In the fourth quarter of 2025, the U.S. market witnessed a concentrated explosion of spot altcoin ETFs. Following the opening of the ETF door by Bitcoin and Ethereum, ETFs for altcoins such as XRP, DOGE, LTC, and HBAR were successively launched in the United States, while ETFs for assets like AVAX and LINK also entered a rapid approval phase. In stark contrast to the decade-long regulatory battle for Bitcoin ETFs, this batch of altcoin ETFs completed the entire process from application to listing in just a few months, demonstrating a significant shift in the U.S. regulatory attitude. The emergence of altcoin ETFs is no longer an isolated event but a natural outcome following a structural relaxation of crypto regulation.

The key catalysts for this listing boom primarily stem from two points: the amendment to the "Generic Listing Standards for Commodity Trust Shares" approved by the SEC on September 17, 2025, and the triggering of the "8(a) clause" during the U.S. government shutdown in November. The Generic Listing Standards established a unified access system for crypto asset ETFs, allowing eligible assets to no longer face the SEC's lengthy individual reviews. As long as a crypto asset has a history of more than six months on a CFTC-regulated futures market and has a monitoring sharing mechanism in place, or if there is already at least 40% related exposure in the market, it can qualify under this system, thereby shortening the exchange-side approval cycle from 240 days to 60-75 days.

Secondly, the triggering of the "8(a) clause" in November and the SEC's passive situation accelerated the process of these ETF listings. During the U.S. government shutdown, the generic standards were briefly interrupted, but the SEC issued guidance on November 14, for the first time allowing issuers to proactively remove the delaying amendment clause from their S-1 registration statements. According to Section 8(a) of the Securities Act of 1933, statements that do not contain this clause will automatically become effective after 20 days, unless the SEC actively stops them. This created a de facto tacit approval channel for listing. At this time, due to the shutdown of various government departments, they were unable to block applications individually within the limited time. Issuers like Bitwise and Franklin Templeton quickly seized the window, completing rapid registration by removing the delaying clause, pushing the altcoin ETFs to land intensively in mid-to-late November, forming the current wave of crypto asset ETF listings in the market.

II. Analysis of Major Altcoin ETF Performance (October–December 2025)

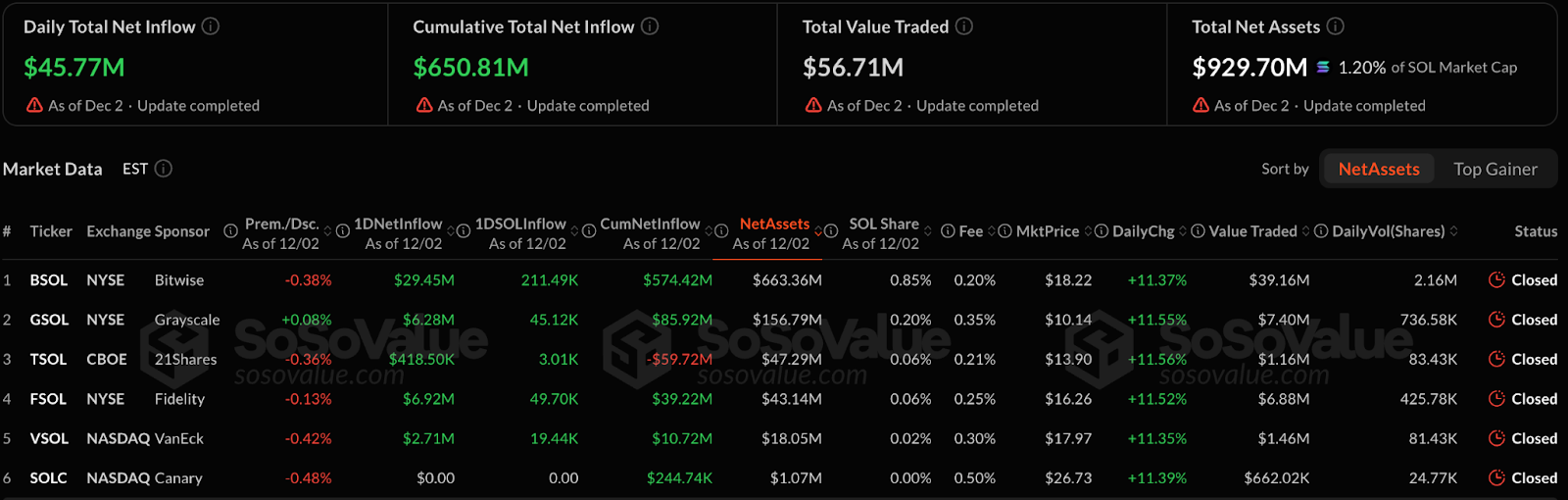

Solana (SOL)

