Daily key market data review and trend analysis, produced by PANews.

1. Market Overview

Driven by the Fed's 25 basis point rate cut and the dovish outlook of plans to purchase $40 billion in short-term Treasuries monthly, precious metals performed particularly strongly, with gold breaking above the December high, approaching the $4290 mark, and spot silver surging to $64, setting a new all-time high. However, the US labor market showed signs of weakness, with initial jobless claims surging by 44,000 to 236,000 last week, the largest weekly increase since the pandemic, coupled with a narrowing trade deficit, keeping the market cautious about the economic outlook. Meanwhile, China convened the Central Economic Work Conference, setting the tone for economic work in 2026, clarifying the implementation of more proactive fiscal policy and moderately loose monetary policy, focusing on expanding domestic demand and technological innovation. But on the specific consumer end, Moutai prices continued to face pressure, with the price of 2025 Feitian Moutai falling below the psychological barrier of 1499 yuan, dropping from around 2200 yuan at the beginning of the year, a cumulative decline of over 30%. Industry insiders worry that continued price declines could reduce or even eliminate distributor profits, potentially triggering a vicious cycle of "price drop → sell-off → further drop". Looking ahead, analysts generally believe that global central bank policies will further diverge in 2026. The Fed ending QT and expanding its balance sheet will bring a liquidity turning point, but dollar depreciation pressure may force the ECB into a difficult balance between inflation and exchange rates.

The recent artificial intelligence boom faced a reality check this week, as doubts about AI investment returns triggered a broad tech stock pullback. Oracle's stock plunged 16% intraday due to cloud infrastructure revenue missing growth expectations and raising its capital expenditure guidance to $50 billion, wiping out over $68.9 billion in market value in a single day (some estimates even reached $102 billion). UBS, Morgan Stanley, and other investment banks downgraded its target. Earnings reports showed its profit growth relied mainly on non-recurring gains, with core business profitability under pressure. Although Broadcom exceeded Q4 revenue and profit expectations, with AI revenue growing 65%, its stock still fell 1.94% after hours, indicating cautious market sentiment. Meanwhile, OpenAI released its most advanced model, GPT-5.2, and announced a $1 billion cooperation agreement with Walt Disney, directly causing Google's stock to fall 2.43%. Domestically, Moore Thread, as the "first domestic GPU stock", saw its stock price soar over 723% after listing, with its market cap breaking 440 billion yuan. After hitting a new high of 941.08 yuan and a cumulative gain of 723%, the company issued a risk warning announcement last night, stating that fundamentals remain unchanged, new products are still in the R&D stage, and short-term impact on performance is limited. In early trading today, the stock fell over 15%, briefly falling below 800 yuan.

Bitcoin is currently battling in the range of $92,000 to $94,000. On-chain data shows reduced transfers by large holders to exchanges, easing selling pressure. CryptoQuant pointed out that if the trend continues, BTC could rebound to $99,000 or even $112,000. Man of Bitcoin analysis suggests BTC remains above the upward trend line; a break above the wedge's upper edge could target the $96,962 to $102,432 area. However, bearish forces remain strong. Analyst Astronomer has opened a short position at $92,700, targeting a pullback to $87,700; Killa suggested Bitcoin could surge to $94,000 or higher short-term but might subsequently pull back. He plans to add to positions in the $95,000 to $98,000 range and expects Bitcoin could fall to $70,000 or even $60,000 next year. Ted also noted the current movement is strikingly similar to the last cycle; if the script repeats, it could surge past $100,000 before crashing below $70,000. In prediction markets, traders generally believe the probability of breaking $100,000 before year-end is only around 30%. Meanwhile, Bloomberg analyst Mike McGlone warned that a new "Santa Claus rally" might not appear, and BTC could end the year below $84,000. The market is currently watching whether BTC can hold the $90,000-$91,000 support zone. A break below could test the bottom of the current range, while holding could lead to another challenge of the $94,000 resistance level.

