Author: Tanay Ved

Compiled by: Saoirse, Foresight News

Key Points

- Uniswap's fee switch links the UNI token to protocol usage through a token supply burn mechanism. Currently, fees generated by the protocol are used to reduce the supply of UNI. This adjustment transforms the UNI token from having only governance functions to an asset that can directly accumulate value.

- Early data shows the protocol's annualized fees are approximately $26 million, with a revenue multiple of about 207x; it will continue to burn around 4 million UNI tokens annually. This move has already incorporated high growth expectations into UNI's $5.4 billion valuation.

- DeFi is gradually transitioning to a "fee-hooked" token model. Mechanisms such as token burning, staker reward distribution, and "vote-escrowed (ve)" locking are all designed to align token holders more closely with the protocol's economic system, thereby reshaping the valuation logic in this field.

Introduction

In late 2025, Uniswap governance passed the "UNIfication" proposal, officially activating the long-awaited protocol "fee switch." This is one of the most significant token economic changes in a DeFi blue-chip project since 2020—a time when the market is increasingly focused on "real yield" and "sustainable value accumulation driven by fees." Now, this fee switch establishes a more direct link between the UNI token and Uniswap's revenue and trading activity, with Uniswap itself being one of the largest decentralized exchanges (DEX) in the cryptocurrency space.

In this article, we will delve into Uniswap's token economic system after the fee switch is enabled, assess the dynamics of UNI token burning, the fee mechanism, and its impact on valuation, and explore the significance of this transformation for the entire DeFi field.

The Disconnect Between DeFi Tokens and Protocol Value

One of the core challenges in the DeFi space is the disconnect between "powerful protocols" and "weak tokens." Many DeFi protocols have achieved clear product-market fit, high usage rates, and stable revenue, but the tokens they issue often only serve governance functions, providing almost no direct access to protocol cash flows for holders. In this context, capital increasingly flows into areas like Bitcoin, underlying public chains (L1s), Meme coins, etc., while the trading prices of most DeFi tokens are severely disconnected from the actual equity of protocol growth.

