XRP’s (XRP) drop toward $2 was preceded by a significant drop in transaction fees, which analysts said may fuel a deeper price correction.

Key takeaways:

XRP transaction fees have dropped to 650 XRP per day, levels last seen in December 2020.

XRP’s descending triangle targets $1.73.

XRP transaction fees drops to five-year lows

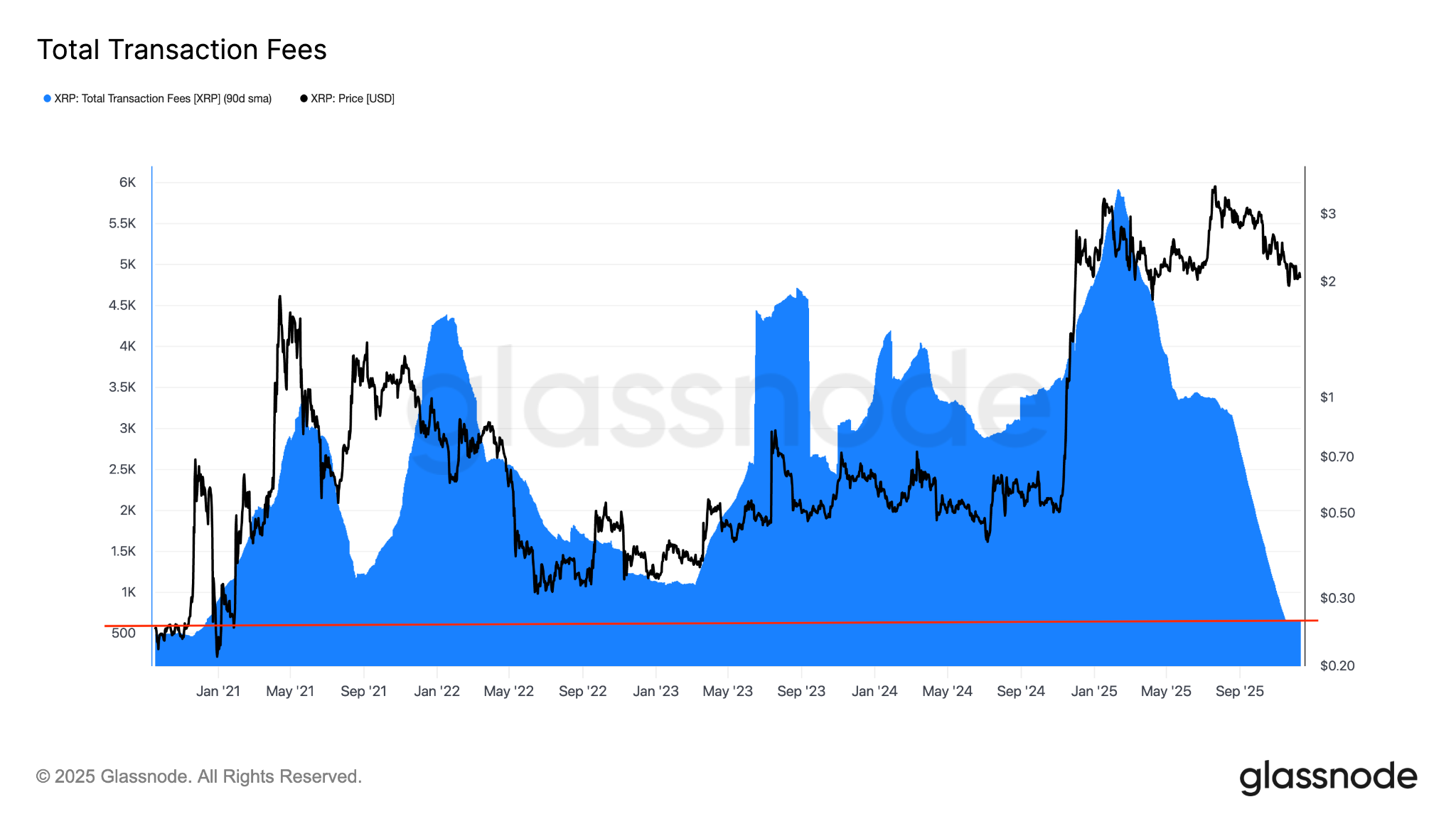

The total daily transaction fees on XRP Ledger (XRPL) have dropped significantly since the beginning of the year, according to onchain data provider Glassnode.

Related: XRP needs a Solana-style strategy to keep up: Ripple executive

The total fees paid daily on XRP have dropped to approximately 650 XRP per day from 5,900 XRP per day on Feb. 9, Glassnode said in a Thursday post on X, adding:

“This marks an 89% decline to levels last seen since December 2020.”