Regarding Ethereum, market sentiment is torn between ETF fund returns and technical pressure. Although spot ETF net inflows rebounded to $21.5 billion, the price remains constrained by key resistance levels. Ali pointed out that ETH has two solid support walls below: one at the $3,150 level, accumulating 2.8 million coins, and another at the $2,800 level, accumulating 3.6 million coins; Glassnode data places key support at $2,770. For future trends, Delphi Digital analyst that1618guy is optimistic, believing ETH has held the daily crossover and completed a retest. If Bitcoin breaks above $94,000, Ethereum could follow towards the $3,600-$3,800 range. However, Man of Bitcoin reminded investors to be cautious, observing that the price is forming a small bearish triangle, and another dip to $3,150 is possible. A break below the trendline would be a clear warning signal.

Additionally, Do Kwon's trial has finally concluded. The US Attorney's Office for the Southern District of New York announced that Terraform Labs founder Do Kwon has been formally sentenced to 15 years in prison for securities fraud and wire fraud, among other charges. The finalization of this news directly caused LUNA, LUNC, and USTC and other related tokens to plummet nearly 30% in 24 hours.

2. Key Data (As of December 12, 13:00 HKT)

(Data source: GMGN, CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

-

Bitcoin: $92,551 (Year-to-date -1.12%), daily spot trading volume $46.5 billion

-

Ethereum: $3,253 (Year-to-date -2.5%), daily spot trading volume $240.1 billion

-

Fear & Greed Index: 29 (Fear)