The first batch of SOL products was listed on October 28. Although the price of SOL has continued to fall by about 31% since listing, funds have shown a counter-trend inflow, buying more as the price dropped. As of December 2, the entire SOL ETF sector had accumulated a net inflow of $618 million, with total assets reaching $915 million, accounting for 1.15% of SOL's total market capitalization. Achieving such a scale in less than two months also reflects, to some extent, the market's broad recognition of SOL's positioning as the "third largest public chain".

The BSOL product launched by Bitwise performed most prominently, with this single product attracting approximately $574 million in funds, making it the single largest fund in terms of inflows among SOL ETFs. BSOL's lead is largely due to its designed staking reward mechanism—all held SOL is directly staked, and the staking rewards obtained are not distributed to investors but are automatically reinvested to enhance the fund's net asset value growth. This method of linking staking returns to the fund's NAV provides a compliant, convenient, and yield-advantageous alternative for institutions/investors who wish to participate in the SOL ecosystem but are unwilling to manage private keys and nodes themselves.

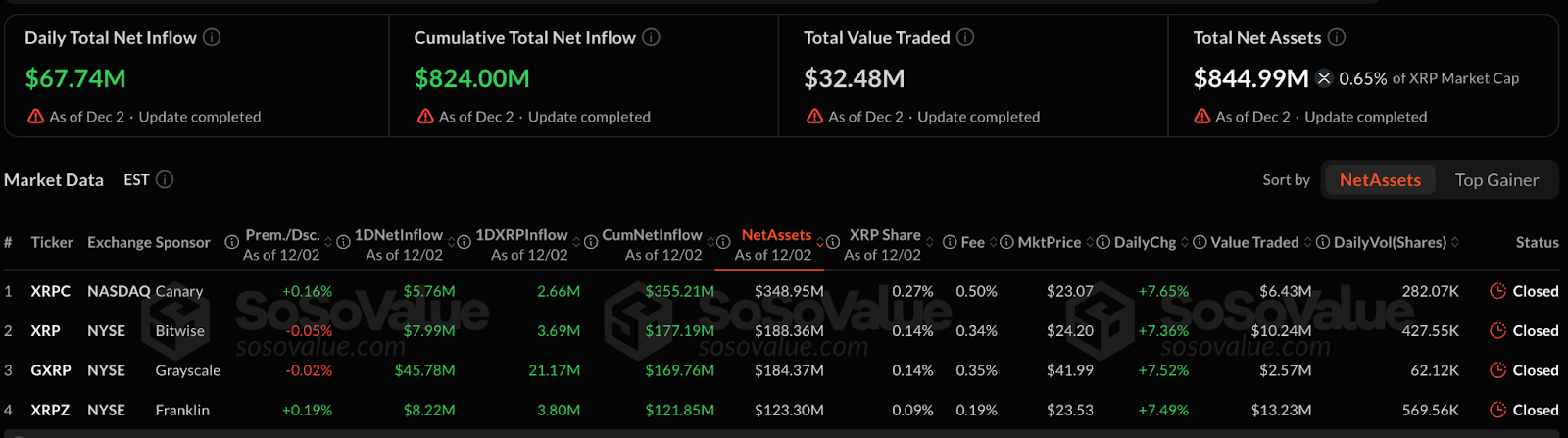

Ripple (XRP)

XRP ETFs began陆续上线 starting November 13, 2025. During the same period, the XRP price fell by about 9%. Like SOL, XRP ETFs also showed a trend of increased buying as the price fell. As of December 2, the cumulative net inflow was $824 million, with total assets valued at approximately $844 million, accounting for 0.65% of XRP's total market capitalization. The size differences among major issuers in the XRP ETF product space were not significantly pronounced, with multiple institutions showing a relatively balanced market share.

Doge (DOGE)

DOGE ETFs encountered a complete cold shoulder from the market, confirming the huge gap between Meme coins and institutional funding channels. Products represented by Grayscale's GDOG (listed November 24) performed extremely poorly, with a cumulative net inflow of only $2.68 million and assets under management of less than $7 million, accounting for only 0.03% of Doge's total market capitalization. More severely, Bitwise's similar product even saw zero inflows, and the low daily trading volume (about $1.09 million) also indicates that traditional investors currently remain skeptical of MEME assets like Doge, which lack fundamental support and rely mainly on community sentiment.

