Written by: Vaidik Mandloi

Compiled by: Chopper, Foresight News

Where Is the True Value of Digital Banks Flowing?

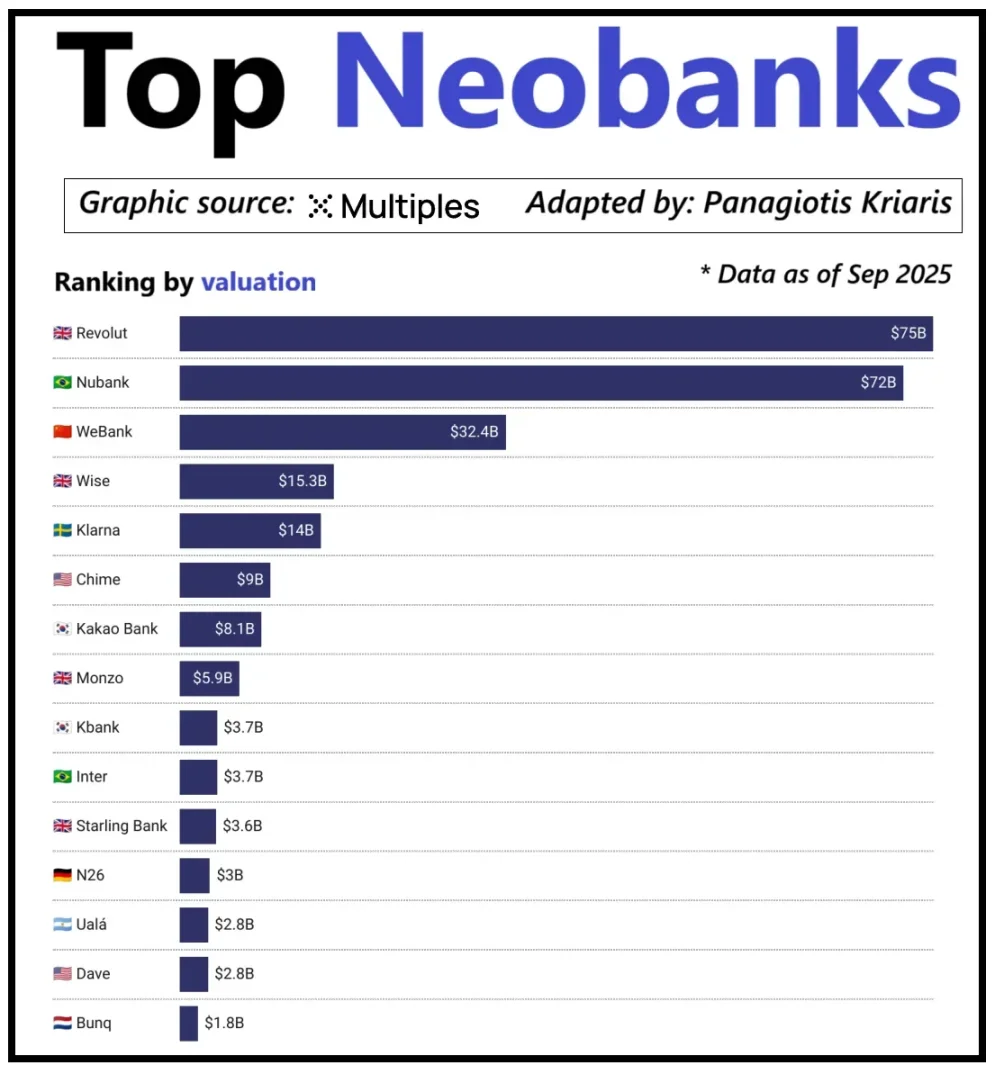

Looking at the world's leading digital banks, their valuation is not solely determined by the size of their user base, but by their revenue per customer. Digital bank Revolut is a typical case: although its number of users is smaller than that of Brazil's digital bank Nubank, its valuation surpasses the latter. The reason lies in Revolut's diversified revenue sources, covering foreign exchange transactions, securities trading, wealth management, and premium membership services, among other sectors. In contrast, Nubank's expansion of its business empire relies mainly on credit business and interest income, rather than bank card fees. China's WeBank has taken another differentiated route, achieving growth through extreme cost control and deep integration into Tencent's ecosystem.

