Societe Generale’s digital-asset arm SG-FORGE has launched its euro stablecoin, EUR CoinVertible, on the XRP Ledger, extending a deployment that already spans Ethereum and Solana and putting another bank-issued, compliance-forward asset into the XRPL ecosystem.

Cassie Craddock, Ripple’s UK & Europe managing director, celebrated the go-live in a post that leaned heavily on the “institutional” framing. “Delighted that EUR CoinVertible is live on the XRP Ledger! A win for the ecosystem. Proud to have Ripple’s custody tech powering this milestone,” she wrote.

XRP Ledger Lands Major TradFi Win

In its February 18, 2026 press release, SG-FORGE described the XRPL integration as part of a “multi-chain deployment strategy,” explicitly positioning the ledger alongside Ethereum and Solana rather than as a one-off experiment. The firm said it expects the move to “increase adoption” by tapping XRPL’s scalability, speed, and low costs on what it called a “secure and decentralized Layer 1 blockchain.”

That line matters because it clarifies the target user: not retail “stablecoin tourists,” but institutions that care about predictable settlement characteristics and operational risk. In parallel messaging shared on social channels, SG-FORGE framed the choice in plain infrastructure terms, performance, cost, and architecture, rather than community affinity or token narratives.

Ripple’s involvement is not merely promotional. SG-FORGE said the XRPL launch is “supported by Ripple’s custody solution,” and it flagged follow-on paths that sound tailored to professional trading and treasury workflows: potential integration into Ripple’s product suite and use of EUR CoinVertible as trading collateral.

Craddock echoed that institutional positioning in the release itself, describing SG-FORGE as “a pioneer... market-leading crypto-assets offering.” She added: “Ripple is proud to have played a part... providing proven and trusted technology.”

Ripple staff also used the moment to underline how these launches tend to happen in practice. One Ripple employee, Luke Judges, wrote that the partnership is real and added: “A top 10 European bank with $1.8TN in assets does not follow XRP ledger community norms or niceties and has their own compliance reqs & timescale for announcements.”

For SG-FORGE, the XRPL rollout also reads like a delivered roadmap item. Back in November 2024, the firm publicly signaled its intent to deploy its MiCA-aligned euro stablecoin on XRPL to broaden adoption, language that closely matches the rationale in today’s announcement.

Jean-Marc Stenger, CEO of SG-FORGE, framed the XRPL go-live as a continuation of that regulated product push. “The successful launch of EUR CoinVertible on the XRP Ledger is a new step. We look forward to further innovation and expanding the reach,” he said.

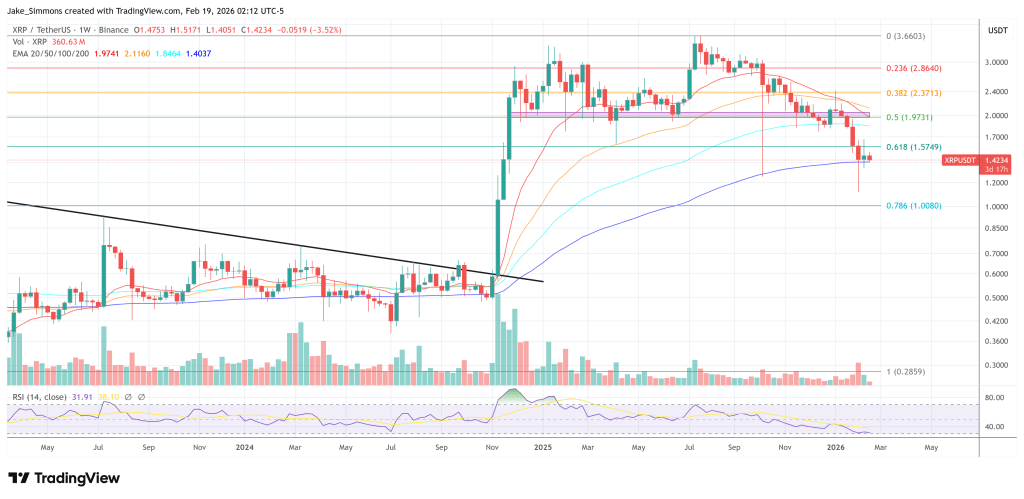

At press time, XRP traded at $1.42.