Payments giant Stripe has acquired the team from crypto wallet firm Valora, just a day after launching its testnet for its stablecoin-focused blockchain project Tempo.

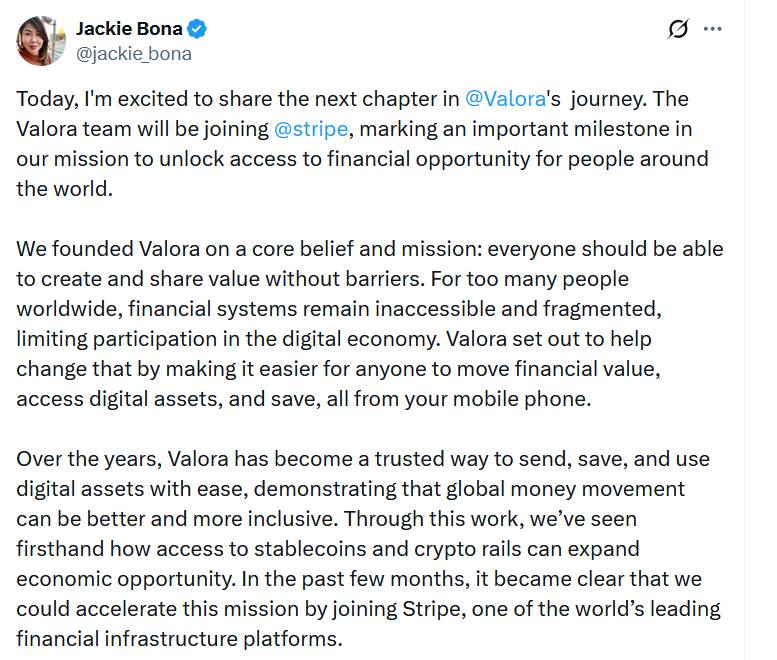

According to Valora CEO Jackie Bona, the acquisition will see the Valora team join Stripe and work on the firm’s blockchain initiatives.

Valora was founded in mid-2021 after spinning out of Celo development group cLabs and raising $20 million in Series A funding in the process.

The Valora app is a mobile wallet that supports stablecoins and other assets across Celo, Ethereum, Base, Optimism and Arbitrum. Apart from the wallet, the team also developed an open protocol launchpad for Web3 apps geared toward a mobile-native experience.

“Stripe shares our conviction that stablecoins and crypto can dramatically expand who gets to participate in the global economy,” said Bona, adding that “by bringing Valora’s team to Stripe, we’ll be able to contribute our expertise in web3 and user-first experiences to a platform with unparalleled reach.”

It is not explicitly stated what the Valora team will work on; however, Stripe will be tapping a team that has had a strong focus on global payments, digital wallets and user-friendly smartphone-based Web3 apps.

“Through this work, we’ve seen firsthand how access to stablecoins and crypto rails can expand economic opportunity. In the past few months, it became clear that we could accelerate this mission by joining Stripe, one of the world’s leading financial infrastructure platforms,” Bona said.

Related: The easiest and safest methods for gifting crypto at Christmas in 2025

The Valora app will continue to function, but its operations and future development will be handed over to cLabs.

Momentum building for Stripe and Tempo

After an on-again-off-again relationship with crypto, Stripe has been making strides in the blockchain space over the past couple of years. Momentum has been building particularly since first unveiling Tempo four months ago in partnership with crypto VC firm Paradigm, with the network already having a $5 billion pre-launch.

The latest move from Stripe comes just a day after Stripe and Paradigm’s layer-1 blockchain project Tempo launched its open testnet.

One of the key features highlighted during the testnet launch was the ease and simplicity of creating stablecoins directly in the browser, among other benefits.

Magazine: 11 critical moments in Ethereum’s history that made it the No.2 blockchain