Thursday 11 December 2025 – A recently launched crypto game using the name of U.S. President Donald Trump has drawn attention across the Web3 space, but a closer look shows an approach that feels atypical for a blockchain-based release. Players are reportedly able to bypass the crypto elements altogether, giving the impression of a traditional Web2 game wrapped in Web3 branding rather than a product built fully around blockchain technology.

PepeNode (PEPENODE) positions itself at the other end of that spectrum. The project is designed as a fully Web3-native game, with blockchain mechanics forming the core of its system rather than an optional add-on. Instead of repeating Play-to-Earn models that struggled or collapsed, such as Axie Infinity, StepN and last year’s wave of Telegram-based games, PepeNode is rolling out what it describes as crypto’s first mine-to-earn meme coin structure aimed at long-term viability.

While many GameFi projects are still testing the waters, PepeNode is taking a more committed stance, arguing that meaningful progress in GameFi requires a complete rethink rather than incremental experiments.

For investors interested in a model that claims to support a sustainable crypto gaming economy, the PepeNode presale is currently live, with PEPENODE priced at $0.0011873 per token. The opportunity is time-limited, however, as the team has announced that the presale will conclude in 27 days. After that point, PEPENODE is expected to be available only through exchanges, where prices may not revisit presale levels.

When Blockchain Is Optional, Does It Still Qualify as GameFi?

A recent post from the TrumpMeme account on X announced the opening of pre-registration for a licensed game built around the Trump brand. The project, titled Trump Billionaires Club, presents Trump in an Apprentice-style role, with gameplay centred on dice rolls, buying up properties, limited stock market activity notably without any direct crypto element and progressing through a glossy “high-roller” ranking ladder.

Players are being lured with the promise to “Live the High-Roller Lifestyle as you race to become the Ultimate TRUMP Billionaire,” with the main draw being a share of $1 million worth of Official Trump (TRUMP) tokens. Beyond that incentive, the game leans on familiar mechanics, integrating Open Loot to distribute digital collectibles an approach many long-time crypto users would recognise as Web2.5 dressed up in Web3 language.

A closer look at the website highlights a key detail: the game runs smoothly even without any blockchain involvement. Web3 features are clearly optional, and players can make purchases using traditional, non-crypto currencies. That raises an obvious question when the project promotes the idea of “Your empire, on-chain” if everything functions off-chain, where does that empire actually exist?

This suggests that while the game may appeal to casual players, it isn’t trying to address the deeper, long-standing problems GameFi has faced. Those same issues once brought millions of newcomers into crypto through gaming, only to see them leave just as quickly when fragile token economies collapsed.

For blockchain gaming to genuinely move forward, those challenges need proper solutions. And at the moment, the project positioning itself as an attempt to tackle them isn’t a familiar board-game-style remake, but the mine-to-earn ecosystem that PepeNode is building.

