Perpetuals trading platform Synthetix is returning to Ethereum’s mainnet, with its founder arguing the network is now more than capable of supporting high-frequency financial applications after years of network congestion drove derivatives activity elsewhere.

“By the time perp DEXs became a thing, the mainnet was too congested, but now we can run it back,” Synthetix founder Kain Warwick told Cointelegraph during an interview on Wednesday.

“It’s kind of crazy that there really hasn’t been a Perp DEX on mainnet,” he added, explaining that reduced demand after the perp DEX exodus, combined with ongoing scaling improvements, has made Ethereum layer 1 more viable again.

“It’s definitely the best place to run a perp DEX,” he said.

Warwick said that high gas fees and network congestion previously made it impractical to operate complex trading infrastructure on the network.

For several years, many perpetual platforms migrated to layer-2 networks or alternative blockchains, and Synthetix followed a similar path, he said, moving to the Ethereum layer-2 network Optimism in 2022 and later expanding to Arbitrum and Base.

Around the same time, decentralized derivatives exchange dYdX transitioned from mainnet to StarkWare layer-2 solution StarkEx.

Warwick says fees were “just too high” to make it feasible

Warwick said it wasn’t feasible to run critical infrastructure because the costs were “just too high.”

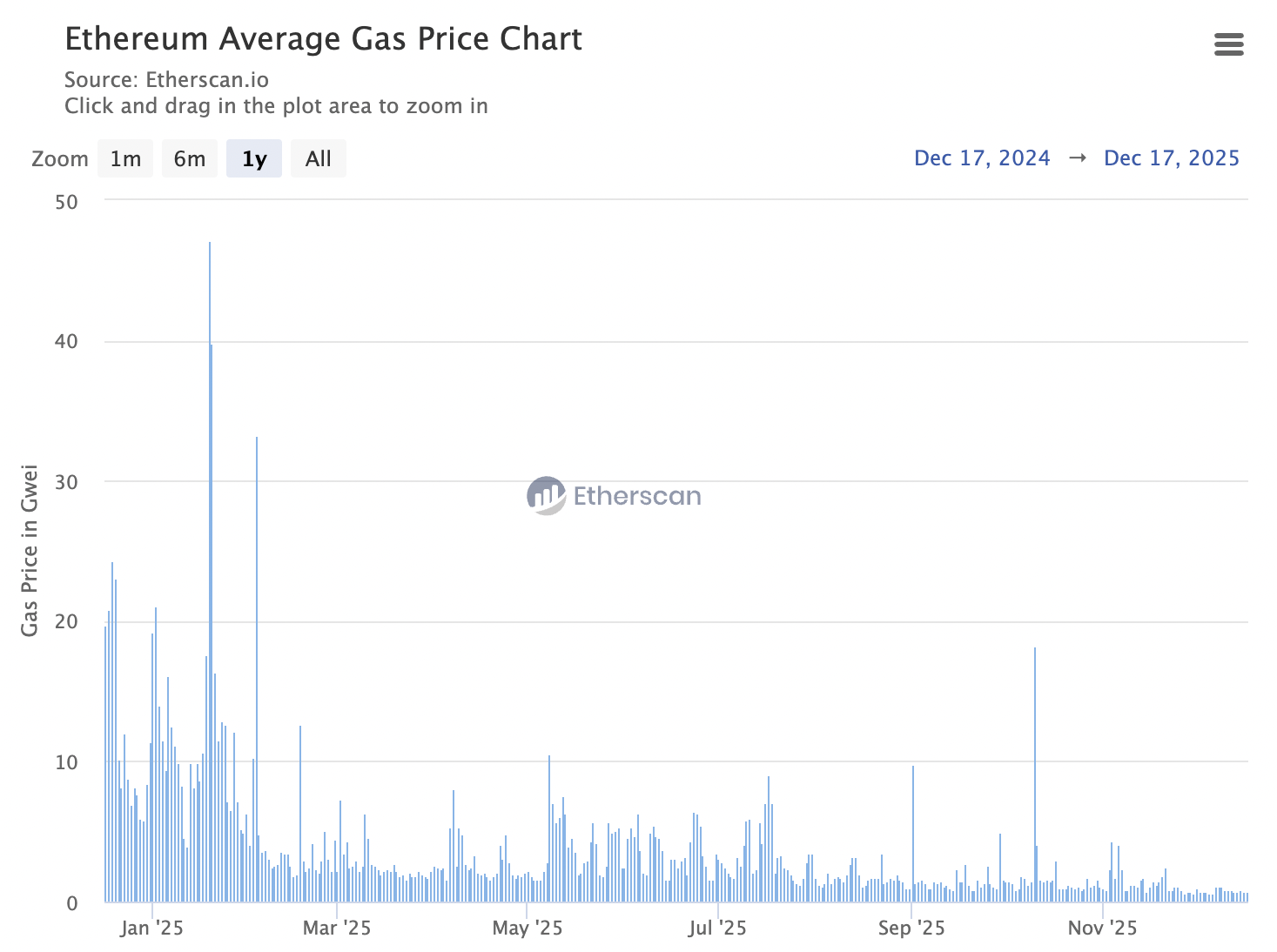

“The cost per transaction and therefore the efficiency of the markets on the chain really degraded,” Warwick said. On Wednesday, Ethereum’s average gas fee stood at approximately 0.71 gwei, nearly 26 times lower than on the same day twelve months ago, when it averaged 18.85 gwei, according to Etherscan.

Warwick said that the combination of layer-2 and layer-1 scaling means that ”you can actually run critical infrastructure on mainnet again.”

Some Ethereum proponents have predicted further improvements toward network capacity in 2026. Ethereum educator Anthony Sassano recently said the goal to significantly increase Ethereum’s gas limit to 180 million next year is a baseline rather than a best-case scenario.

Warwick expects other perpetual exchanges to follow Synthetix

Warwick expects other perpetual DEXs to follow Synthetix back to mainnet, arguing Ethereum now has the capacity to support multiple perp DEXs simultaneously.

Related: Ripple pilots RLUSD on Ethereum L2s in multichain push

“It wouldn’t be a Synthetix launch if someone didn’t try and, you know, follow us within 20 minutes,” Warwick said.

“The main advantage is most of the liquidity in the crypto world is on Ethereum mainnet; most of the assets, most of the margin, most liquidity, almost everything is there. It is the most efficient onchain market,” he said.

Warwick added that Ethereum’s development has improved significantly in 2025, and it has potentially been the best year for the network since the Merge in September 2022.

“There’s been a renewed kind of focus on, like, the needs of builders, in a way that I think in the past, maybe it was much more focused on the network itself,” he said.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?