Author: zhou, ChainCatcher

The cryptocurrency wallet market in 2025 is witnessing a fierce battle for market share.

As the meme coin frenzy subsides, high-frequency trading users are increasingly migrating to exchange-affiliated wallets that offer lower fees and stronger incentives. In the face of the closed-loop ecosystems of exchanges, the survival space for independent players is continuously shrinking.

Against this backdrop, Phantom's performance has drawn attention. Earlier this year, it raised $150 million in funding, pushing its valuation to $3 billion. Since the fourth quarter, the project has successively launched its own stablecoin CASH, a prediction market platform, and a crypto debit card, attempting to find new growth points beyond trading business.

$3 Billion Valuation: From Solana Origins to Multi-Chain Expansion

Looking back at Phantom's development history, in 2021, the Solana ecosystem had just exploded, and on-chain infrastructure was still incomplete. Traditional crypto wallets like MetaMask primarily supported Ethereum-based chains, with insufficient compatibility for other chains, resulting in certain user experience shortcomings.

Typically, when creating a wallet, users must manually write down a 12 or 24-word seed phrase. If the key is lost, assets become permanently irrecoverable, which many potential users find cumbersome and risky.

The three founders of Phantom had previously worked for years at 0x Labs (an Ethereum DeFi infrastructure project). They seized this opportunity, choosing to start with Solana to create a wallet with a simple interface and intuitive operation. Their core innovation lies in optimizing the backup process: providing various simple methods such as email login, biometric recognition, and encrypted cloud backup to assist and replace manual copying of seed phrases, significantly lowering the entry barrier for beginners.

In April 2021, the Phantom browser extension was launched, and within months, its user base exceeded one million, becoming the preferred choice for Solana users. According to RootData, in July of the same year, Phantom, still in its testing phase, received a $9 million Series A funding round led by a16z; in January 2022, Paradigm led a $109 million Series B round, valuing it at $1.2 billion; until early 2025, Paradigm and Sequoia again led a $150 million funding round, pushing its valuation to $3 billion.

As it scaled, Phantom subsequently began expanding its multi-chain footprint, supporting multiple public chains including Ethereum, Polygon, Bitcoin, Base, and Sui, attempting to shed the label of "Solana-specific wallet." However, Phantom still does not natively support BNB Chain, and previously, users have complained that Phantom supports ETH but not BNB Chain, causing issues with claiming airdrops.

Highs and Lows of 2025

2025 has been a year of extremes for Phantom: on one hand, rapid breakthroughs in user and product aspects; on the other, trading volume share being significantly eroded by exchange-affiliated wallets.

Specifically, user growth is a bright spot. Phantom's monthly active users grew from 15 million at the beginning of the year to nearly 20 million by year-end, ranking among the fastest-growing independent wallets, especially with significant user increases in emerging markets like India and Nigeria.

Meanwhile, Phantom's custodial assets under management exceeded $25 billion. At its peak, it generated $44 million in weekly revenue, and its annual revenue once surpassed that of MetaMask. Currently, Phantom's cumulative revenue is close to $570 million.

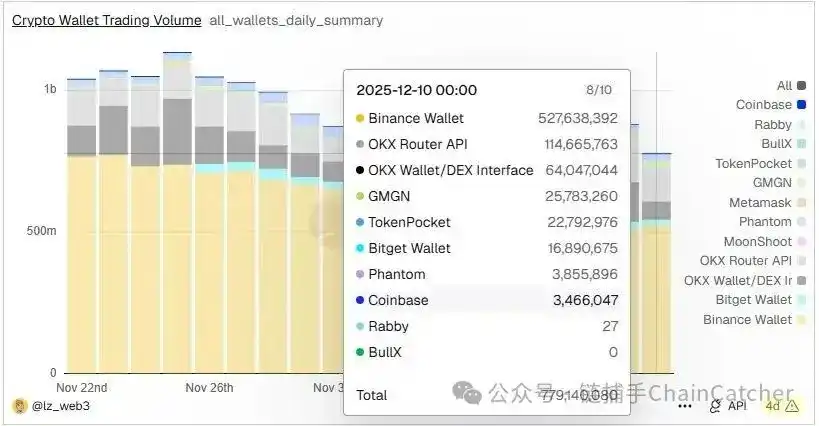

However, concerns on the trading volume side are equally prominent. According to Dune Analytics data, Phantom's share in the global embedded swap market dropped from nearly 10% at the beginning of the year to 2.3% in May, and further shrank to only 0.5% by year-end. Exchange-affiliated wallets, leveraging fee advantages, faster listing speeds, and high airdrop subsidies, have attracted a large number of high-frequency trading users. Currently, Binance Wallet holds nearly 70%, while OKX (wallet + routing API) combined holds over 20%.