The First GameFi Economy Built to Grow Stronger Over Time

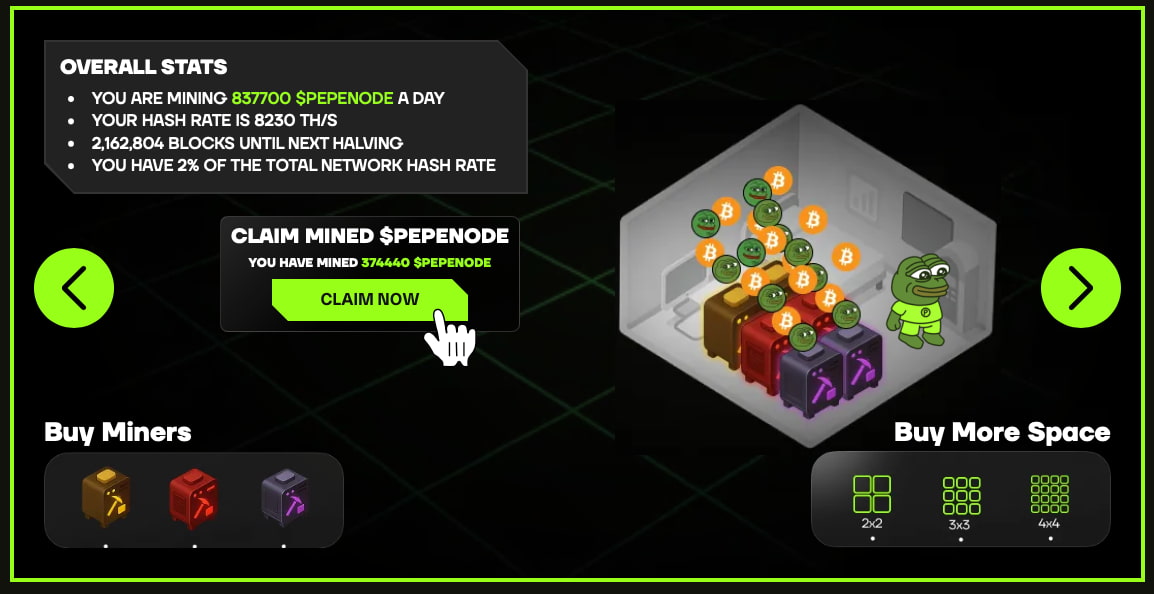

PepeNode keeps the concept simple on the surface: it turns crypto mining into a virtual game. But once you look a little deeper, it becomes clear the goal is to quietly strip away what never worked in earlier GameFi models. Rather than leaning on hype or shallow mechanics, the project is structured around systems that are meant to hold up over time.

Instead of pushing players into repetitive tapping, endless clicking, or mindless loops, PepeNode drops them into an empty, lifeless server room with a clear message build something that actually functions. Progress isn’t cosmetic. Every action, from buying nodes to upgrading facilities, is paid for using PEPENODE, and every decision carries real consequences.

Put the wrong components together and the system slows down, becoming inefficient and unstable. Combine the right ones and performance improves, with token output increasing like a properly tuned mining operation. The experience feels closer to solving an engineering problem than “playing” a traditional game, and that distinction is very much intentional.

And unlike games that rely on a thin “Web3” label and a familiar brand costume, PepeNode treats simulation as more than a buzzword. When the project talks about simulation, it means it in a literal sense. The team has already hinted at systems that reflect the real-world problems miners deal with every day, from heat surges and power consumption to overall system stability the full set of operational headaches, minus the real electricity bill.

Players do earn PEPENODE from their setups, but the token isn’t just a reward. Its role runs much deeper. The more PEPENODE is spent in-game to fine-tune and optimise a rig, the greater the chance of unlocking higher-tier payouts, including major meme coin rewards such as Pepe (PEPE) and Fartcoin (FARTCOIN).

What really sets the model apart is how upgrades are handled. Every improvement consumes PEPENODE, and 70% of the tokens used are permanently removed from circulation. Progression, therefore, doesn’t expand supply it reduces it. As activity in the game increases, PEPENODE becomes increasingly scarce.

That combination of strategic building, deliberate token spending and access to desirable crypto rewards is why PepeNode is being highlighted as a serious candidate for one of the first GameFi economies designed to hold up over the long term.

Presale Nears Its End as PepeNode Enters Final 27-Day Window

With the presale window still open, early supporters have a chance to secure PEPENODE while directly backing the game’s ongoing development. Tokens are available through the official PepeNode presale site and can be purchased using ETH, BNB, USDT on both ERC-20 and BEP-20 networks, as well as standard credit or debit cards.

Buyers can connect using most major wallets, including Best Wallet, which is often cited as one of the leading crypto and Bitcoin wallets in use today. PepeNode is already listed in Best Wallet’s Upcoming Tokens discovery section, making it possible to buy, monitor, and later claim tokens directly inside the app.

To add another layer of reassurance, the project’s smart contract has undergone a full audit by Coinsult, providing early participants with added confidence in the security and structure of the code.

Those looking to stay informed can follow PepeNode on X and Telegram, or visit the PepeNode website to take part in the presale while it remains open.

Visit PepeNode to join the presale.