A fresh update from a crypto expert has emerged regarding XRP and Ripple’s next trajectory, sparking a debate in the community. In recent years, this update has turned out to be one of the most accurate in determining the future of the leading altcoin, reinforcing the significance of the update.

New Research Outlines XRP’s Direction

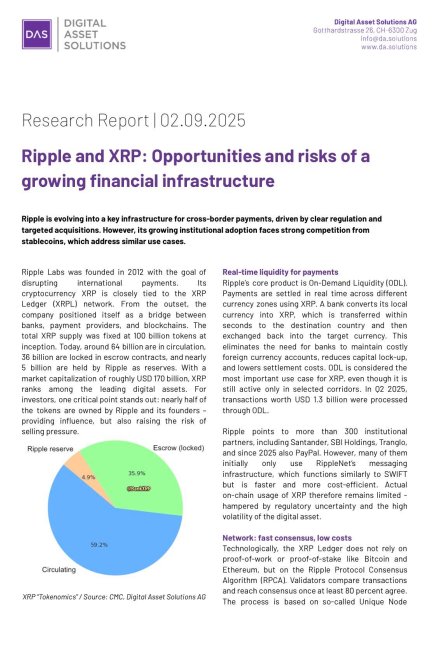

In a post on the X platform shared by Stern Drew, a crypto expert, Digital Asset Solutions (DAS) Research has delivered what many XRP watchers have been waiting for and finding difficult to determine. The Research seems to have offered insights and provided a clear data-driven signal that breaks through months of conjecture and market noise.

According to the expert, DAS Research just presented the most convincing evidence so far of where XRP is headed. While their analysis offers a clear view of the future direction, it shows that the altcoin and Ripple, an American-based payment firm, are no longer competing in crypto.

Ripple and XRP are shifting into a global payment infrastructure, one that is used by banks, Fintechs, and cross-border networks that seek speed, scale, and settlement transparency. Looking at the Research, there are 3 core realities that are likely to shape the next trajectory of the asset and the payment firm.

The first scenario is that XRP boosts the structural advantage, which includes fast settlement, low cost, neutral bridge asset, globally distributed ledger, and institutional-grade reliability. Drew stated that this is the reason adoption is growing in the midst of enterprises that seek predictable value transfer, and not speculation.

Secondly, the Research highlights the transformation of stablecoins, as these coins are becoming strategic assets, not competitive ones. Instead of opposing them, Ripple is absorbing stablecoins, which are becoming a key part of the crypto and financial landscape.

Ripple’s integration of stablecoins is evidenced by its RLUSD, a dollar-pegged token acting as the fiat anchor. Meanwhile, XRP serves as the liquidity and bridge asset that ties everything together. In the current landscape, this connection is precisely how scaled settlement ecosystems develop.

Catalysts To Drive The Next Future

With key updates and achievements of Ripple, the Research noted that the catalysts to spur the next phase are already forming. Some of these catalysts include RippleNet’s partnership expansion, RLUSD corridors opening, and institutional custody maturing. Even Exchange-Traded Fund (ETF) structures are entering the conversation.

Each of these catalysts raises the likelihood that regulated financial plumbing will incorporate XRP. Meanwhile, direct bank-level chain utilization is the only sector that is currently lagging behind. However, this is exactly what worldwide licensing pushes, ZK-enabled identity layers, Ripple Prime, and RLUSD are meant to open.

Drew believes that DAS is creating awareness of what investors are unable to see. Behind the scenes, XRP is cementing its position as infrastructure, not a trade, and the competition is not other tokens, but the existing payment system, which is starting to shift.