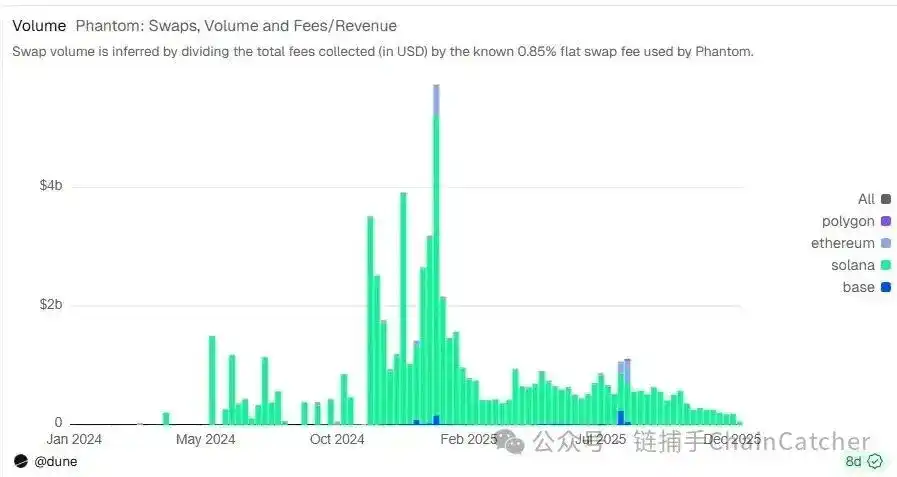

A greater market concern for Phantom lies in its deep binding with Solana. Data shows that 97% of Phantom's swap transactions occur on Solana, while Solana's Total Value Locked (TVL) has fallen more than 34% from its peak of $13.22 billion on September 14, now down to a six-month low of $8.67 billion. This directly drags down Phantom's core trading metrics.

Facing these pressures, Phantom is betting resources on new products, attempting to open up a second growth curve.

In terms of product dimensions, Phantom has launched a series of differentiated features:

- In July, integrated Hyperliquid perpetual contracts, driving approximately $1.8 billion in trading volume in just about 16 days after launch, generating nearly $930,000 in revenue through rebate mechanisms (builder codes);

- In August, acquired meme coin monitoring tool Solsniper and NFT data platform SimpleHash, further consolidating coverage of niche trading needs.

- The native stablecoin CASH, launched at the end of September, quickly saw its supply exceed $100 million, with a November peak of over 160,000 transactions. Its core competitiveness lies in fee-free P2P transfers and accompanying lending rewards;

- The Phantom Cash debit card, first launched in the US in December, allows users to directly spend on-chain stablecoins with the card, and is compatible with mainstream mobile payments like Apple Pay and Google Pay;

- On December 12, announced the launch of a prediction market platform, integrating the Kalshi prediction market within the wallet, currently open to eligible users;

- Simultaneously launched the free SDK "Phantom Connect," allowing users to seamlessly access different web3 applications with the same account, further lowering the onboarding barriers for developers and users.

Among these, the debit card and CASH stablecoin are the most watched. Phantom is attempting to use them to solve the "last mile" problem of spending crypto assets.

Phantom CEO Brandon Millman has publicly stated that in the short term, there will be no token issuance, no IPO, and no building of their own chain. All efforts are focused on refining the product to turn the wallet into a financial tool usable by ordinary people. He believes that the endgame of the wallet race is not about who has the largest trading volume, but about who first brings crypto into daily payments.

However, the path to the "last mile" of cryptocurrency payments is not easy, and Phantom is not the first independent non-custodial wallet to launch a debit card.

Prior to this, MetaMask had already partnered with Mastercard, Baanx, and CompoSecure in Q2 2025 to launch the MetaMask Card, supporting real-time conversion of cryptocurrency to fiat for spending, and rolling out in multiple regions including the EU, UK, and Latin America. MetaMask's card has broader coverage and an earlier start, but is limited by the Ethereum and Linea networks, with higher fees and slower speeds, leading to user feedback that it is "convenient but rarely used."

In comparison, Phantom's debit card started later, currently only available in limited quantities in the US, and its actual adoption remains to be seen. Theoretically, leveraging Solana's low-fee advantage, it might be more competitive in fee-sensitive emerging markets, but it still has a clear gap compared to MetaMask Card in terms of global coverage and merchant acceptance.

Regarding stablecoins, if CASH cannot form a sustained network effect, it may follow the path of other wallet-native stablecoins that started high but fell quickly, such as MetaMask's native stablecoin mUSD, whose supply quickly surpassed the $100 million mark after launch but dropped to about $25 million in less than two months.

Conclusion

As the meme frenzy recedes, trading volume is no longer a reliable moat, and independent wallets must return to the essence of financial services.

Overall, Phantom integrates Hyperliquid perpetual contracts and the Kalshi prediction market on the trading end to retain advanced users; on the consumption end, it bets on the CASH stablecoin and debit card, attempting to truly bring on-chain assets into daily life.

This dual-drive strategy of "trading derivatives + consumption payments" is Phantom's self-redemption under the挤压 (squeeze) of the Matthew effect in the wallet赛道 (race). It is not only searching for a second growth curve but also defining the endgame for independent wallets.