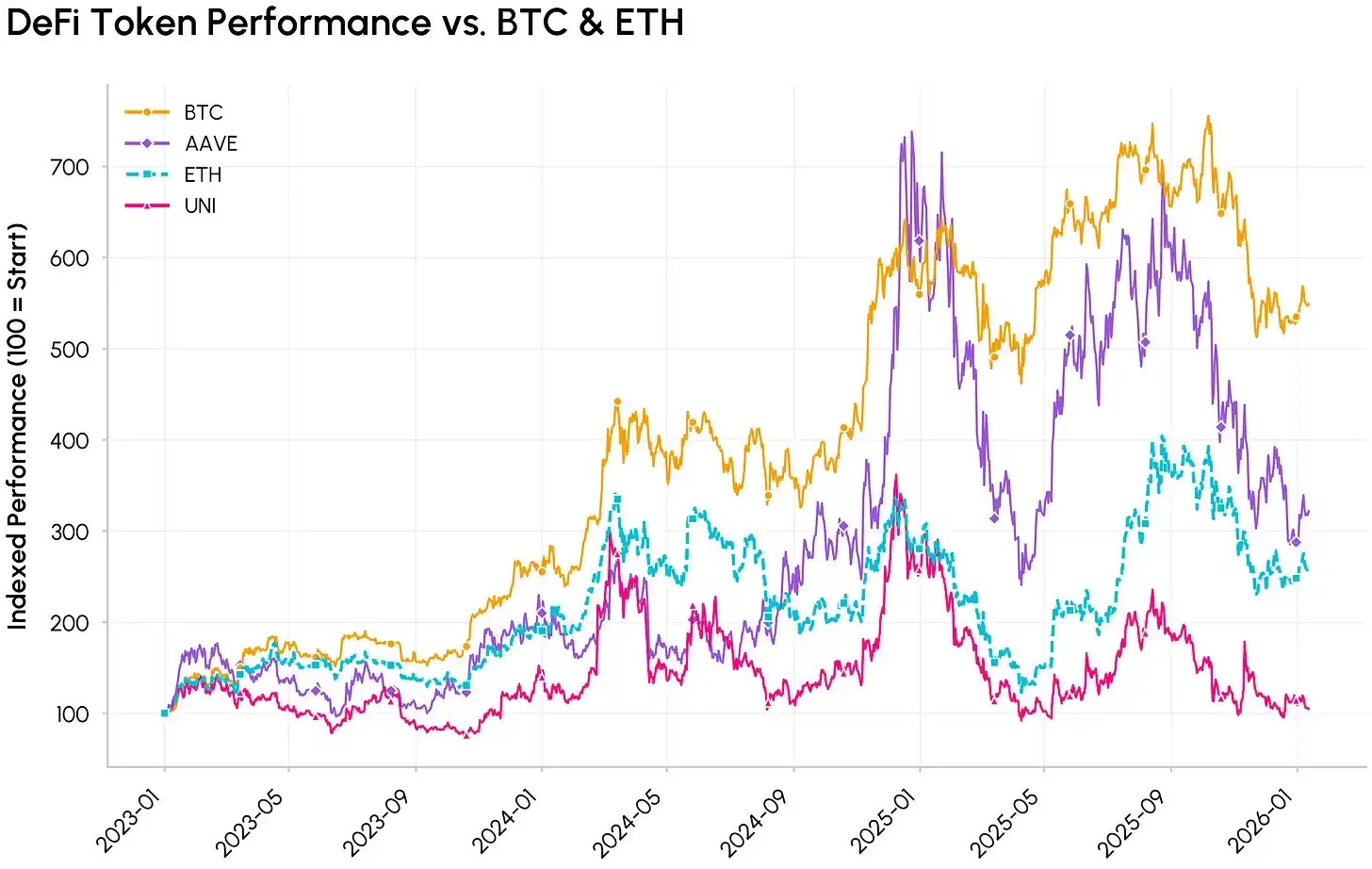

Indexed performance comparison of DeFi tokens (AAVE, UNI) vs. mainstream cryptocurrencies (BTC, ETH)

Uniswap launched as a decentralized exchange (DEX) on the Ethereum network in November 2018, designed to enable order book-free, intermediary-free exchange of ERC-20 tokens. In 2020, Uniswap issued the UNI token and positioned it as a governance token—a practice consistent with DeFi blue-chip projects like Aave, Compound, and Curve, where the primary purpose of issuing tokens is often governance voting and user incentives.

