Macro Analyst: Bitcoin (BTC) Will Fall Below $70,000 Due to Japan's Hawkish Policy

The Bank of Japan is expected to raise its benchmark interest rate on Friday, which has historically been a bearish signal for high-risk assets like Bitcoin.

Several macro analysts have indicated that if the Bank of Japan (BoJ) raises interest rates as expected on December 19th, Bitcoin (BTC) could face further declines, falling back to the $70,000 level.

Key Points:

The Bank of Japan's tightening policy could pressure Bitcoin by reducing global liquidity.

Both macro and technical signals point to a Bitcoin downside target of around $70,000.

Bank of Japan Rate Hikes Have Historically Preceded 20% to 30% Bitcoin Price Drops

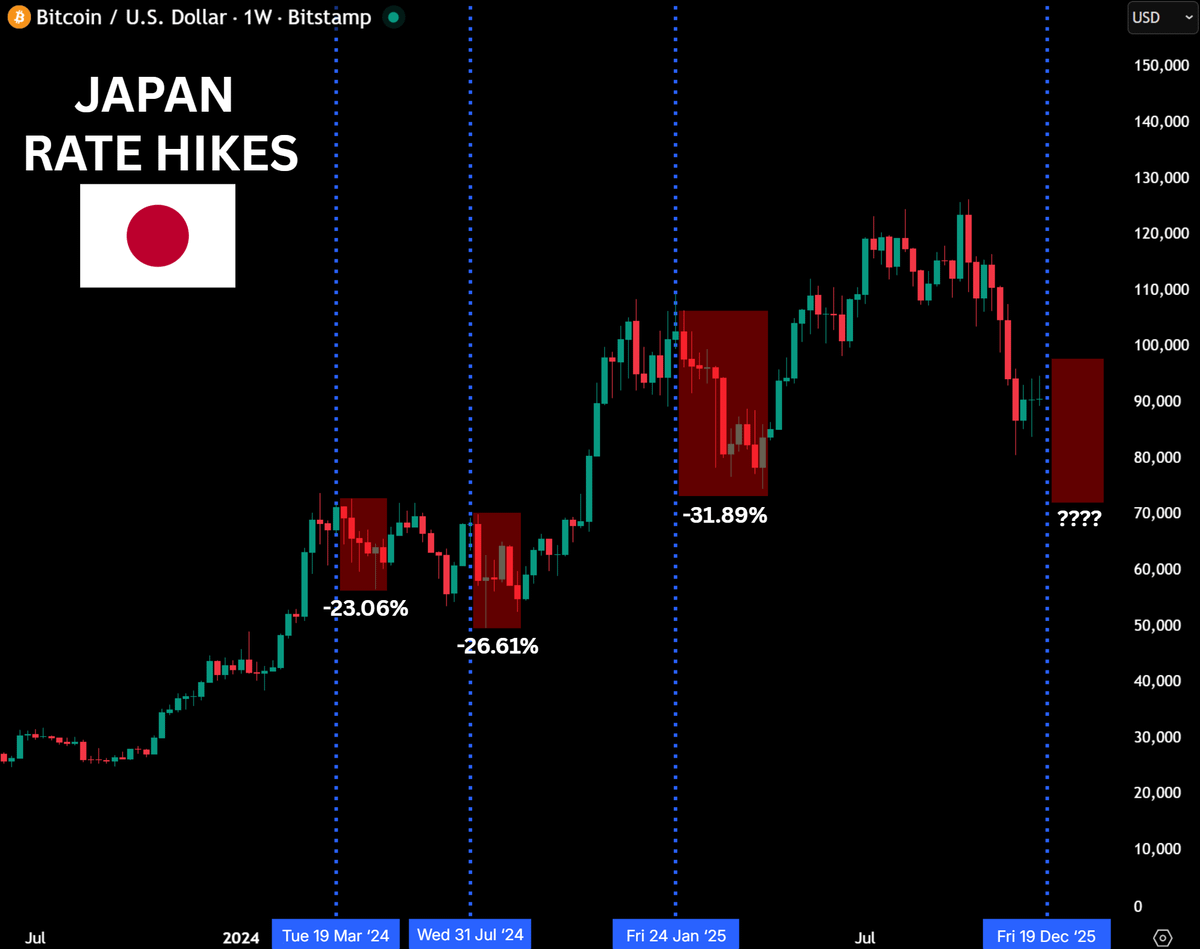

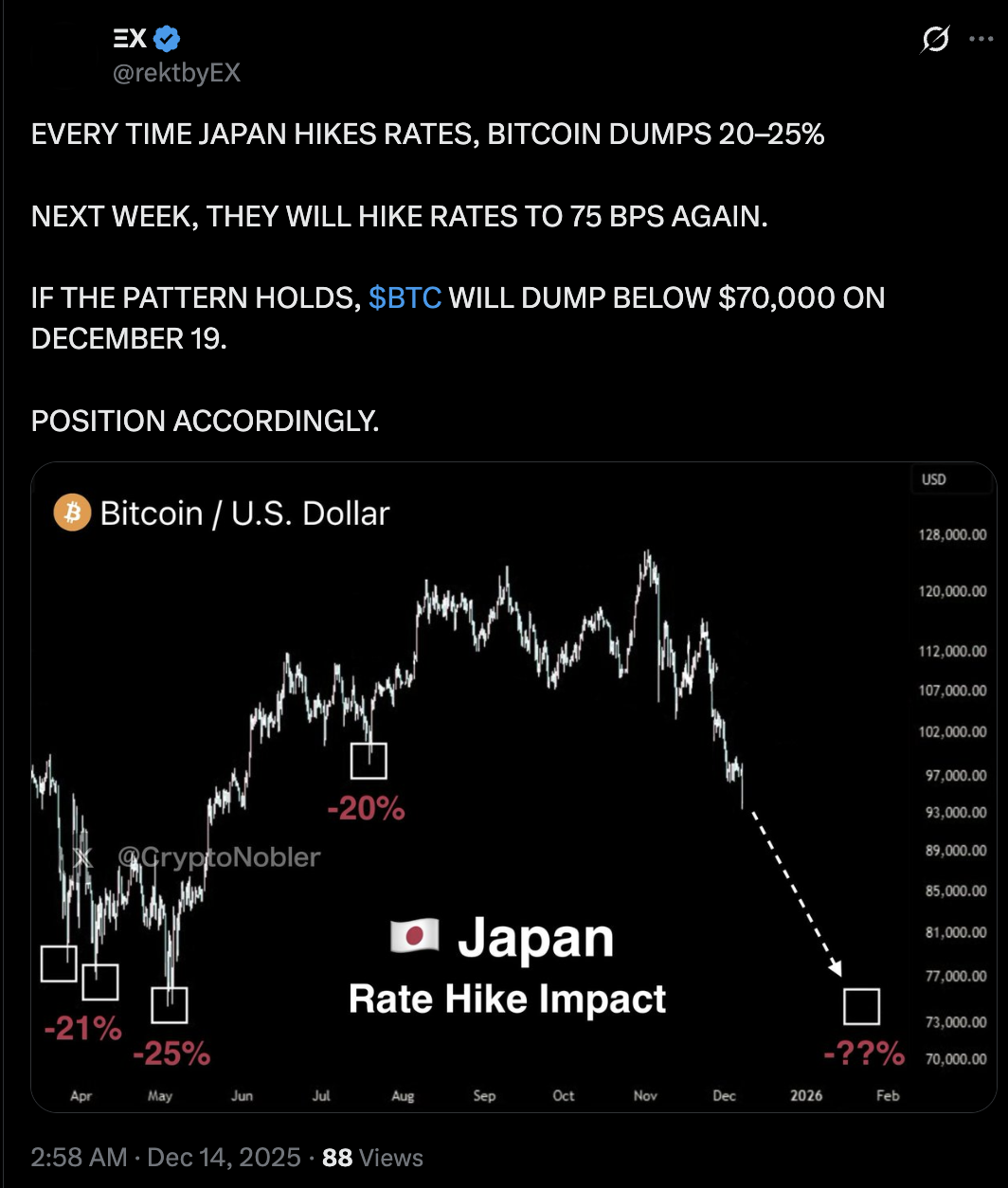

According to data compiled by analyst AndrewBTC, since 2024, every interest rate hike by the Bank of Japan has been accompanied by a Bitcoin price pullback of over 20%.

The analyst pointed out on the X platform on Saturday that BTC fell approximately 23% in March 2024, about 26% in July 2024, and around 31% in January 2025.

Analyst AndrewBTC warned that if the Bank of Japan hikes rates on Friday, a similar downside risk could emerge again. A recent Reuters poll showed that most economists expect the Bank of Japan to raise rates again at its December policy meeting.

The core of this view lies in Japan's role in global liquidity.

In the past, Bank of Japan rate hikes typically pushed the yen higher, increasing the cost of borrowing and investing in high-risk assets. This often forced traders to unwind so-called "yen carry trades," thereby reducing global market liquidity.

As liquidity tightens, Bitcoin comes under pressure, and investors reduce leverage and lower exposure during risk-averse periods.

Analyst EX stated that in such a macroeconomic environment, Bitcoin will "fall below $70,000".

Bitcoin Bear Flag Pattern Targets the Same $70,000 Area

Bitcoin's daily chart is also sending technical warning signals, with the price trend consolidating within a classic bear flag structure.

This pattern emerged after Bitcoin's sharp drop from the $105,000 to $110,000 range in November, followed by the formation of a narrow upward consolidation通道. Such structures often预示 a brief pause before the prior trend continues.

Once the price confirms a break below the flag's lower boundary, it could trigger a new round of declines, with a measured target range of approximately $70,000 to $72,500. Over the past month, multiple analysts, including James Check and Sellén, have given similar downside targets.

Related Recommendation: Curve founder proposes burning 17 million CRV to aid research and development team

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph shall not be liable for any loss or damage arising from your reliance on this information.