Valuation of Leading Emerging Digital Banks

Currently, crypto digital banks are reaching the same developmental milestone. The combination of "wallet + bank card" can no longer be called a business model, as any institution can easily launch such services. The platform's differentiated competitive advantage is precisely reflected in its chosen core monetization path: some platforms earn interest income from user account balances; some profit from stablecoin payment flows; and a few platforms place their growth potential on the issuance and management of stablecoins, as this is the most stable and predictable source of income in the market.

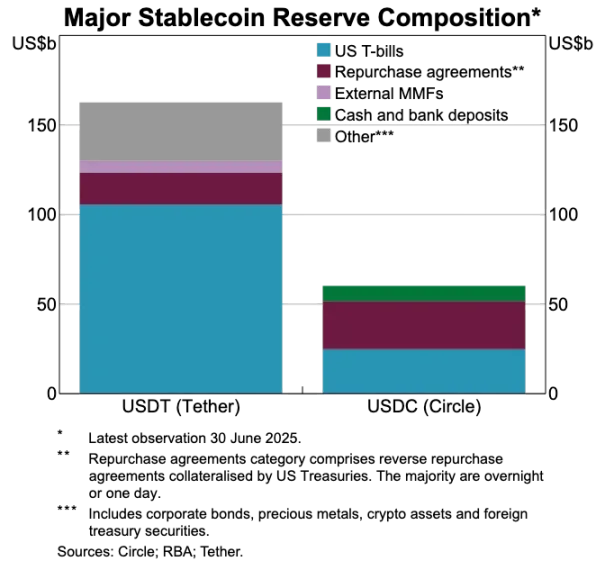

This also explains why the importance of the stablecoin track is increasingly prominent. For reserve-backed stablecoins, the core profit comes from the investment returns on reserves, i.e., the interest generated by investing reserves in short-term government bonds or cash equivalents. This income belongs to the stablecoin issuer, not the digital bank that merely provides users with stablecoin holding and spending functions. This profit model is not unique to the crypto industry: in traditional finance, digital banks similarly cannot earn interest from user deposits; the actual profits go to the partner banks that custody the funds. The emergence of stablecoins has made this model of "separation of profit ownership" more transparent and centralized. The entity holding short-term government bonds and cash equivalents earns interest income, while consumer-facing applications are primarily responsible for user acquisition and product experience optimization.

As the adoption scale of stablecoins continues to expand, a contradiction gradually emerges: the application platforms that undertake user引流, transaction matching, and trust building often cannot profit from the underlying reserves. This value gap is forcing companies to integrate vertically, breaking away from being mere front-end tools and moving closer to the core links that control fund custody and management rights.

It is precisely for this consideration that companies like Stripe and Circle are increasing their布局 in the stablecoin ecosystem. They are no longer satisfied with staying at the distribution level but are expanding into settlement and reserve management, as these are the core profit-making links of the entire system. For example, Stripe launched its proprietary blockchain Tempo, which is tailored for low-cost, instant transfers of stablecoins. Instead of relying on existing public chains like Ethereum or Solana, Stripe built its own transaction channel to control the settlement process, fee pricing, and transaction throughput, all of which directly translate into better economic benefits.

Circle has adopted a similar strategy, building the专属 settlement network Arc for USDC. Through Arc, inter-institutional USDC transfers can be completed in real-time without causing congestion on the public chain network or requiring high fees. Essentially, Circle has built an independent USDC backend system through Arc, no longer constrained by external infrastructure.