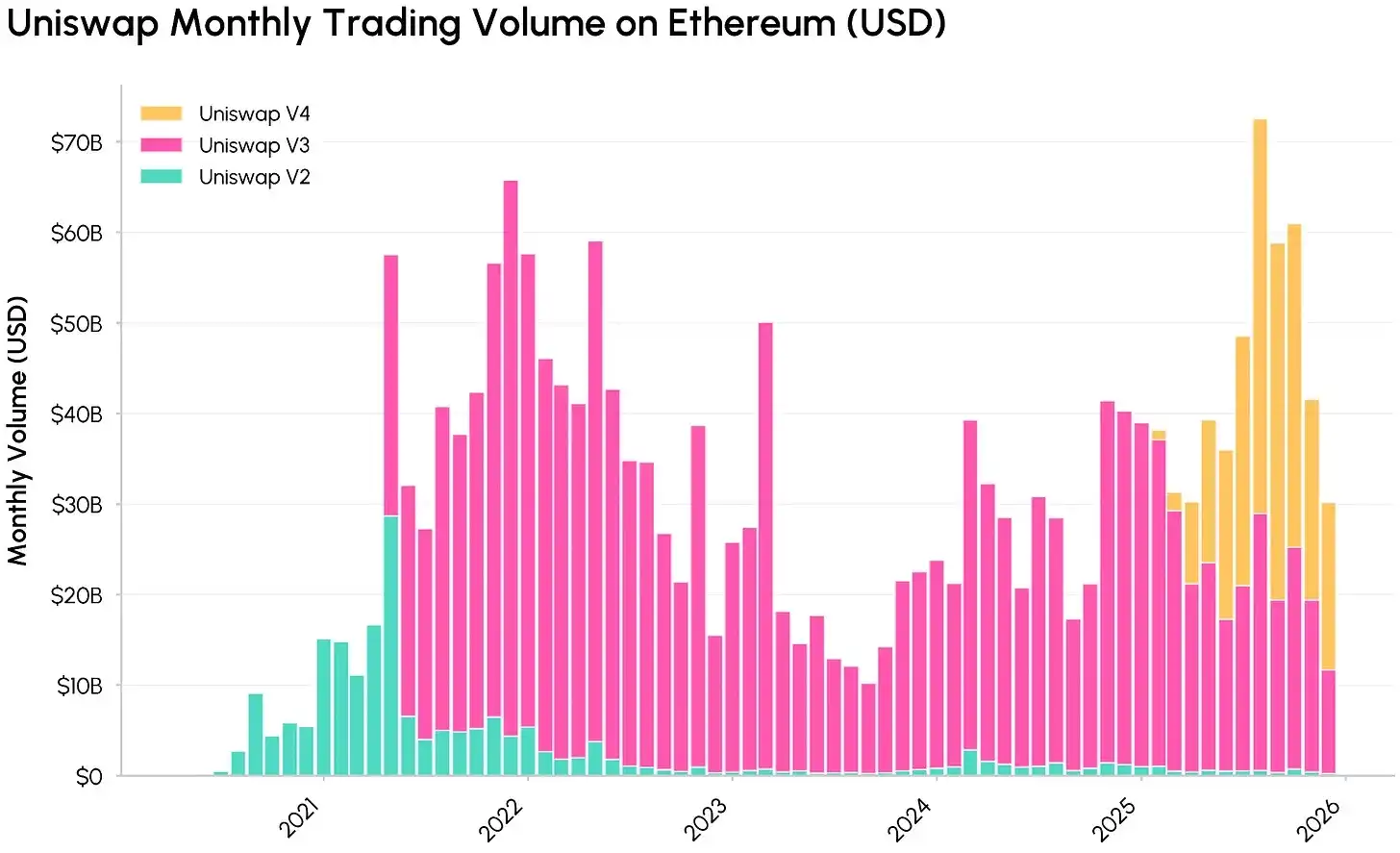

Monthly trading volume (in USD) trends of various Uniswap versions (V2, V3, V4) on the Ethereum network. Source: Coin Metrics Network Data Pro

With version iterations, Uniswap has become a core component of on-chain financial infrastructure, processing tens of billions of dollars in trading volume and generating substantial fee income for liquidity providers (LPs). However, like most DeFi governance tokens, UNI token holders cannot directly share in the protocol's revenue, leading to an increasing disconnect between the scale of the protocol's underlying cash flow and the economic interests of token holders.

In practice, the value generated by Uniswap primarily flows to liquidity providers (LPs), borrowers, lenders, and related development teams, while token holders only receive governance rights and inflationary rewards. This contradiction between "governance-only" tokens and the "need for value accumulation" laid the foundation for the introduction of Uniswap's fee switch and the "UNIfication" proposal—which explicitly links the value of the UNI token to protocol usage, aligning token holders more closely with the economic system of the decentralized exchange (DEX).

Uniswap Fee Switch: Fees and Burn Mechanism

With the passage of the "UNIfication" governance proposal, the Uniswap protocol introduced the following key adjustments:

- Activate protocol fees and UNI burn mechanism: Turn on the protocol "fee switch," directing protocol-level pool fees from Uniswap V2 and V3 on the Ethereum mainnet into the UNI token burn mechanism. By establishing a programmatic link between "protocol usage" and "token supply," UNI's economic model shifts from "governance-only" to "deflationary value accumulation."

- Execute retrospective treasury token burn: A one-time burn of 100 million UNI tokens from the Uniswap treasury to compensate token holders for the fee revenue missed over the years.

- Include Unichain revenue: Sequencer fees generated by the Unichain network (after deducting Ethereum Layer 1 data costs and Optimism's 15% share) will be fully incorporated into the aforementioned "burn-driven" value capture mechanism.

- Adjust organizational incentive structure: Integrate most functions of the Uniswap Foundation into Uniswap Labs, and establish an annual growth budget of 20 million UNI, enabling Uniswap Labs to focus on protocol promotion; simultaneously, reduce its take rate in interfaces, wallets, and API services to zero.

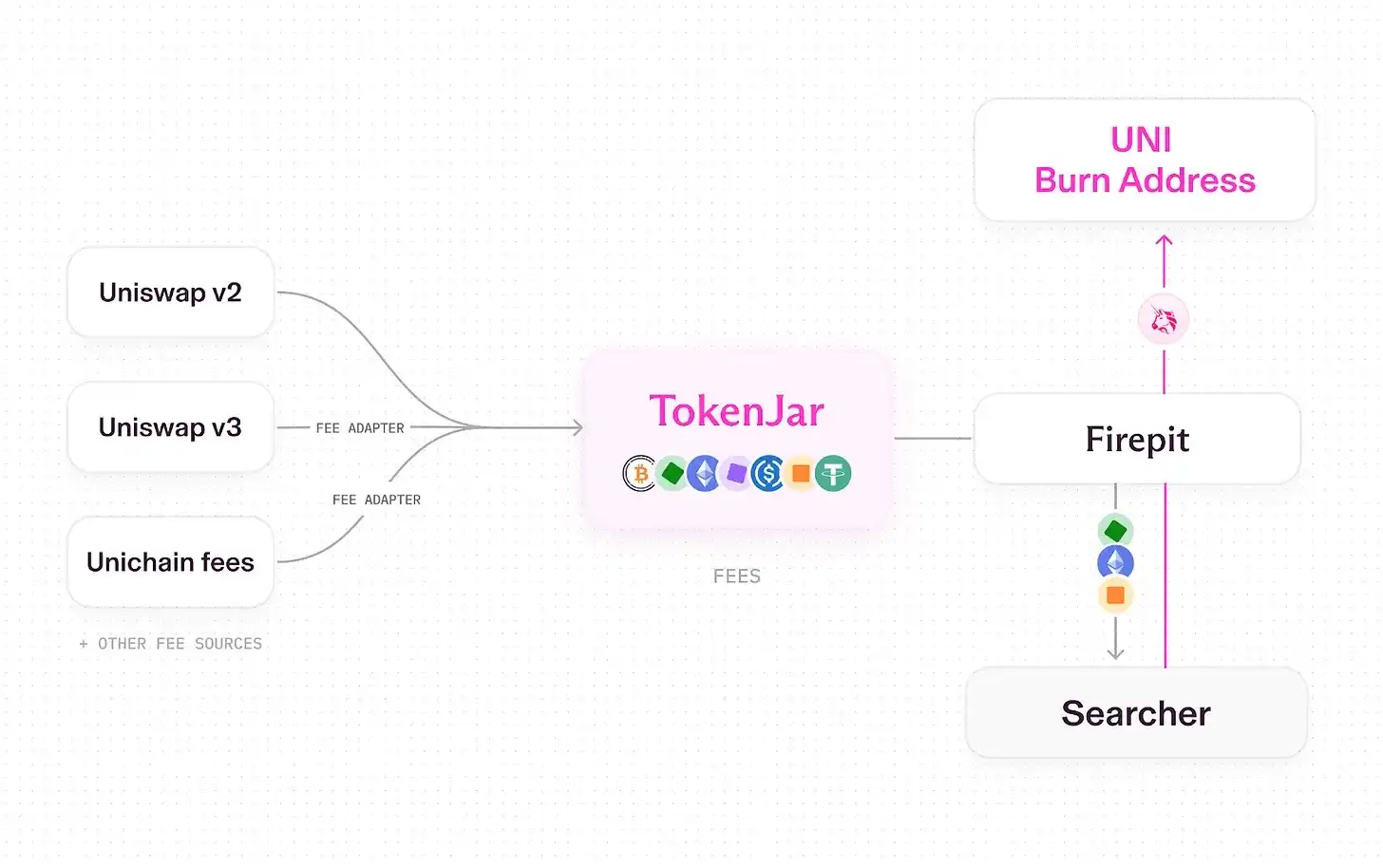

Complete process of converting protocol fees into UNI token burns after the Uniswap fee switch is turned on. Source: Uniswap UNIfication

Currently, Uniswap operates in a "pipelined" mode, using dedicated smart contracts to handle asset release and conversion (such as UNI token burning). The specific process is:

- Transactions on Uniswap V2, V3, and Unichain generate fees;

- A portion of the fees belongs to the protocol (the rest is distributed to liquidity providers);

- All protocol-level fees flow into a single treasury smart contract called "TokenJar" on each chain;

- Value in the TokenJar can only be released when UNI tokens are burned through the "Firepit" smart contract.

