Key Bitcoin (BTC) Price Levels to Watch Ahead of the Final FOMC Meeting of 2025

Ahead of the FOMC meeting, Bitcoin's volatility remains high, with strong resistance at $94,000 and multiple key support levels below.

On Tuesday, as market volatility intensified ahead of the Federal Reserve's interest rate decision on Wednesday, Bitcoin's price once again failed to break through the $94,000 resistance level.

Key Points:

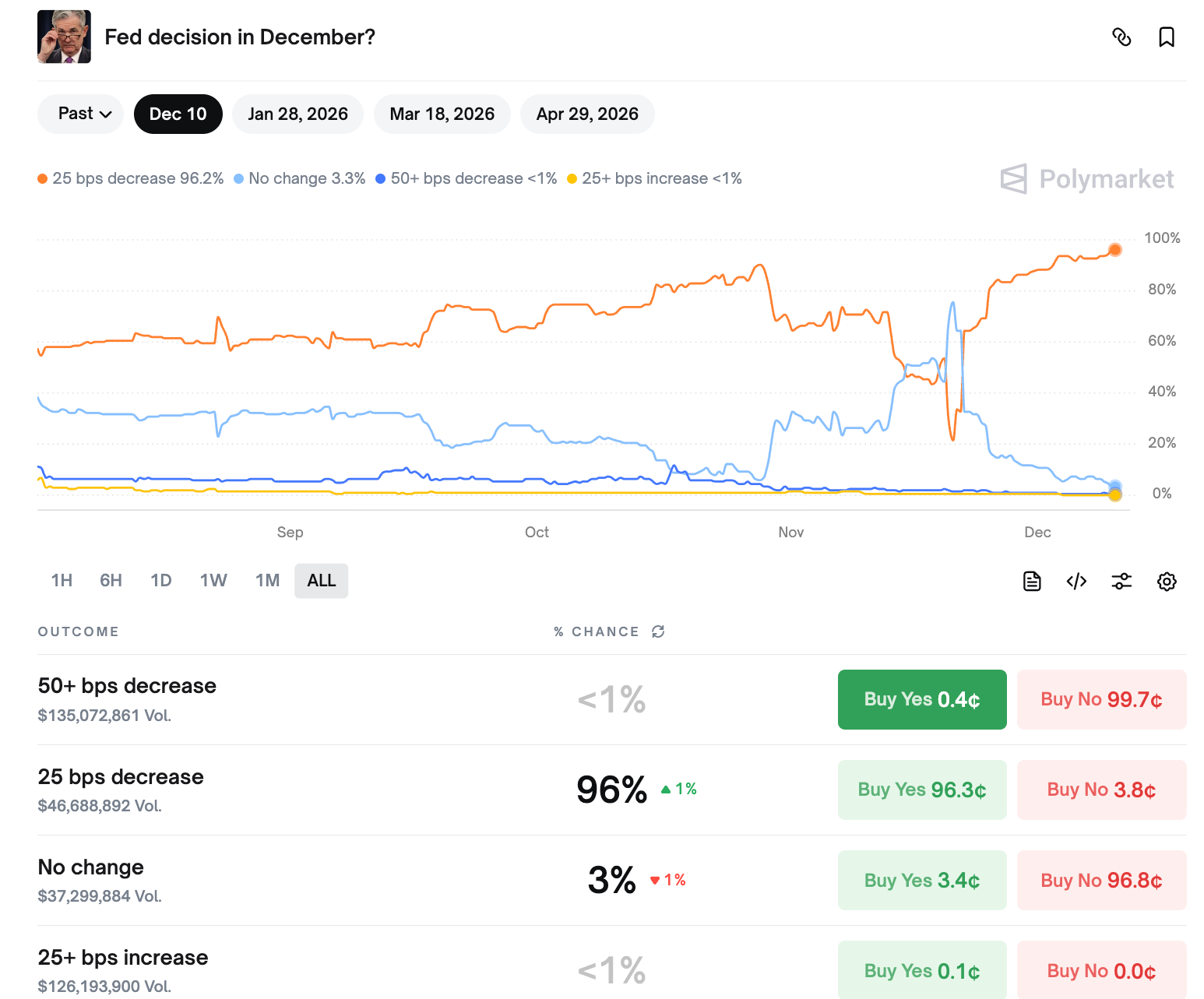

According to Polymarket data, the probability of a 25 basis point rate cut on Wednesday is now 96%.

If key support levels are broken, the BTC price could fall to $84,000.

Probability of a 25 Basis Point Rate Cut is 96%

The final two-day meeting of the U.S. Federal Open Market Committee (FOMC) for the year began on Tuesday, with the interest rate policy decision expected to be announced on Wednesday at 2:00 PM (Eastern Time).

Market participants expect the Fed to cut rates by 0.25%, which would be the third rate cut this year.

Polymarket shows a 96.8% probability of rates falling to between 3.50% and 3.75%, while the probability of rates remaining unchanged is 3%.

However, any bullish price trends resulting from the rate cut may have already been priced in by the market.

On Wednesday, Bitcoin fell to $92,000 as the market worried that Federal Reserve Chairman Jerome Powell's post-meeting speech could cause market turbulence again.

"Yesterday's weak employment data slightly dampened hopes for a rate cut and shook traditional financial markets; now all eyes are on the Fed and wage data," Bitcoin analyst AlphaBTC stated in an X post on Wednesday, adding:

"If the Fed unexpectedly turns hawkish or wages remain strong, another round of selling is expected."

Therefore, the market will closely watch Powell's rhetoric at the FOMC press conference to observe any changes in tone.

Market commentator Wess said on Tuesday: "Right now, the market has priced in a '25 basis point rate cut,' but the real drama will unfold in Powell's speech."

Key Bitcoin Price Levels to Watch

Bitcoin must convert $93,300 into support to target new highs above $100,000.

To do this, Bitcoin/USD must first reclaim the area above the 50-day simple moving average (yellow line) at $98,000.

The $100,000 psychological barrier is particularly important for Bitcoin's price, as repeated resistance at this level could trigger another round of selling, similar to what was seen in February.

Above this, the main supply zone extends to $108,000, where the 200-day simple moving average is located. This trend line was first lost on November 3rd since April 22nd.

Bulls still need to overcome this barrier to increase the probability of Bitcoin reaching $110,000.

Conversely, bears will try to maintain the annual opening resistance at $94,000, thereby increasing the possibility of breaking below the new low of $90,000.

A key area to watch is between $90,000 and last Sunday's low of $87,500. Below this point, the next step would be to retest the November 21st low of $84,000, erasing all gains from the past three weeks.

Bitcoin analyst AlphaBTC is focused on a BTC rebound to $98,000, warning that a break below $91,000 would have a disastrous impact on the market.

"But Bitcoin must now hold $91,500, otherwise we will see a bloodbath in the market."

Bitcoin liquidation heatmaps show a large concentration of liquidity between $93,000 and $96,000. Below the spot price, the area to watch is $91,500.

This highlights the potential price volatility areas, depending on the outcome of today's FOMC meeting.

Related recommendation: Bitcoin (BTC) wallet linked to Silk Road transfers $3 million to new address

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. Although we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph is not responsible for any losses or damages resulting from reliance on this information.