Privacy protection is another important motivation for this布局. As Prathik explained in the article "Reshaping Blockchain Glory," public chains record every stablecoin transfer on a public and transparent ledger. This characteristic is suitable for open financial systems but has drawbacks in business scenarios such as salary payments, supplier payments, and treasury management. In these scenarios, transaction amounts, counterparties, and payment patterns are all sensitive information.

In practice, the high transparency of public chains allows third parties to easily reconstruct a company's internal financial status through blockchain explorers and on-chain analysis tools. The Arc network allows inter-institutional USDC transfers to be settled off the public chain, preserving the advantages of高速 settlement of stablecoins while ensuring the confidentiality of transaction information.

Comparison of Asset Reserves for USDT and USDC

Stablecoins Are Breaking the Old Payment System

If stablecoins are the core of value, the traditional payment system appears increasingly outdated. The current payment process requires the participation of multiple intermediaries: the payment gateway is responsible for fund collection, the payment processor completes transaction routing, the card network authorizes the transaction, and the issuing and acquiring banks of the transacting parties最终 complete the清算. Each link generates costs and causes transaction delays.

Stablecoins directly bypass this lengthy chain. Stablecoin transfers do not require the involvement of card networks, acquirers, or waiting for batch settlement windows; instead, they enable peer-to-peer direct transfers based on the underlying network. This characteristic has a profound impact on digital banks because it彻底改变了用户的体验预期 – if users can achieve instant fund transfers on other platforms, they will absolutely not tolerate the cumbersome and expensive transfer processes within digital banks. Digital banks must either deeply integrate stablecoin transaction channels or become the least efficient link in the entire payment chain.

This transformation also reshapes the business model of digital banks. In the traditional system, digital banks could obtain stable fee income from bank card transactions because the payment network firmly controlled the core links of transaction flow. But in the new system dominated by stablecoins, this profit space is greatly compressed: peer-to-peer stablecoin transfers do not incur fees. Digital banks that rely solely on bank card consumption for profit are now facing a completely fee-free competitive track.

Therefore, the role of digital banks is shifting from card issuers to payment routing layers. As payment methods shift from bank cards to direct stablecoin transfers, digital banks must become core nodes for stablecoin transactions. Digital banks that can efficiently process stablecoin transaction flows will dominate the market, because once users regard them as the default channel for fund transfers, it becomes difficult to switch to other platforms.

Identity Verification Is Becoming the New Generation Account Carrier

As stablecoins make payments faster and cheaper, another equally important bottleneck is gradually emerging: identity verification. In the traditional financial system, identity verification is an independent环节: banks collect user documents, store information, and complete审核 in the background. But in the scenario of instant wallet fund transfers, every transaction relies on a trusted identity verification system; without this system, compliance review, anti-fraud control, and even basic permission management would be impossible.

It is for this reason that identity verification and payment functions are accelerating their integration. The market is gradually moving away from分散的 KYC processes across platforms towards a portable verified identity system that can be used across services, countries, and platforms.

This change is happening in Europe, where the EU Digital Identity Wallet is entering the implementation stage. The EU no longer requires each bank and each application to conduct independent identity verification but has created a unified identity wallet backed by the government, which all residents and businesses can use. This wallet is not only used for identity storage but also carries various certified credentials (age, proof of residence, license qualifications, tax information, etc.), supports users in signing electronic documents, and has built-in payment functions. Users can complete identity verification, share information on demand, and make payments in one process, achieving seamless full-process integration.

If the EU Digital Identity Wallet is successfully implemented, the entire architecture of the European banking industry will be重构: identity verification will replace bank accounts as the core entry point for financial services. This will make identity verification a public good, and the differences between banks and digital banks will be weakened, unless they can develop value-added services based on this trusted identity system.

The crypto industry is also developing in the same direction. Experiments related to on-chain identity verification have been conducted for years. Although there is no perfect solution yet, all explorations point to the same goal: providing users with a way to verify their identity or related facts without confining the information to a single platform.

Here are some typical cases:

-

Worldcoin: Building a global proof-of-personhood system to verify users' real human identity without compromising their privacy.