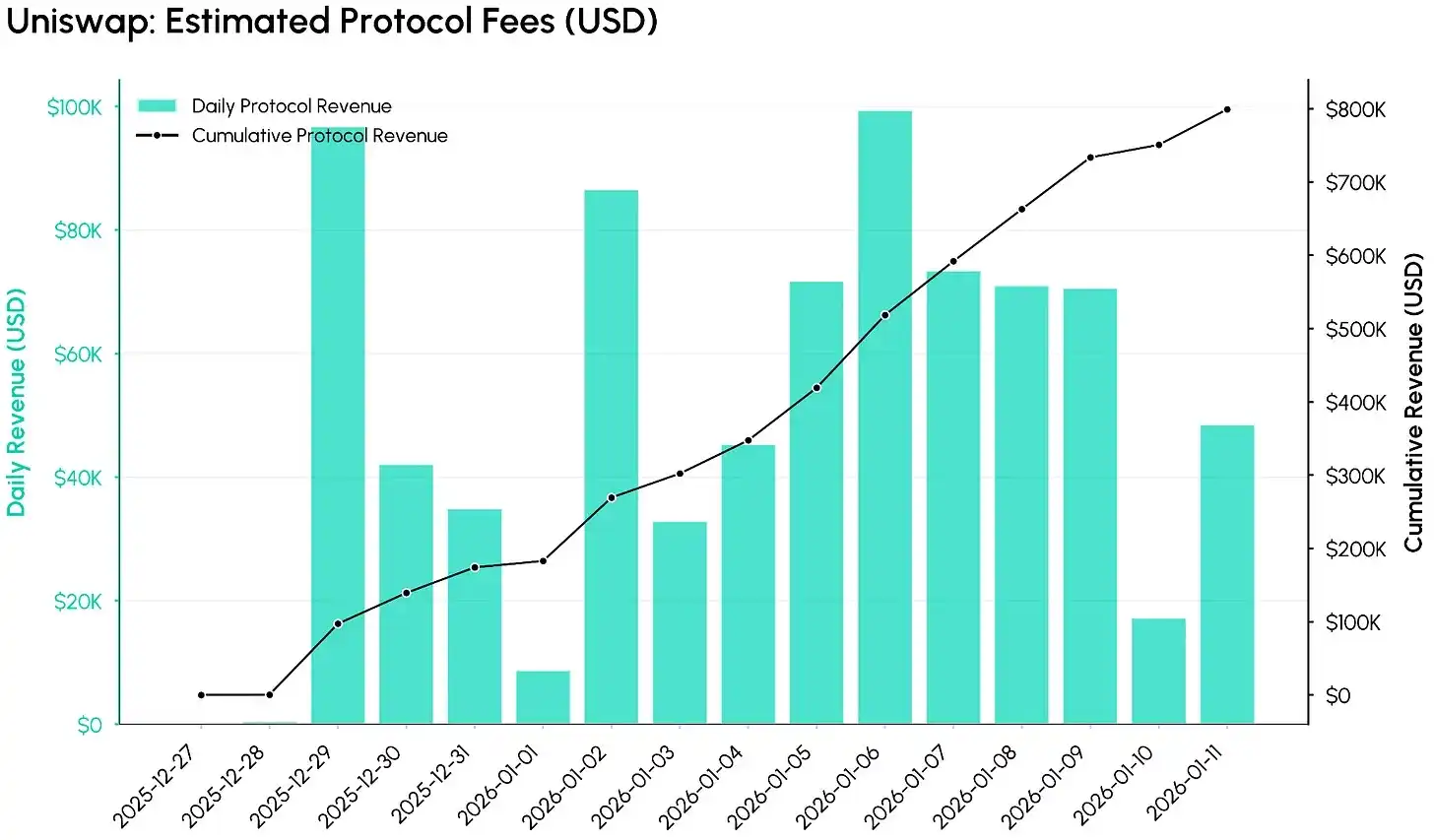

Protocol fee data after the Uniswap fee switch was turned on (starting December 27, 2025). Source: Coin Metrics ATLAS