Hedera (HBAR)

HBAR ETF, as a representative of small and mid-cap projects, achieved relatively successful penetration for its size. The ETF was listed on October 29. Although the HBAR price fell about 28% in nearly two months, the ETF累计获得了 a net inflow of $82.04 million. This brought the assets under management of the HBAR ETF to 1.08% of HBAR's total market capitalization. This penetration effect is far higher than that of altcoins like Doge and LTC, which may also mean the market has some confidence in mid-cap assets like HBAR that have clear enterprise-level applications.

Litecoin (LTC)

The LTC ETF became a classic case study: traditional assets lacking new narratives struggle to rejuvenate even with ETF access, at least for now. After its listing on October 29, its price performance was weak, falling about 7.4%. At the fund level, attention was scarce, with a cumulative net inflow of only $7.47 million, and it faced the尴尬局面 of zero inflows on multiple single days. A daily trading volume of only about $530,000 highlights its lack of liquidity. This indicates that the old narratives LTC currently relies on, such as "digital silver," lack appeal in today's market.

ChainLink (LINK)

Grayscale's GLINK ETF was officially listed on December 3. On its first day of trading, it attracted nearly $40.9 million in inflows. The total asset value currently stands at approximately $67.55 million, accounting for 0.67% of Link's total market capitalization. Judging from the first-day trading results, GLINK had a good start in terms of both liquidity and fund attraction.

III. Major Participants and Funding Sources of Altcoin ETFs

Since the陆续上市 of altcoin ETFs, the crypto ETF market has seen a clear divergence: while the prices of Bitcoin and Ethereum continued to fall, and related ETFs experienced constant outflows, altcoin ETFs like SOL, XRP, HBAR, and LINK saw counter-trend inflows of funds. This means that some of the funds withdrawn from BTC and ETH ETFs did not leave the crypto market but turned to assets with higher growth potential. This also indicates that the funding sources for altcoin ETFs have a two-tier structure, involving both存量再配置 (reallocation of existing holdings) and增量入场 (new capital entering the market).

The new incremental funds mainly come from the traditional financial giants participating in this issuance round, including BlackRock, Fidelity, VanEck, FranklinTempleton, Canary, etc. The funding sources behind these institutions cover pension funds, insurance capital, wealth management accounts, 401K retirement plans, asset management clients, and family offices. Previously limited by compliance thresholds from directly purchasing altcoins, they can now achieve legal allocation for the first time through ETFs, forming real new capital inflows. In other words, the batch launch of altcoin ETFs has given traditional capital a new opportunity to enter the market and buy crypto assets.

IV. Future Outlook: The Next Round of Altcoin ETF Expansion

The successful launch of the first batch of products like SOL, XRP, and HBAR has clearly landed the institutionalized path for altcoin ETFs. Next, public chains with larger ecosystems and higher institutional attention will become the focus of the next batch, including AVAX, ADA, DOT, BNB, TRX, SEI, APT, etc. Once approved for listing, these assets are expected to further attract compliant funds, bringing a new round of liquidity expansion to the multi-chain ecosystem. Looking ahead, the altcoin ETF market will show three major trends:

First, intensifying concentration at the top and product differentiation will proceed in parallel.

Assets with clear fundamentals and long-term narratives will receive sustained funding preference, while projects lacking ecosystem drivers will struggle to improve their performance even after listing. Meanwhile, competition among ETF products will increasingly revolve around fees, staking rewards, and brand capability, with leading issuers sucking up most of the funds.

Second, product forms will move from single-asset tracking to strategization and portfolioization.

Index-type, multi-asset basket, and actively managed products will emerge陆续, meeting the professional needs of institutions for risk diversification, yield enhancement, and long-term allocation.

Third, ETFs will become a key force reshaping the funding structure of the crypto market.

Assets included in ETFs will gain a "compliance premium" and stable fund inflows, while tokens not entering the compliant framework will face continued loss of liquidity and attention, further strengthening the market's layered structure.

In other words, the competitive focus of altcoin ETFs is shifting from "whether it can be listed" to "how to continuously attract funds after listing." As AVAX, ADA, DOT, BNB, TRX, etc., enter the final stages of审批, the second round of expansion for altcoin ETFs has quietly begun. 2026 will become a key node for the comprehensive institutionalization of crypto assets, not only continuing to expand in the number of listings but also bringing deep reshaping to the logic of fund pricing and the landscape of ecological competition.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush