During the brief uptrend that began in April, crypto treasury companies, as the main force of market accumulation, provided a continuous stream of ammunition for the market. However, when both the crypto market and stock prices fell simultaneously, these crypto treasury companies seemed to collectively fall silent.

When prices hit a阶段性 bottom, it should theoretically be the perfect time for these treasury companies to buy the dip. But the reality is that buying activity has slowed or even stalled. The reason behind this collective silence is not simply because "ammunition" was exhausted at high points or due to panic, but rather because the highly premium-dependent financing mechanism has become mechanically paralyzed during the downturn, leading to a situation where "funds are available but unusable."

Hundreds of Billions in "Ammunition" Locked Up

To understand why these DAT companies are facing the dilemma of "having money but being unable to use it," we need to conduct an in-depth analysis of the sources of ammunition for crypto treasury companies.

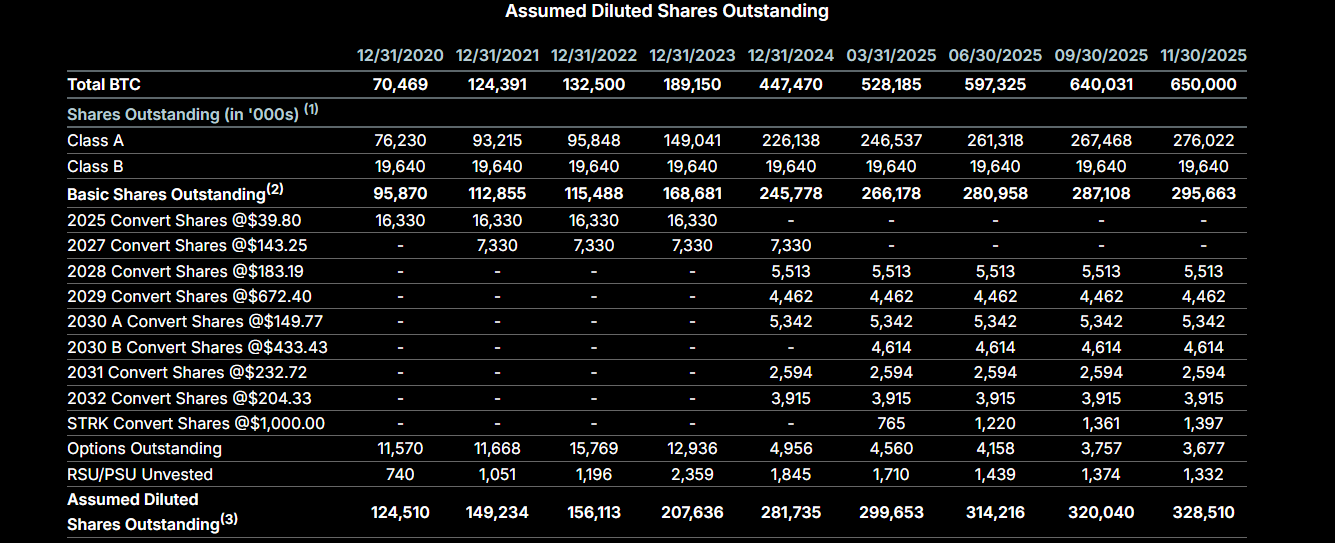

Taking Strategy, the first listed crypto treasury company, as an example, its funding has primarily come from two sources: "convertible notes," which involve borrowing money at very low interest rates to buy cryptocurrencies, and the At-The-Market (ATM) issuance mechanism, where Strategy can sell additional shares when its stock price trades at a premium to the value of its held crypto assets, using the proceeds to buy more Bitcoin.

Before 2025, Strategy's main funding source was "convertible notes." As of February 2025, Strategy had raised $8.2 billion through convertible notes to purchase additional Bitcoin. Starting in 2024, Strategy began large-scale use of its At-The-Market (ATM) equity program. This issuance method is more flexible: when the stock price is higher than the market value of the held crypto assets, the company can issue additional shares at market price to raise funds for purchasing more crypto assets. In Q3 2024, Strategy announced a $21 billion ATM equity offering program, and in May 2025, it established a second $21 billion ATM program. To date, the total remaining capacity of these programs is still $30.2 billion.

However, these capacities are not cash; they are quotas for the sale of Class A preferred shares and common shares. For Strategy to convert these quotas into cash, it needs to sell these shares on the market. When the stock price is at a premium (e.g., the stock price is $200, and each share represents $100 worth of Bitcoin), selling shares allows Strategy to exchange the newly issued shares for $200 in cash, which can then be used to buy $200 worth of Bitcoin, thereby increasing the Bitcoin backing per share. This was the logic behind Strategy's "perpetual motion machine" of seemingly infinite ammunition. However, when Strategy's mNAV (mNAV = market capitalization / value of held coins) falls below 1, the situation reverses. Selling shares now means selling at a discount. Since November, Strategy's mNAV has remained below 1 for an extended period. This is why, despite having a large number of shares available for sale recently, Strategy has been unable to use them to purchase Bitcoin.

Furthermore, not only has Strategy been unable to raise funds to buy the dip recently, but it also chose to raise $1.44 billion by selling shares at a discount to establish a dividend reserve pool to support preferred share dividend payments and existing debt interest payments.

As the standard template for crypto treasuries, Strategy's mechanism has been adopted by most treasury companies. Therefore, we can see that when crypto assets fall, the reason these treasury companies fail to enter the market to buy the dip is not unwillingness but rather because their stock prices have fallen too much, effectively "locking" their ammunition depots.