-

Average GAS: BTC: 1.2 sat/vB, ETH: 0.04 Gwei

-

Market Dominance: BTC 58.46%, ETH 12.2%

-

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, SOL, BARD

-

24-hour BTC Long/Short Ratio: 49.95% / 50.05%

-

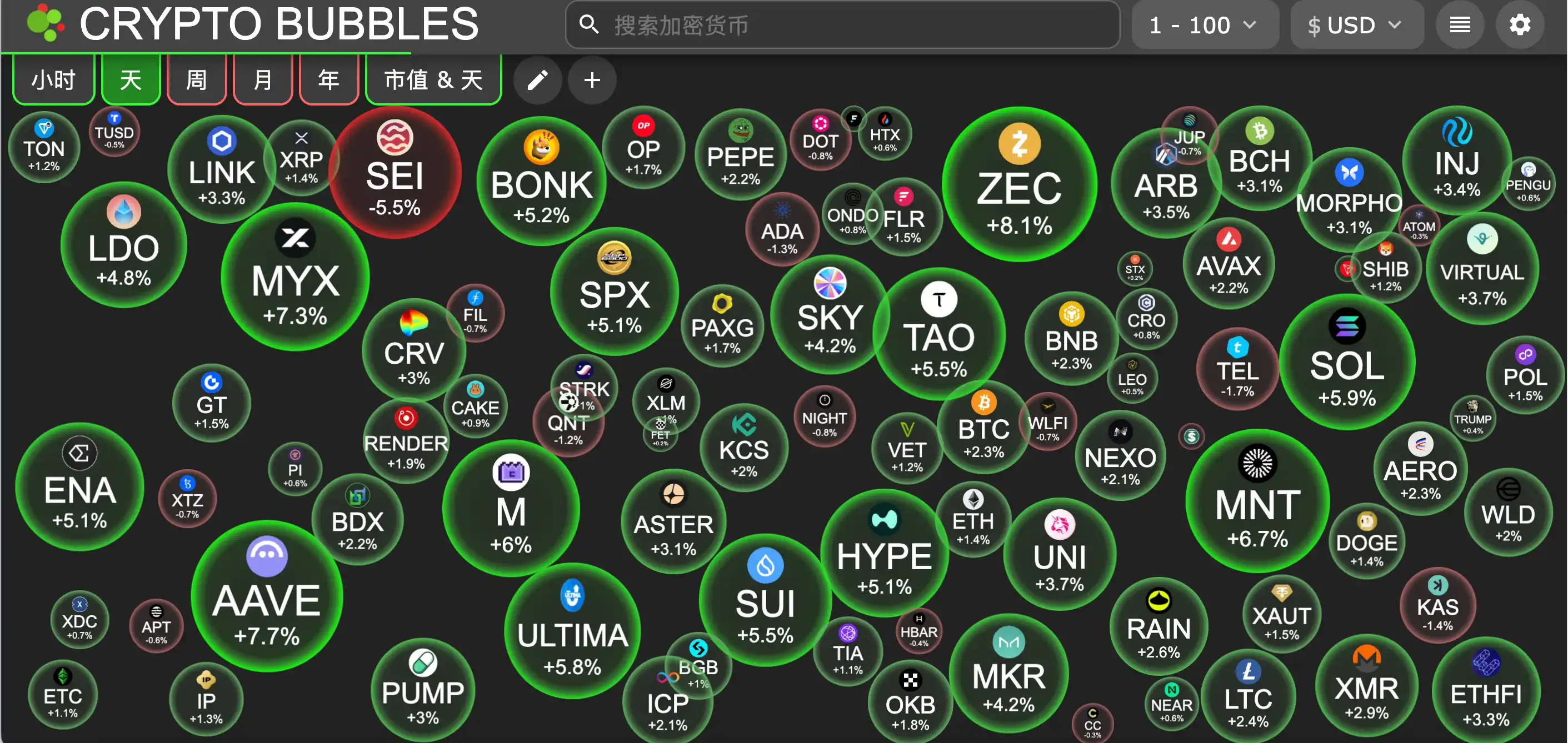

Sector Gains/Losses: Layer2 sector up 3.6%, DeFi sector up 3.2%

-

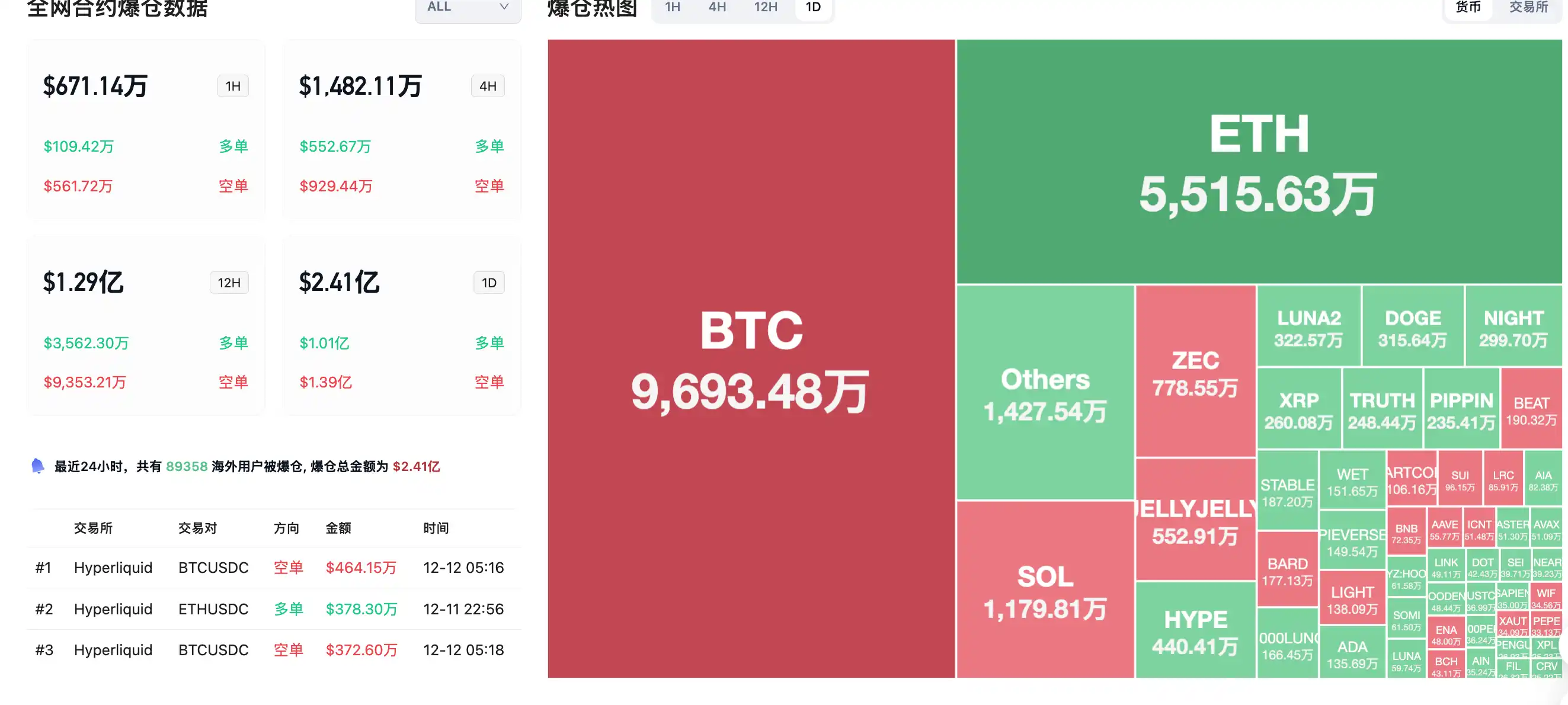

24-hour Liquidation Data: 89,358 people liquidated globally, total liquidation amount $241 million, including BTC liquidations $96.93 million, ETH liquidations $55.15 million, SOL liquidations $11.79 million

3. ETF Flows (As of December 11)

-

Bitcoin ETF: -$77.3419 million

-

Ethereum ETF: -$42.3734 million

-

Solana ETF: +$11.02 million

4. Today's Outlook

-

Binance Alpha will list RaveDAO (RAVE)

-

Talus Foundation: US airdrop claim portal is open, deadline December 14

-

Bittensor will undergo its first halving on December 14, reducing TAO daily issuance to 3600 coins

-

The US SEC Crypto Working Group will hold a roundtable on financial regulation and privacy on December 15

-

Aptos (APT) will unlock approximately 11.31 million tokens at 00:00 on December 12, representing 0.83% of the circulating supply, valued at approximately $19.3 million;

-

Cheelee (CHEEL) will unlock approximately 20.81 million tokens at 08:00 on December 13, representing 2.86% of the circulating supply, valued at approximately $10.8 million;

