Real-world asset (RWA) tokenization network Real Finance has secured $29 million in private funding to build an infrastructure layer for RWAs, aiming to make it easier for institutions to adopt tokenized assets.

The funding round included a $25 million capital commitment from Nimbus Capital, a digital asset investment firm, with additional participation from Magnus Capital and Frekaz Group, the company informed Cointelegraph.

Real Finance stated that the funding will be utilized to expand its compliance and operational infrastructure as it develops a full-stack RWA platform.

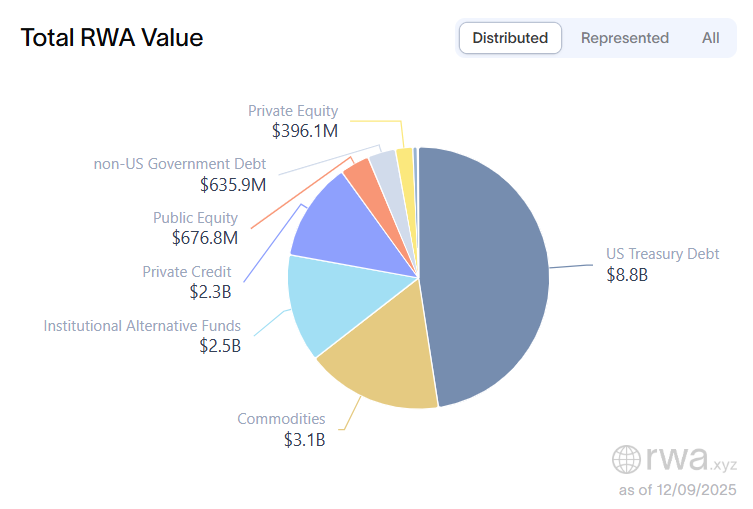

In the near term, the company aims to tokenize $500 million worth of RWAs — a target it says would represent about 2% of today’s tokenized asset market.

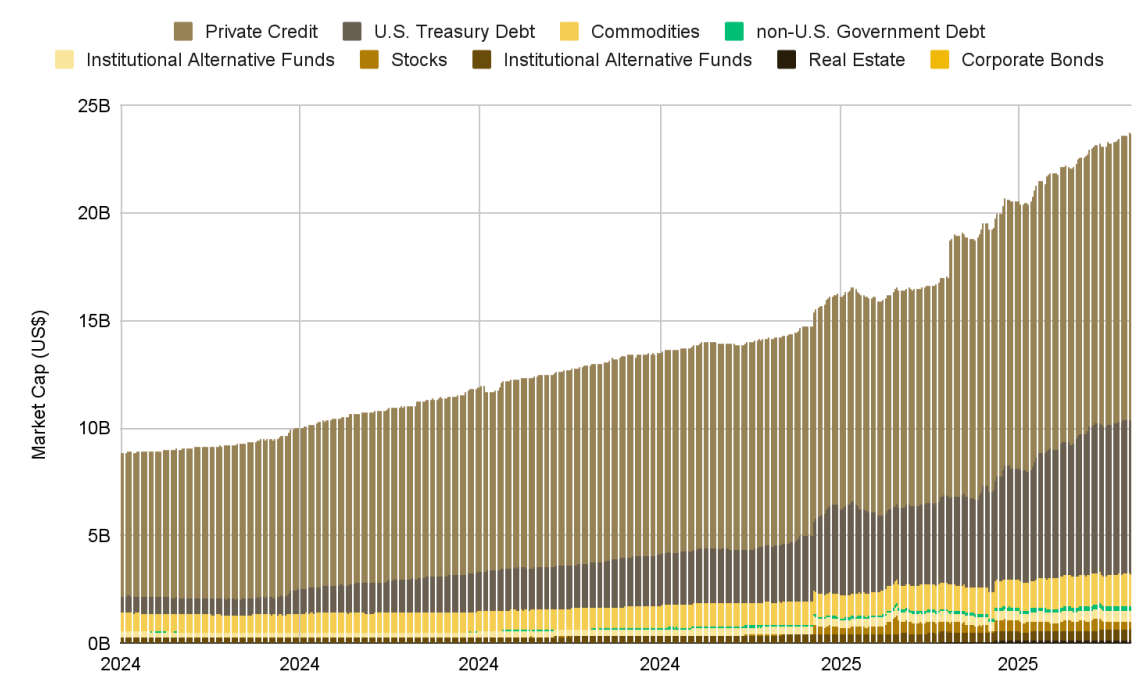

To date, the tokenization market has been dominated by US Treasury products, private credit and institutional alternative funds, although tokenized public equities and other asset types are also beginning to gain traction, according to industry data.

Money market funds, which are low-risk investment vehicles that invest in short-term, highly liquid assets, often hold some of the same instruments, such as Treasury bills. Tokenized money market funds have also been expanding quickly, with their market size growing roughly tenfold since 2023, according to data from the Bank for International Settlements.

Goldman Sachs and BNY Mellon are among the largest institutions to enter the tokenized money market fund space, adding further momentum to one of the fastest-growing segments of the RWA sector.

Related: Tokenized money market funds emerge as Wall Street’s answer to stablecoins

Tokenized RWA market poised for major expansion, industry insiders say

With 2025 already a landmark year for tokenized real-world assets due to rising institutional participation, next year could see even stronger growth, according to Chris Yin, co-founder and CEO of Plume, an RWA-focused layer-2 blockchain.

“Currently, we are tracking to over 10x the RWA holders number since the start of the year,” Yin told Cointelegraph, adding that “we think it’s not crazy to imagine another banner year with 25x+ in user growth numbers.”

Beyond US government debt, Yin said the market is seeing rising interest in private credit, mineral rights, energy assets, GPUs and other nontraditional categories.

His outlook aligns with a June report from Binance Research, which noted that clearer regulatory expectations in the United States could draw even more major institutions into tokenization.

Related: SEC ends Biden-era probe into tokenized equity platform Ondo Finance