of 10%, but the quota is relatively small, only 10,000 USDG; the annualized yield for the excess part will drop to 5%.

I recall that other exchanges also have similar deposit activities (such as Huobi's 20% annualized U current earn coin), but I haven't participated personally yet. You can consider them according to your own usage.

On-chain Strategy One: Ethereal Hedging Orders, Maximum APR Up to 27%

When there is still quota space on the CEX side, I personally suggest giving priority to CEX activities. First, because the incentive intensity of current CEX activities is already attractive enough; second, it can also reduce unnecessary protocol risks and path wear and tear.

If you really consider on-chain opportunities, it is recommended to use the strategy of amplifying margin returns through hedging orders on the decentralized contract exchange Ethereal (https://app.ethereal.trade/trade/BTCUSD).

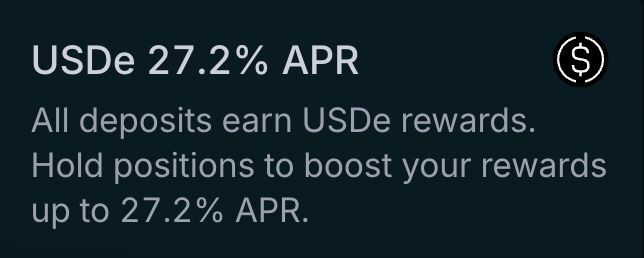

Lighter's TGE reignited the interactive enthusiasm for the Perp DEX track. My current operation method is to open orders on popular Perp DEXs like Variational to earn points, while simultaneously opening reverse orders on Ethereal in a completely mirrored way for hedging. The reason for doing this is that while Ethereal gives the抵押资产 USDe a basic APR of 5.13%, it also amplifies the yield based on the user's order situation (APR can reach up to 27.2%,收益来自交易费分成), and additionally gives points rewards corresponding to future airdrops.

Everyone has different judgments about the future competitive landscape of Perp DEXs, but whether you are mainly farming points on Variational, Backpack, Nado, or StandX, it is currently recommended to use Ethereal as the number one hedging option, using the实实在在的抵押资产收益 to slow down or even cover the wear and tear.

It should be noted that using Ethereal temporarily requires an invitation code to unlock all functions (easy to get in DC), and then you need to bridge USDe from Ethereum to the Ethereal chain (can use StarGate) for deposit and use it as a gas token. There will be certain wear and tear on the path, so it is not recommended to operate with too small an amount.

On-chain Strategy Two: Huma Prime Waiting for Increased Quota, Maximum Annualized 28%

This is a pool that requires setting a small alarm clock.

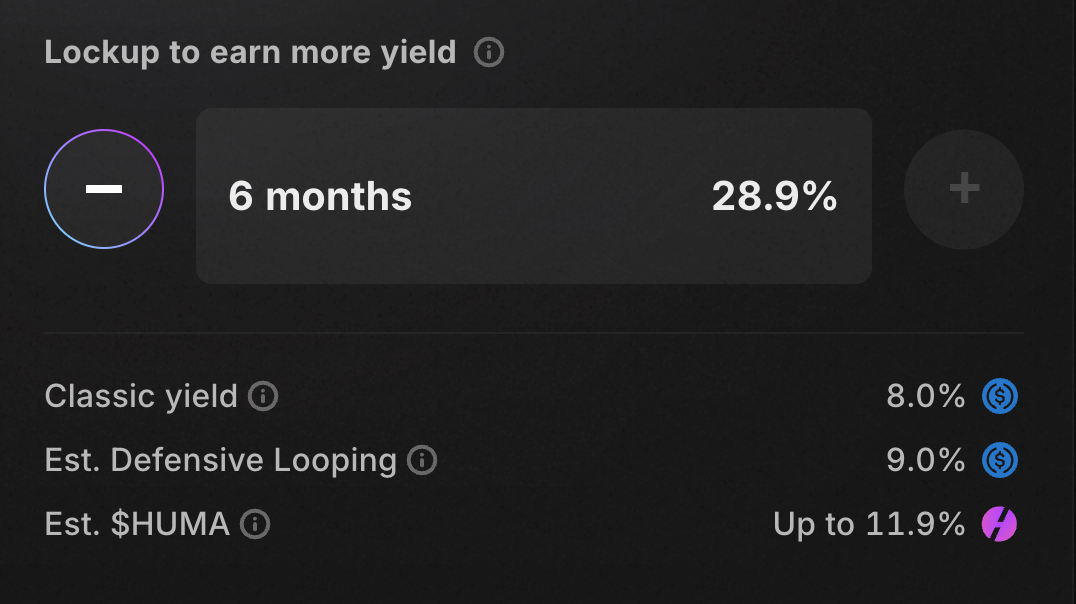

PayFi leader Huma launched a new pool called Huma Prime yesterday. Actually, to put it bluntly, it is a revolving loan pool for PST. If locked for 6 months, the maximum annualized yield can reach 28% (22.6% without badge加成). The收益 is composed of basic收益, revolving loan收益, plus HUMA incentives.

The first 12 hours after the launch of this pool were not open to the public, only supporting OG and Vanguard badge holders to deposit. However, it was filled up only 3 hours after opening, so new users暂时 have no chance to deposit and can only wait for the official quota increase to participate.

It needs to be emphasized first that Huma Prime is different from the previous Classic and Maxi pools. The LP positions have no secondary market, so it is impossible to exit early. Users can only redeem at the Huma official window after the lock-up period ends.