According to Coin Metrics ATLAS data, significant protocol fees have flowed into the system in the first 12 days after the fee switch was enabled. The chart below tracks the daily estimated protocol fees (in USD) and the cumulative total, showing that under the initial configuration, the fee switch quickly monetized Uniswap's trading volume—within just 12 days, cumulative protocol-level fees reached approximately $800,000.

If current market conditions remain stable, the protocol's annualized revenue is projected to be around $26-27 million (for reference only), but actual revenue will depend on market activity and the promotion progress of the fee mechanism across various pools and chains.

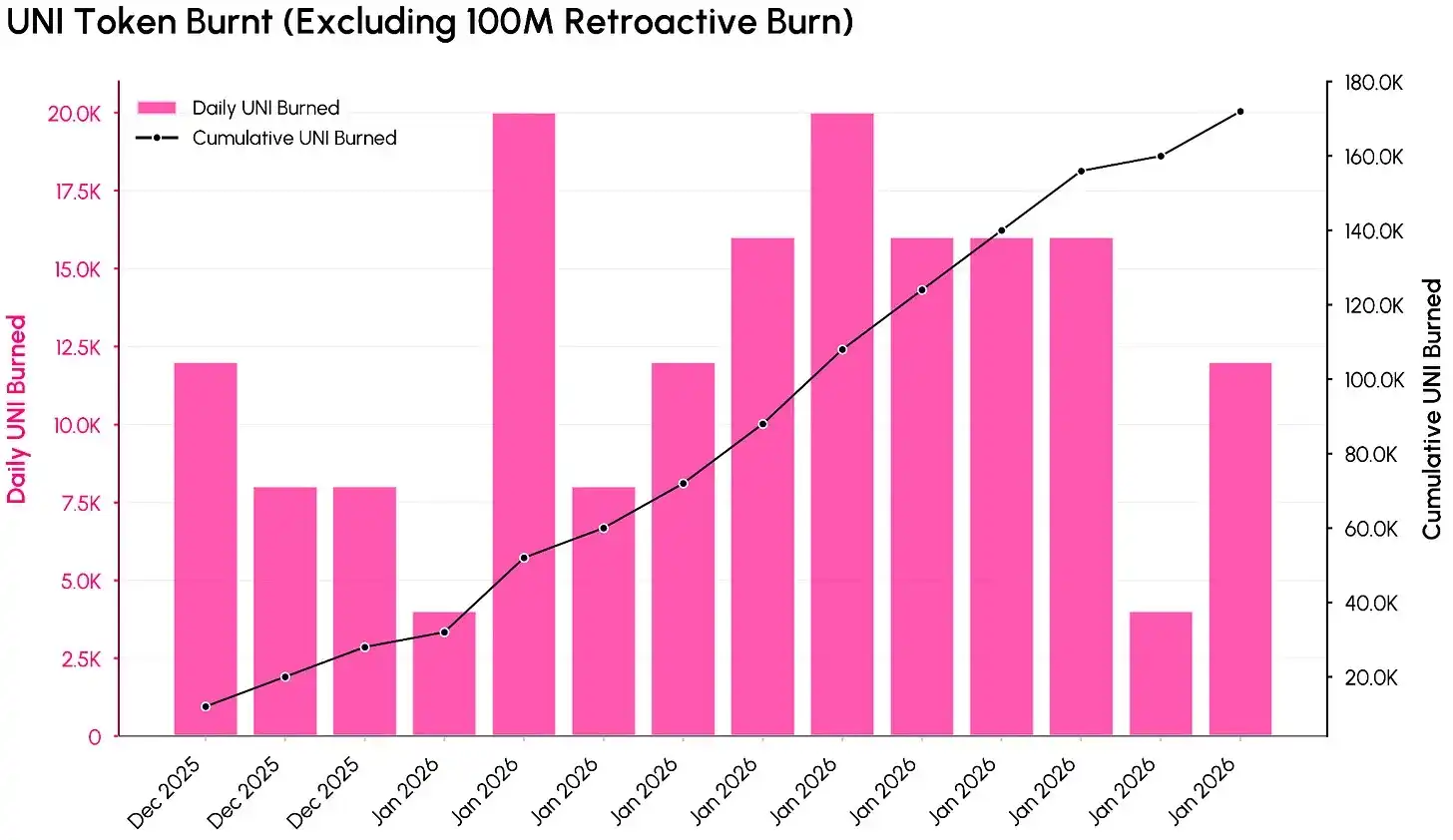

UNI token burn data after the Uniswap fee switch was turned on (excluding the 100 million retrospective burn). Source: Coin Metrics ATLAS

The chart above shows how protocol fees are converted into a reduction in the UNI token supply (excluding the 100 million retrospective burn). As of the time of data collection, the total number of UNI tokens burned had reached approximately 100.17 million (equivalent to about $557 million), accounting for 10.1% of the initial total supply of 1 billion.

Based on the burn data from the first 12 days after the "UNIfication" proposal took effect, the annualized burn rate for UNI tokens is estimated to be around 4 to 5 million. This data highlights that protocol usage now generates "periodic, programmatic" UNI burns, rather than simply inflationary token issuance.

Valuation and Impact on the DeFi Field

After the fee switch is enabled, UNI token valuation can be assessed not just from a "governance function" perspective but also through a "cash flow lens." With UNI's current market capitalization of $5.4 billion, compared to the initial annualized protocol fees of approximately $26 million shown by TokenJar data, its revenue multiple is about 207x—a valuation closer to high-growth tech assets than a mature decentralized exchange (DEX). Excluding the treasury burn portion, UNI's annualized burn volume is about 4.4 million tokens, representing only 0.4% of the current supply, indicating a relatively low "burn rate" relative to its valuation.

Market capitalization trend of Uniswap token UNI. Source: Coin Metrics Network Data Pro

