Author: Zen, PANews

In today's generative AI applications, users often face a fragmented conversational experience. When switching between different models, the context of previous conversations often cannot be continued, forcing users to start over and repeat information each time. For example, details of a project discussed on ChatGPT cannot be directly inherited when switching to Claude or other models, severely impacting efficiency.

Moreover, the conversational data from these large models is typically stored on the platforms' servers, leaving users with little privacy protection and control over their own data. "These real-world issues not only create a disjointed user experience but also raise concerns about user data sovereignty and security.

Addressing this pain point, the industry has begun exploring the concept of a "migratable, user-controlled memory layer," and blockchain technology may be the key to achieving this goal.

Leveraging the open interoperability of blockchain, it might be possible to create a privacy memory layer that saves AI context as a digital asset, allowing seamless transfer across multiple AI platforms. This would eliminate the worry of "forgetting" past interactions every time a tool is changed, while ensuring data privacy and sovereignty.

ZetaChain 2.0 Released, Building a Universal Layer for AI and Web3

Addressing the above needs, ZetaChain, a public chain project focused on cross-chain interoperability, seized the opportunity presented by the convergence of AI and Web3. In its roadmap review at the end of 2025, ZetaChain announced its "2.0" version plan, introducing new features for the AI era on top of its existing universal cross-chain architecture.

