As the market volatility heats up again, the price of Bitcoin witnessed a pullback, bringing it closer to the $90,000 threshold. While BTC’s price faces a pullback, key on-chain metrics are beginning to follow suit, reaching levels that could shape or determine the next trajectory of the market.

A Crucial Breakdown In Bitcoin Realized Loss

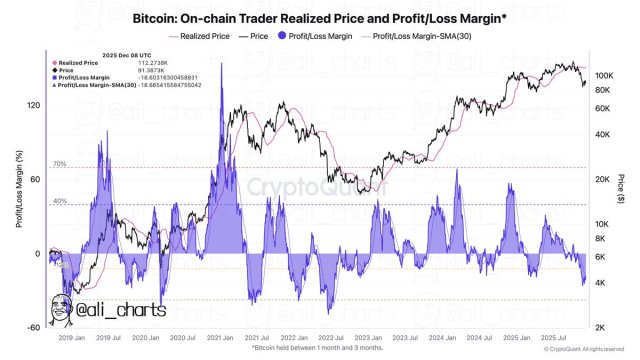

Given the bearish state of the market, on-chain indicators for Bitcoin are flashing a slight but crucial signal in its dynamics. BTC On-Chain Trader Realized Price and Profit/Loss Margin, one of the most important metrics, has now dropped below a crucial level as the market and BTC’s price fluctuate.

According to Ali Martinez, a seasoned crypto analyst and trader, this drop in the metric is offering a clue to the next potential path for the BTC market. Following weeks of increased capitulation-driven losses, the drop in realized losses indicates that market players are no longer selling coins at sharp discounts.

While the wave of panic selling that clouded recent market turbulence may finally be dissipating, this crucial indicator is providing traders with new grounds to reevaluate the short-term course of Bitcoin. This implies that sentiment is gradually stabilizing, pointing to an early shift from capitulation to accumulation.

In the post, Ali Martinez highlighted that the metric has fallen below the critical -37%, now located at -18%. The drop may appear increasingly negative, but it is hinting at a pivotal junction for the broader Bitcoin market.

Historically, this drop in the metric below this level has led to a rebound in investors’ confidence in the market. Martinez claims that some of the best buy-the-dip opportunities have emerged when Bitcoin on-chain traders’ realized loss falls below -37%.

BTC’s Rebound Requires Fresh Liquidity

Since the sharp pullback from its all-time high, Bitcoin has failed to bounce back strongly. Darkfost, a market and author at CryptoQuant, claims that one of the major reasons why BTC is currently struggling to recover is the absence of incoming liquidity. This is the biggest issue in the market now.

Liquidity here refers solely to stablecoins. According to Darkfost, monitoring these flows makes it easier to assess if new liquidity is poised to enter the market or if it is still lacking. Data shows that since August, stablecoin inflows into exchanges have steadily declined from 158 billion to around $76 billion.

This sharp drop represents a 50% decrease in incoming liquidity. Additionally, the 90-day average has dropped, from $130 billion in stablecoin inflows to $118 billion. A drop in liquidity suggests that Bitcoin is battling with a decline in demand, which has not been strong enough to absorb the selling pressure impacting the market.

Presently, the trend is still negative, and the minor rebounds observed are primarily a consequence of reduced selling pressure rather than more purchasing demand. For BTC to regain a genuine bullish trend, Darkfost stated that the key rests on new liquidity entering the market.