This situation highlights a new trade-off: although a clearer value capture mechanism enhances UNI's investment attributes, the current data implies that the market has extremely high expectations for its future growth. To reduce this revenue multiple, Uniswap needs to take comprehensive measures: expand the scope of fee capture (e.g., cover more pools, launch V4 version "hook" features, conduct fee discount auctions, optimize Unichain), achieve sustained trading volume growth, and offset the annual 20 million UNI growth budget and other token releases through deflationary mechanisms.

From an industry structure perspective, the "UNIfication" proposal pushes the DeFi field towards a direction where "governance tokens must be explicitly linked to the protocol economy." Whether it's Uniswap's token burning, Ethena's "direct fee distribution to stakers," "vote-escrowed locking + fee/bribe sharing" in DEXs like Aerodrome, or hybrid mechanisms like the Hyperliquid perpetual contract model, they are essentially different forms of "protocol fee sharing," with the core purpose of strengthening the link between tokens and the protocol economy. As the world's largest decentralized exchange (DEX) adopts a "fee-hooked + burn-driven" design, future market评判标准 for DeFi tokens will no longer be limited to "Total Value Locked (TVL)" or "narrative heat," but will focus more on "the efficiency of converting protocol usage into lasting value for holders."

Conclusion

The activation of Uniswap's fee switch marks a critical juncture: the UNI token transforms from a "pure governance asset" to an "asset explicitly linked to protocol fees and usage." This shift makes UNI's fundamentals more analyzable and investable, but also subjects its valuation to stricter scrutiny—current valuations already incorporate strong expectations for future fee capture capabilities and growth potential.

In the future, two key variables will influence UNI's long-term trajectory: first, the level to which Uniswap can raise protocol-level fees without harming the economic interests of liquidity providers (LPs) and trading volume; second, the evolving attitude of regulators towards "fee-hooked tokens" and the "buyback-and-burn token" model. These two factors will jointly shape the long-term risk-return characteristics of the UNI token and will also provide important references for how other DeFi protocols share value with token holders.