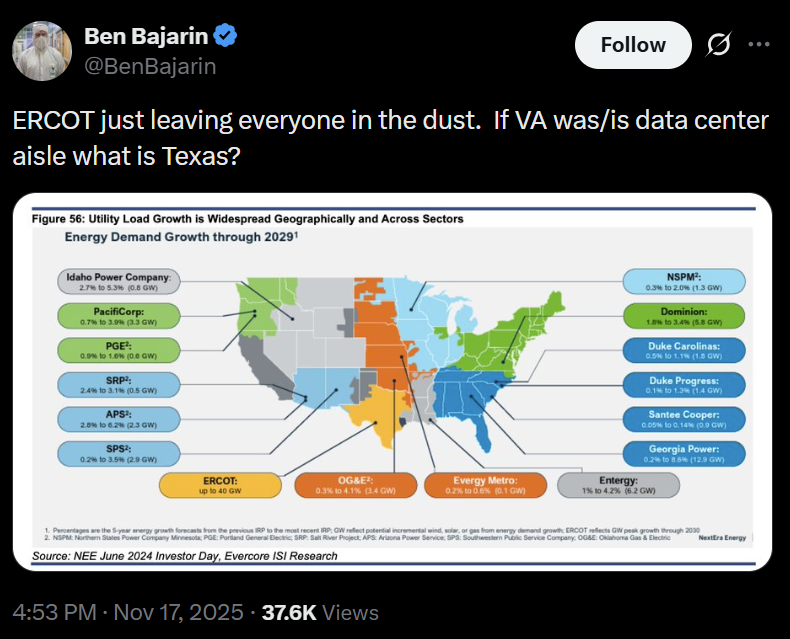

Texas is rapidly emerging as an epicenter of artificial intelligence-driven energy demand, with an unprecedented surge in large-load power requests, a wave now dominated by AI data centers rather than Bitcoin miners.

The figures, highlighted in The Miner Mag’s latest newsletter and drawn from ERCOT’s new System Planning and Weatherization Update, point to a grid facing a fundamentally different kind of growth.

ERCOT, the Electric Reliability Council of Texas, which operates the state’s independent power grid and oversees reliable electric service for about 90% of Texans, reported that its large-load interconnection queue has ballooned to 226 gigawatts of new requests, roughly 73% tied to AI facilities.

Developers have already filed 225 large-load requests this year, and on the supply side, ERCOT is reviewing 1,999 generation proposals totaling 432 GW, according to The Miner Mag.

However, the load is growing faster than the supply. While the generation queue is massive, it remains dominated by solar and battery projects, which are resources that don’t provide the around-the-clock power that AI data centers require. That mismatch is setting up future reliability and investment challenges.

State regulators are racing to adapt, The Miner Mag reported. New rules are being developed to classify any customer requesting 75 MW or more as a “special handling” case, and ERCOT has more than doubled the number of transmission projects under review.

Related: Bitcoin miners gambled on AI last year, and it paid off

What about Bitcoin miners?

The Miner Mag report drew a contrast between today’s surge in AI-driven power demand and the earlier boom from Bitcoin (BTC) miners, noting that Texas’ emerging grid crunch is now being fueled by AI, not crypto.

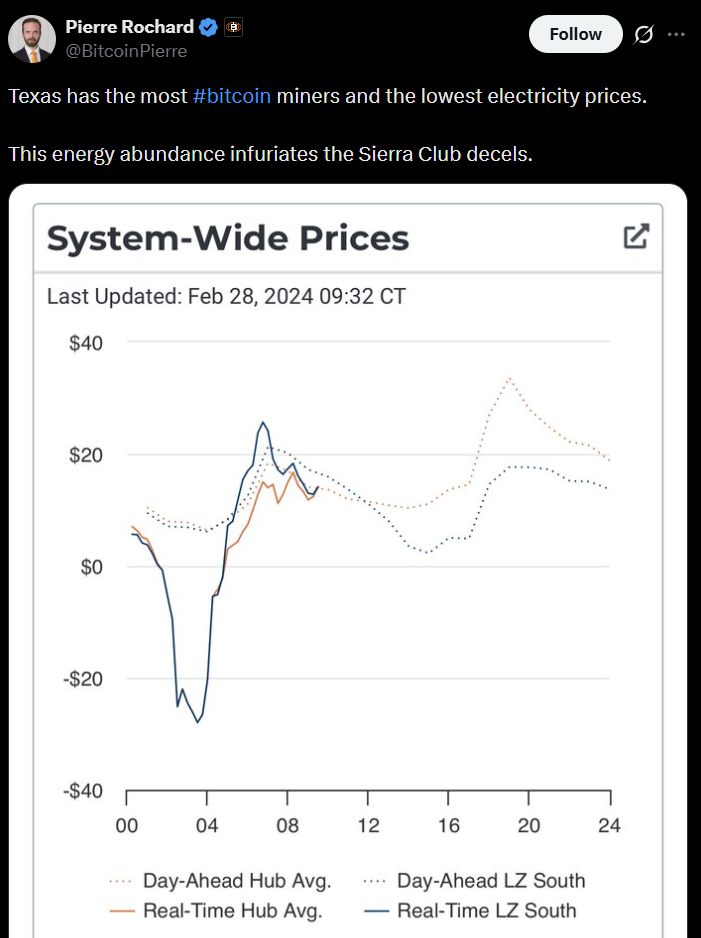

Bitcoin miners were once among the largest new power users in the state. Their impact was arguably positive: Miners frequently curtailed operations during peak demand and, according to a January study by the Digital Asset Research Institute, helped bolster grid stability and save the state an estimated $18 billion.

However, the landscape is shifting. Many miners and digital asset operators are reallocating their infrastructure toward AI computing to capitalize on the soaring demand for GPU capacity.

A recent example is Mike Novogratz’s Galaxy, which secured $460 million to convert its former Texas Bitcoin mining site into a large-scale AI data center.

Related: Bitcoin miners enter ‘harshest margin environment of all time’