Nominal Firepower Ample, Actually "Guns Without Bullets"

So, besides Strategy, how much purchasing power do other companies have? After all, there are now hundreds of crypto treasury companies in the market.

From the current market perspective, although there are many crypto treasury companies, their potential for future purchases is not very large. There are mainly two situations. One type consists of companies that were originally crypto asset holding enterprises. Their crypto asset holdings mainly come from their existing holdings rather than new purchases financed by debt issuance. Their ability and motivation to raise funds through debt are not strong. For example, Cantor Equity Partners (CEP), ranked third in Bitcoin holdings, has an mNAV of 1.28. Its Bitcoin holdings primarily resulted from a merger with Twenty One Capital, and it has had no purchase records since July.

The other type consists of strategy companies similar to Strategy. However, due to the recent severe decline in stock prices, their mNAV ratios have generally fallen below 1. The ATM capacities of these companies are also effectively locked and cannot be utilized until their stock prices recover above 1.

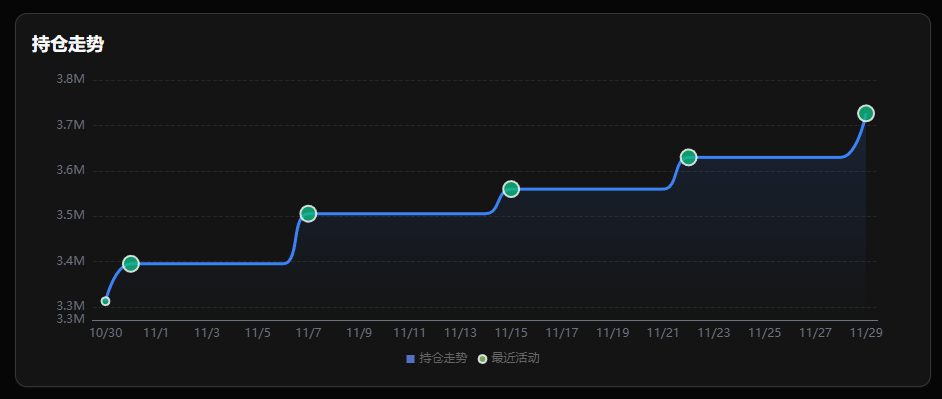

Beyond issuing debt and selling stock, there is another, more direct "ammunition depot": cash reserves. Taking BitMine, the largest DAT company for Ethereum, as an example, although its mNAV is also below 1, the company has maintained its purchase plan recently. According to data from December 1st, BitMine stated it still has $882 million in unencumbered cash on its books. BitMine Chairman Tom Lee recently stated, "We believe Ethereum's price has bottomed. BitMine has resumed accumulating, purchasing nearly 100,000 ETH last week, double the amount of the previous two weeks." BitMine's ATM capacity is also substantial. In July 2025, the total capacity of its program was increased to $24.5 billion, and it currently has nearly $20 billion remaining.

BitMine Holdings Change

Additionally, CleanSpark proposed issuing $1.15 billion in convertible bonds before the end of the year to purchase Bitcoin. The Japanese listed company Metaplanet has been a relatively active Bitcoin treasury company recently, raising over $400 million through Bitcoin-collateralized loans or share issuance since November to purchase Bitcoin.

In terms of total volume, the "nominal ammunition" (cash + ATM capacity) on the books of various companies amounts to tens of billions of dollars, far exceeding the previous bull market. However, in terms of "effective firepower," the actual number of bullets that can be fired has decreased.

Shifting from "Leveraged Expansion" to "Yield Generation for Survival"

Besides having their ammunition locked, these crypto treasury companies are also exploring new investment strategies. During the market uptrend, most companies' strategy was straightforward: buy relentlessly, obtain more financing as the price of coins and stocks rose, and then continue buying. As the situation reversed, many companies not only found it harder to raise funds but also faced the challenge of paying interest on previously issued bonds and covering operational costs.

Consequently, many companies are turning their attention to "crypto yield"—participating in crypto asset network staking activities to obtain relatively stable staking rewards. These rewards can then be used to pay the interest on their financing and operational costs.

For instance, BitMine plans to launch MAVAN (a US-based validator network) in Q1 2026 to initiate ETH staking. This is expected to generate approximately $340 million in annualized revenue for BitMine. Similar approaches are seen with Upexi, Sol Strategies, and other Solana network treasury companies, which can achieve around 8% annualized yield.

It is foreseeable that as long as mNAV cannot return above 1.0, hoarding cash to meet debt maturities will become the main theme for treasury companies. This trend also directly influences asset selection. Since Bitcoin lacks native high yield, the accumulation by pure Bitcoin treasuries is slowing down. In contrast, Ethereum treasuries, which can generate cash flow through staking to cover interest costs, have maintained more resilient accumulation speeds.

This shift in asset preference is essentially a compromise by treasury companies in the face of liquidity difficulties. When the channel for obtaining cheap funds through stock price premiums is closed, finding yield-generating assets becomes their only lifeline for maintaining a healthy balance sheet.

Ultimately, the "infinite ammunition" was merely an illusion built on stock price premiums during a positive cycle. When the flywheel locks up due to trading at a discount, the market must face a stark reality: these treasury companies have always been amplifiers of trends, not saviors against them. Only when the market sentiment recovers first can the funding valves be reopened.

Twitter:https://twitter.com/BitpushNewsCN

Bitpush TG Discussion Group:https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush