Cardano is finally doing the unsexy but absolutely necessary plumbing work: getting serious, external oracle infrastructure wired in, with a governance wrapper that looks a lot more like “adult supervision” than the old ad-hoc ecosystem scramble.

On a Dec. 11 livestream, Charles Hoskinson said the ecosystem’s new “Pentad” structure — the coordination bloc spanning Input Output, the Cardano Foundation, EMURGO, the Midnight Foundation, and Intersect — has approved its first major integration under the “critical integrations” framework: bringing Pyth’s Lazer oracle to Cardano, with deployment targeted for early 2026.

Pyth Deal Kicks Off Cardano’s Critical Integrations Push

“This is the appetizer announcement,” Hoskinson said, framing Pyth as the first of what he expects to be a broader menu: bridges, stablecoins, analytics, custodians — the stuff that turns a chain into a DeFi venue people actually build on, not just a community that argues about roadmaps.

Hoskinson didn’t really sugarcoat why this matters. “Oracles are really the first part of major integrations,” he said, because you need reliable data coming in and you need credible pathways to the rest of the industry. He also admitted the in-house approach hasn’t landed the way it should’ve: Cardano “tried to build an indigenous oracle solution and it hasn’t worked out as well as it should.” So [...] Pyth. That’s the pivot.

Pyth, in its own marketing, has been pushing Lazer as an ultra-low latency product designed for speed-sensitive trading use cases — basically, price updates fast enough that perps and other twitchy DeFi apps don’t feel like they’re operating on last cycle’s data. Hoskinson called Pyth “one of the most advanced Oracle solutions on market,” and emphasized the practical angle: lots of feeds, lots of publishers, and broad distribution across chains.

Intersect’s announcement (the one Hoskinson pulled up mid-stream) from X states: “One of the first concrete outcomes of the Critical Cardano Integrations workstream is now in place! The Steering Committee [...] has approved the first major integration under this framework: bringing Pyth Lazer oracle to Cardano. Pyth provides low-latency, institutional-grade market data across thousands of price feeds spanning crypto, equities, FX, commodities and ETFs, already used by hundreds of DeFi applications across 100+ blockchains to power trading, lending and risk management.”

Hoskinson argued, “[Pyth] effectively attaches Cardano now to the information networks of the entire cryptocurrency space.” He said the team is already exploring whether it can switch parts of the ecosystem — including Djed — over to Pyth, and he wants Cardano dapp teams to seriously evaluate the integration once it’s available.

“Pyth is just the appetizer in the Cardano critical integrations,” he said. “There are many more things to come.”

The broader context is that Cardano’s new “Pentad” has been positioning “critical integrations” as a coordinated, treasury-backed effort to “prime Cardano for 2026,” including a budget proposal tied to ecosystem-wide enablers. If Pyth is the first concrete output, it’s also a signal the Pentad model is going to be judged on execution, not vibes.

Hoskinson, closing out, put it in his usual rally language: “Cardano is not an island anymore [...] the cavalry has come.” The market can do what it wants in the short term. But getting credible oracle rails in place is the kind of boring upgrade that tends to matter later — when teams are deciding where to deploy, and where liquidity is willing to live.

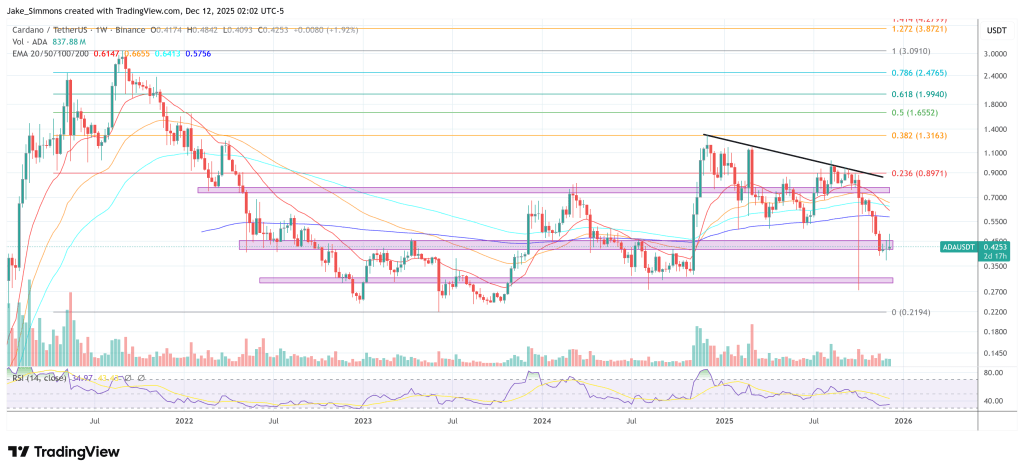

At press time, ADA traded at $0.4253.