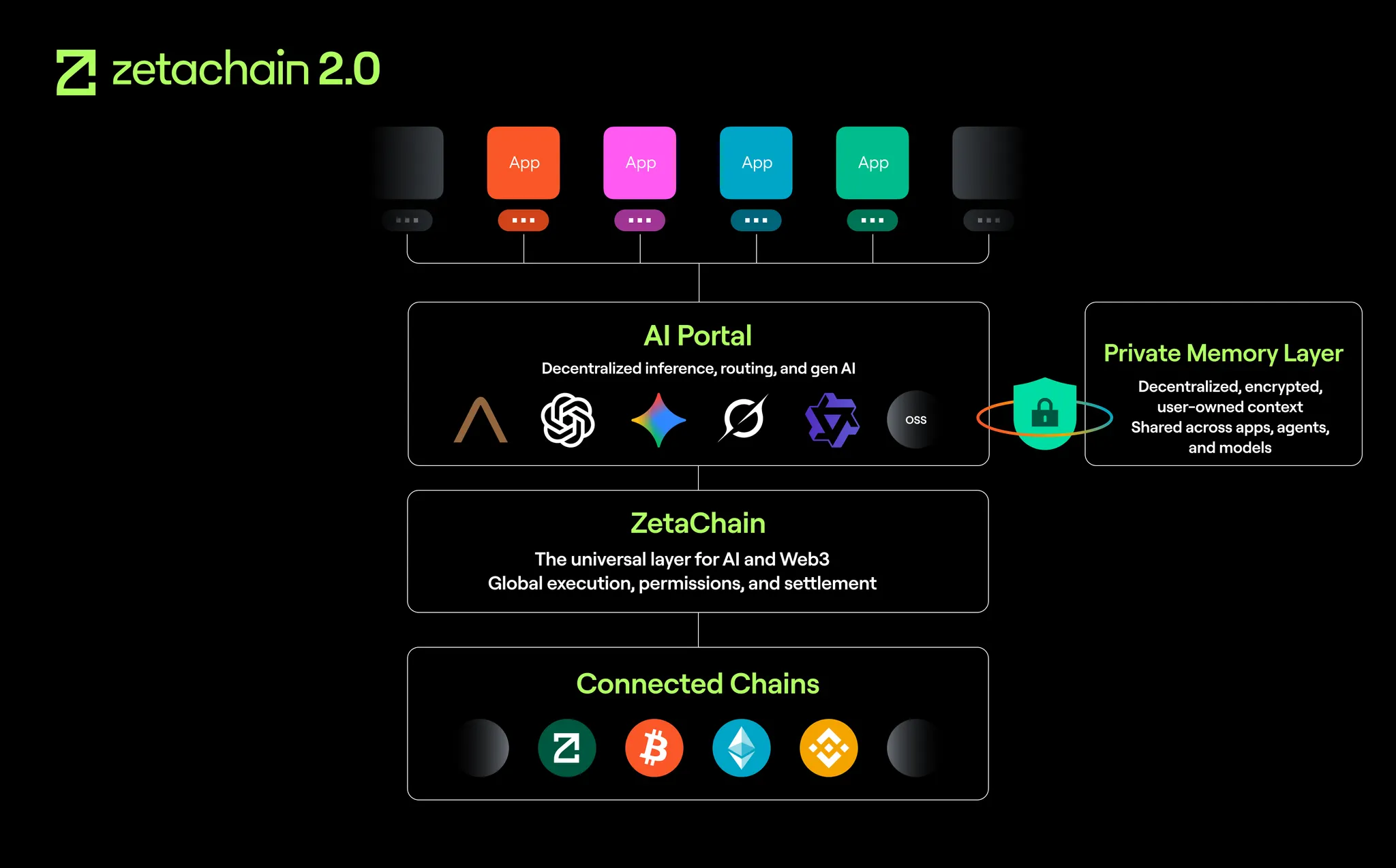

On January 27, 2026, ZetaChain 2.0 officially launched, alongside its first AI product—Anuma, a privacy-centric large model aggregation application. According to official introductions, ZetaChain 2.0 revolves around the following three core capabilities:

Private Memory Layer is a protocol-level memory system specifically designed for AI interactions, aiming to bridge the contextual gap between AI tools, turning users' digital memories into assets they truly control. Based on the privacy memory layer, all user conversation content is stored encrypted, with only the user holding the key; even the platform itself cannot view it. Valuable information generated across different models and at different times will be controlled by the user, allowing for continuous accumulation and随时 migration to new conversations, without being monopolized by any single AI service.

AI Portal is a unified routing and execution layer, enabling applications to access multiple AI model providers without being locked in, with built-in support for availability, fallback, and cost/performance optimization. The AI Portal handles the underlying model routing and context bridging. Users can freely choose different models like ChatGPT, Anthropic Claude, Google Gemini, etc., to get answers, with previous conversational memories supported by the privacy memory layer.

Beyond the protocol itself, ZetaChain 2.0 also packages its key capabilities into a Software Development Kit (SDK). Developers can directly integrate privacy-persistent memory, cross-model switching, and monetization components into their products. This SDK allows applications or AI Agents to maintain continuous context across different models and call upon different model capabilities on demand, significantly reducing the cost and complexity for teams to build their own infrastructure.

In terms of mechanism design, the three core modules complement each other. The Private Memory Layer provides privacy-first user memory and data support, the AI Portal enables continuous interaction across mainstream large models, and the SDK ecosystem facilitates efficient and rapid participation and expansion by third-party developers. This also allows ZetaChain to expand from a底层 cross-chain protocol to a universal platform serving both Web3 and AI.

Focusing on Privacy and User Sovereignty, Anuma Launches and Opens Applications

Alongside the official launch of ZetaChain 2.0, the project team's other highlight is its first consumer-grade AI product on the platform, Anuma. Currently, Anuma is in a private beta phase, gradually opening up trial access through an invitation-based waitlist; users can apply for early access via the public waitlist.

As a large model aggregation application, Anuma integrates with multiple mainstream large models, allowing users to invoke different AI engines within a single conversation. It offers the convenience of聚合 tools like Poe, while supporting models such as OpenAI's GPT series and Anthropic's Claude.

When a user asks a question, they can specify or change the model used for the response. Switching between engines requires just a click, without needing to migrate to another application. Users can flexibly choose the most suitable model on Anuma to get answers based on the question type, while the entire conversation process continues seamlessly in the same window.

Technically, thanks to ZetaChain's Private Memory Layer, every segment of a user's conversation in Anuma is encrypted and stored as personal memory, seamlessly migrating to new models or new sessions. When a user starts a new conversation or switches AI models within an existing conversation, Anuma can securely inject the relevant context into the target model, enabling it to understand the prior background and user intent. This eliminates the need for users to repeat the same background information across different AIs, greatly improving the efficiency of cross-model collaboration.

Traditional Web2 enterprises exploiting their centralized advantage to misuse user data has long been deeply resented. Practices like platform-based price discrimination and data selling are repeatedly prohibited yet persist. This user vigilance and concern towards centralized platforms has also extended to the rapidly developing AI field.

Anuma places great emphasis on the confidentiality of conversation content and user sovereignty. The entire platform employs an end-to-end encryption scheme to protect user data. From the moment a user inputs a message on the front end, the content is encrypted using the user's key before being passed to the privacy memory layer for storage. When context needs to be provided to an AI model, it is decrypted by the user's client or a trusted execution environment before being sent to the model. Throughout this process, conversation records are always stored on-chain or in transit in ciphertext form; even ZetaChain's nodes or servers cannot窥视 the content.

