XRP’s price seems to be heading for the $2 mark once again, following the pullback across the broader cryptocurrency market. Even with the prices becoming increasingly bearish, this movement has not entirely affected the overall sentiment toward the altcoin, as evidenced by another day of bullish inflows into the Spot XRP Exchange-Traded Funds (ETFs).

Huge Capital Keeps Pouring Into XRP Spot ETFs

In the evolving Exchange-Traded Fund (ETF) landscape, the XRP funds are quietly building one of their biggest waves yet. Since the launch of the funds, they have demonstrated substantial growth, challenging the likes of their Bitcoin and Ethereum ETFs counterparts.

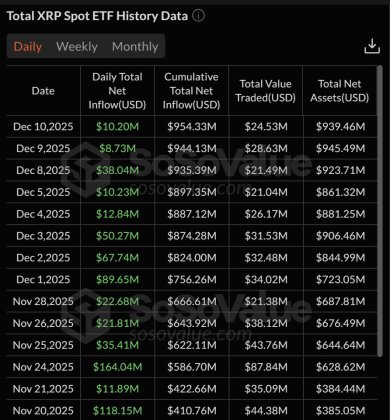

The funds are extending a remarkable run of consistent inflows that are starting to attract more market attention. A recent X post from Moon Lambo, a crypto enthusiast and YouTuber, shows that the XRP Spot ETFs have now recorded their 19 consecutive days of inflows.

What began as a means for more exposure has evolved into a distinct pattern of confidence as asset managers continue to purchase the leading altcoin through the initiative in spite of overall market volatility. Since the first spot XRP ETF was introduced, there has never been a day of outflows.

Following weeks of their inception, the cumulative inflow into the funds is currently valued at a staggering $954 million. With such a massive capital accumulated in mere weeks, reflecting relentless demand for the altcoin, the expert believes that this figure could explode in the next 5 to 10 years.

Will The ETFs Acquire The Entire Supply?

After examining the growth of the funds, SMQKE, a crypto pundit and researcher, reported that the XRP spot ETFs are aiming for the 42.87% of supply that truly matters in the market. According to the expert, the funds do not need to take all of the supply to generate a supply shock.

Currently, only 42.87% of the XRP supply is in circulation and available for purchase on the market, which is the real pool from which ETFs are pulled. Data shows that the funds now hold about 0.75% of the overall supply.

When compared to the 42.87% that is actually liquid, this is a tiny fraction. However, each step forward draws directly from the limited circulating supply. As demand for the funds increases, the 42.87% share is being eroded.

With each incremental increase, the amount of XRP remaining on the open market gets tighter, which is where the early stages of supply pressure start to develop. When the funds move from 0.75% closer to the 42.87% supply that is in circulation, the impact becomes visible. This is because inflows remain focused on a much smaller pool, not the entire supply.

However, SMQKE noted that the ETFs do not need to control 100% of the supply before the market feels its impact. Instead, they just need to concentrate on reducing the 42.87% supply that is currently accessible.