-

Gitcoin Passport: Integrates various reputation and verification credentials to reduce the risk of Sybil attacks in governance voting and reward distribution.

-

Polygon ID, zkPass, and ZK-proof frameworks: Allow users to prove specific facts without revealing the underlying data.

-

Ethereum Name Service (ENS) + Off-chain credentials: Enable crypto wallets to not only display asset balances but also associate users' social identities and verified attributes.

The goal of most crypto identity verification projects is the same: to allow users to independently prove their identity or related facts, and the identity information is not locked into a single platform. This aligns with the EU's push for a digital identity wallet: one identity credential can accompany users as they move freely between different applications without repeated verification.

This trend will also change the operating model of digital banks. Today, digital banks regard identity verification as core control: user registration, platform审核,最终 forming an account belonging to the platform. But when identity verification becomes a credential that users can carry autonomously, the role of digital banks transforms into service providers accessing this trusted identity system. This will simplify the user account opening process, reduce compliance costs, eliminate repeated审核, and simultaneously make crypto wallets取代 bank accounts as the core carrier of user assets and identity.

Future Development Trends Outlook

In summary, the once core elements of the digital banking system are gradually losing competitiveness: user scale is no longer a moat, bank cards are no longer a moat, and even a simple user interface is no longer a moat. The real differentiated competitive barriers are reflected in three dimensions: the profit-generating products chosen by the digital bank, the capital flow channels they rely on, and the identity verification systems they access. Beyond this, other functions will gradually converge and become increasingly replaceable.

Future successful digital banks will not be lightweight versions of traditional banks but will be wallet-first financial systems. They will anchor a core profit engine, which directly determines the platform's profit space and competitive barriers. Overall, the core profit engines can be divided into three categories:

Interest-Driven Digital Banks

The core competitiveness of these platforms is to become the preferred channel for users to store stablecoins. As long as they can attract large-scale user balances, platforms can earn income through reserve-backed stablecoin interest, on-chain yields, staking, and re-staking, without relying on a庞大的 user base. Their advantage lies in the fact that the profitability of asset holding is far higher than that of asset flow. These digital banks appear to be consumer-facing applications but are essentially modern savings platforms disguised as wallets. Their core competitiveness is to provide users with a smooth experience of earning interest on deposited coins.

Payment Flow-Driven Digital Banks

The value of these platforms comes from transaction volume. They will become the main channels for users to receive, send, and spend stablecoins, deeply integrating payment processing, merchants, fiat-to-crypto exchange, and cross-border payment channels. Their profit model is similar to that of global payment giants: the profit per transaction is meager, but once they become the preferred channel for users' capital flow, they can accumulate considerable income through庞大的 transaction volume. Their moat is user habit and service reliability, i.e., becoming the default choice when users have fund transfer needs.

Stablecoin Infrastructure Digital Banks

This is the deepest and potentially most profitable track. These digital banks are not just channels for stablecoin flow but are committed to controlling the issuance rights of stablecoins, or at least controlling their underlying infrastructure. Their business scope covers core环节 such as stablecoin issuance, redemption, reserve management, and settlement. The profit space in this field is the most substantial because control of the reserves directly determines the归属 of收益. These digital banks integrate consumer-facing functions with infrastructure ambitions. They are no longer mere applications but are developing towards full-featured financial networks.

In short, interest-driven digital banks make money by users storing coins, payment flow-driven digital banks make money by users transferring coins, and infrastructure digital banks can profit continuously regardless of what users do.

I predict the market will split into two major camps: the first camp consists of consumer-facing application platforms that mainly integrate existing infrastructure. Their products are simple and easy to use, but user switching costs are extremely low. The second camp moves towards the core areas of value aggregation, focusing on businesses such as stablecoin issuance, transaction routing, settlement, and identity verification integration.

The positioning of the latter will no longer be limited to applications but will be infrastructure service providers disguised as consumer-facing entities. Their user stickiness is extremely high because they will quietly become the core system for on-chain capital flow.