This stands in stark contrast to traditional AI chat services, where chat logs are typically stored in plain text on servers, posing risks of being viewed by operators or leaked. Anuma, through blockchain and encryption technology, achieves a level of security similar to Web3 wallet private key management—only the user can interpret their data. It can provide a more reassuring choice for sensitive AI applications in fields like law and medicine, encouraging users to engage in more private exchanges.

In fact, even before Anuma's launch, there were already some multi-model aggregated AI conversation products on the market, notably Poe from the "American Quora" Quora, and TypingMind from the open-source community.

Compared to the cloud service model of these two platforms and local deployment, Anuma's on-chain encrypted storage balances privacy and sovereignty. In terms of ease of use and model richness, Anuma eliminates the cumbersome configuration process of the TypingMind model, offering direct access to the convenient multi-model conversation experience similar to Poe.

Behind the Move into AI: ZetaChain's Technical Logic and Natural Evolution

ZetaChain's decision to launch version 2.0 and Anuma at this time is backed by solid technical accumulation and a clear evolutionary logic.

As the first universal L1 blockchain project, ZetaChain has focused on solving the fragmentation problem in the blockchain领域 since its launch in 2021,致力于 building an underlying network connecting all public chains. Built based on Cosmos SDK, it natively supports interoperability with heterogeneous chains like Ethereum, Bitcoin, and Cosmos.

Through innovations like CAF, ZetaChain simplifies traditional cross-chain operations that require bridges and wrapping into a single contract call on one chain, providing users with unified liquidity and user experience. By the end of 2025, the ZetaChain mainnet had integrated ten major mainstream blockchain networks, including Bitcoin, covering tens of millions of users, with累计 on-chain transactions reaching 225 million.

At the ecosystem and capital level, ZetaChain has also gained broad recognition. According to public data, the project raised $27 million in funding from知名 institutions including Blockchain.com, Jane Street, and Sky9 Capital. In 2024-2025, global tech and infrastructure giants like Google Cloud, Deutsche Telekom, and Alibaba Cloud successively joined the network as validator nodes, endorsing its security and compliance.

Entering the second half of 2025, with the explosion of generative AI, the ZetaChain team keenly realized that the industry's multi-chain ecosystem and multi-model AI actually share similar pain points—both involve fragmentation across multiple platforms and systems, requiring a universal layer for integration. Thus, they proposed the strategic concept of an "AI Universal Platform," introducing blockchain's trusted computing and storage into the AI field to build blockchain infrastructure for the AI era.

ZetaChain 2.0 is the realization of this vision. It retains and strengthens the original cross-chain functions while adding new AI privacy memory and interaction capabilities. This aligns with ZetaChain's consistent vision of making Web3 friendly to both humans and AI. The natural evolution from a "Universal Blockchain" to an "AI Universal Platform" is both顺应 the trend of technological convergence and an extension of the project's mission.

"ZetaChain has already achieved scaled unification at the blockchain experience level." As Ankur Nandwani, a core contributor to ZetaChain, stated, "ZetaChain 2.0 extends the same approach to AI, enabling the next generation of applications and Agents to operate between models and blockchains,默认 equipped with private, authorizable memory capabilities and global monetization channels."

New Paradigm of Deep Integration of Blockchain and AI, What are the Prospects?

The launch of ZetaChain 2.0 and its debut product Anuma represents a significant attempt at the deep integration of blockchain and AI. Within this system, we see a new paradigm for multi-model AI applications: privacy-first, user-controlled, cross-platform portability.

Of course, it must be objectively noted that Anuma is currently in a very early Private Beta stage, and the overall ecosystem is also in its initial construction phase. Many features and details await feedback from广大 testers for refinement, such as support for more models, optimization of memory layer capacity and performance, and enrichment of third-party developer tools. This means that in the short term, Anuma is far from replacing the experience of mature individual platforms, and some users will need time to adapt to this new interaction mode.

However, it cannot be ignored that the direction represented by Anuma is pioneering. In the track of multi-model aggregation experience, Anuma offers a different approach from the solutions of large companies. Instead of monopolizing data and model invocation rights by a centralized platform, it returns choice and memory to the user, achieving trust-minimized coordination through blockchain technology.

As Anuma's public beta opens and features iterate, perhaps more innovative applications will emerge on this platform, such as privacy-guaranteed AI advisors, cross-domain intelligent search assistants, and so on. How far this new trend of privacy-first multi-model experience can go remains to be tested by time.