On-chain Strategy Three: Kamino PRIME/CASH Revolving Loan, Maximum Annualized 23.45%

Users who can accept Huma Prime are generally not too resistant to revolving loans. If you don't want to wait for the quota, you can consider the PRIME/CASH revolving loan on Kamino. The Multiply function can build positions with one click by selecting the leverage multiplier, up to 8 times, corresponding to an APY of about 23.45%.

In terms of asset risk, PRIME is a yield stablecoin issued by Hastra, Figure, and Provenance, with抵押资产 being real-world Home Equity Line of Credit (HELOC). CASH is a stablecoin issued by Phantom.

This pool has been open for over a month now, and the historical yield backtest is relatively stable. It is recommended to assess the risk and return situation yourself before participating.

On-chain Strategy Four: Pendle Neutrl(sNUSD) LP, Maximum Annualized 18.41%

Neutrl is a project I personally like very much and have introduced many times before. Simply put, it is a more aggressive version of Ethena, but the hedging asset is changed from mainstream tokens to altcoins acquired at a discount OTC — the main investor is the largest OTC trading platform STIX, giving it a certain uniqueness in model.

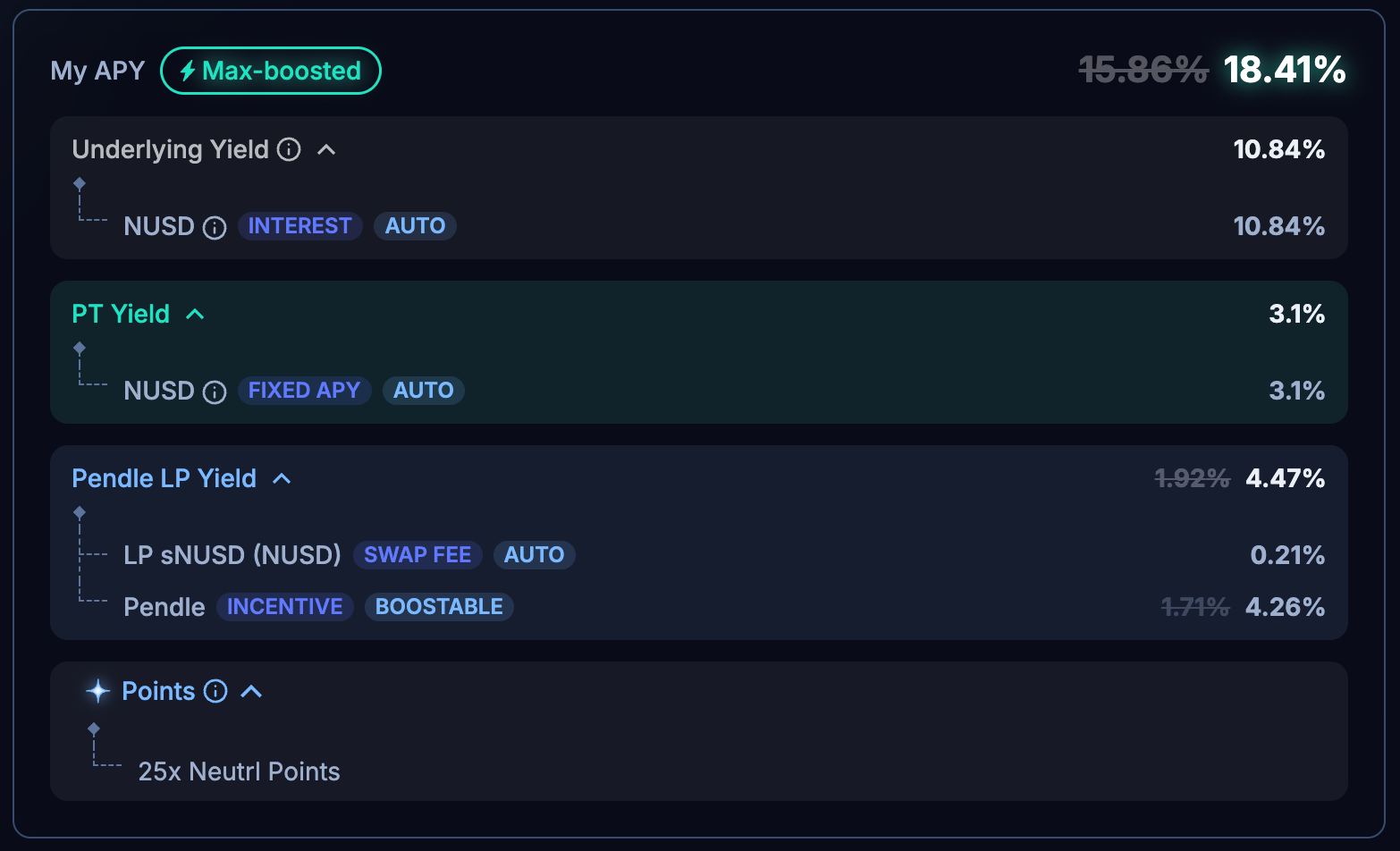

Compared to static deposits (holding NUSD) or staking (holding sNUSD), the most efficient way to participate now is to form an sNUSD LP on Pendle. With sufficient PENDLE staking, the maximum annualized yield can reach 18.41%, the basic annualized yield is 13.97%, plus 25x Neutrl points to capture airdrop opportunities.

Since the pool is on the Ethereum mainnet, there will be certain wear and tear when entering and exiting the path, so it is not recommended to participate with small amounts.