Today's top gainers among top 100 coins by market cap: Zcash up 8.1%, Aave up 7.7%, MYX Finance up 7.3%, Mantle up 6.7%, MemeCore up 6%.

5. Hot News

-

CCB responds to account lock due to Dogecoin transfer备注: Accounts are set to "no receipt, no payment" status if high risk is detected

-

DOYR token creator issued nearly 10,000 MEME coins through 3 associated addresses, profiting over $1.2 million

-

Only one Bitcoin treasury company's stock has outperformed the S&P 500 year-to-date in 2025

-

Jupiter to launch stablecoin JupUSD next week

-

YouTube introduces new option to pay US creators using stablecoins

-

Bloomberg: Coinbase plans to announce prediction markets and tokenized stocks next week

-

"1011 Insider Whale" added 41 BTC to long positions, total BTC long holdings reach 1000 BTC

-

Terraform Labs founder Do Kwon sentenced to 15 years in prison by US judge

-

a16z releases "17 Crypto Trends for 2026", focusing on RWA, AI agents, privacy chains, and other key directions

-

Pump.fun has repurchased 13.8% of PUMP token circulating supply since buyback program launch

-

Fed cuts rates by 25 bps, expects only one rate cut in 2026

-

If SpaceX IPO valuation reaches $1.5 trillion, Musk's net worth will approach $1 trillion

-

Sei to partner with Xiaomi to pre-install Web3 payment app in new global phones