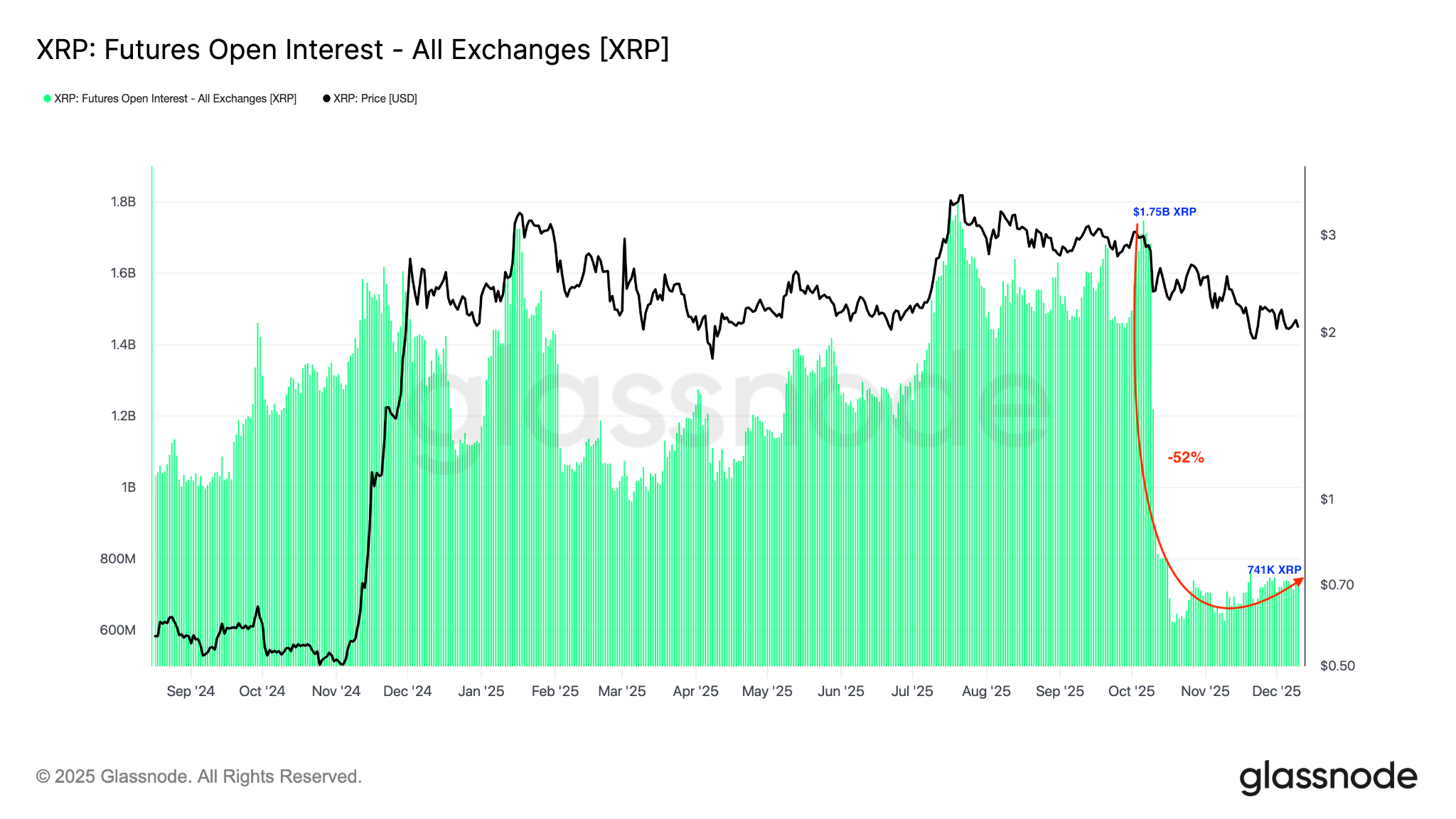

The drop in transaction fees coincides with a sharp drop in XRP’s futures open interest (OI), which has fallen to 0.74 billion XRP from 1.75 billion XRP in early October, representing a 59% flush-out.

Paired with the funding rates dropping to 0.001% from approximately 0.01% (7D-SMA), this suggests reduced confidence among derivatives traders in XRP’s ability to recover.

As Cointelegraph reported, social sentiment toward XRP has tanked into the “fear zone,” the most FUD since early October, but some analysts say such a drop could be a precursor for a massive rally in XRP price, as seen in the past.

XRP’s descending triangle targets $1.73

Price technicals for the XRP/USD pair are also showing a potential risk of dropping lower if it completes a descending triangle pattern.

The chart below points to more downside risk if the price breaks below the triangle’s support line at $2.

The measured target of the pattern, calculated by adding the triangle’s height to the breakout point, is $2.20, representing a 15% decline from the current price.

As Cointelegraph reported, the area between $2 and $1.98 remains a key support zone for XRP, and holding is crucial to avoiding further losses to $1.61.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.