On Sunday, XRP staged a bounce to the $2.1 price level, flipping the market into a bullish atmosphere. However, on-chain metrics are flashing conflicting signals as the market splits between bullish and bearish narratives due to a disparity in investors’ actions on major exchanges.

A Two-Sided XRP Market Mood Emerges

XRP, a leading altcoin, has sent one of its most perplexing signals in recent months, leaving traders unsure about what to expect next in the market or price. Arthur, a market expert and official partner of the BingX crypto exchange, has outlined a distinct behavior among investors in two regions.

According to the market expert, the altcoin is exhibiting a mixed signal right now after examining the activity of investors on the Binance and Bithumb exchanges. Currently, investors on the Binance exchange are demonstrating bullish activity while those on Bithumb are displaying signs of weakening sentiment and uncertainty.

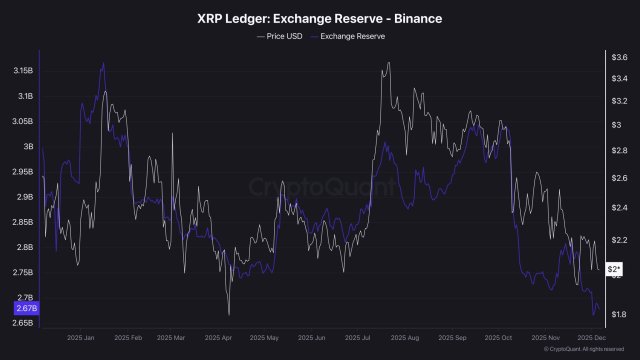

On the Binance side, Arthur noted that the supply of XRP on the exchange is experiencing a steady decline. This persistent withdrawal from the largest cryptocurrency exchange in the world is mostly carried out by large investors known as whale holders, which is causing a tightening supply.

Such a pattern extends beyond simple reshuffling from these key investors. Furthermore, it points to a strategic move by wealthy investors, who usually take action ahead of more general market trends. Historically, the movement of these high-value wallets’ assets away from centralized exchanges is a sign that the cohort could be getting ready for an impending market catalyst.

Meanwhile, on Upbit and Bithumb, the expert reported that there is a steady flow of XRP into the two largest crypto exchanges in South Korea. When coins flow into exchanges, it usually points to short-term selling pressure, suggesting that investors in the Asian region are currently locking in profits.

Heightened Demand For The Altcoin Via ETFs

Demand for XRP is still waxing strong in certain key areas, especially the Spot Exchange-Traded Funds (ETFs). Following weeks of market turbulence, institutional appetite for the altcoin appears to have increased, creating a strong new tailwind.

In another X post, Arthur reported that the altcoin has experienced steady inflows over the last 15 days, signifying the longest continuous run since funds tracking the token started trading. Within this timeframe, the expert highlighted that the funds have recorded a whopping $900 million Asset Under Management (AUM).

Despite modest price movement, this consistent flow of funds indicates that big investors are discreetly increasing exposure, indicating growing confidence in XRP’s long-term prospects. With the Clarity Act set to gain approval, the expert is confident that the development could attract more inflows into the funds. It may also see retail investors, institutional investors, and ETFs moving in a single direction.