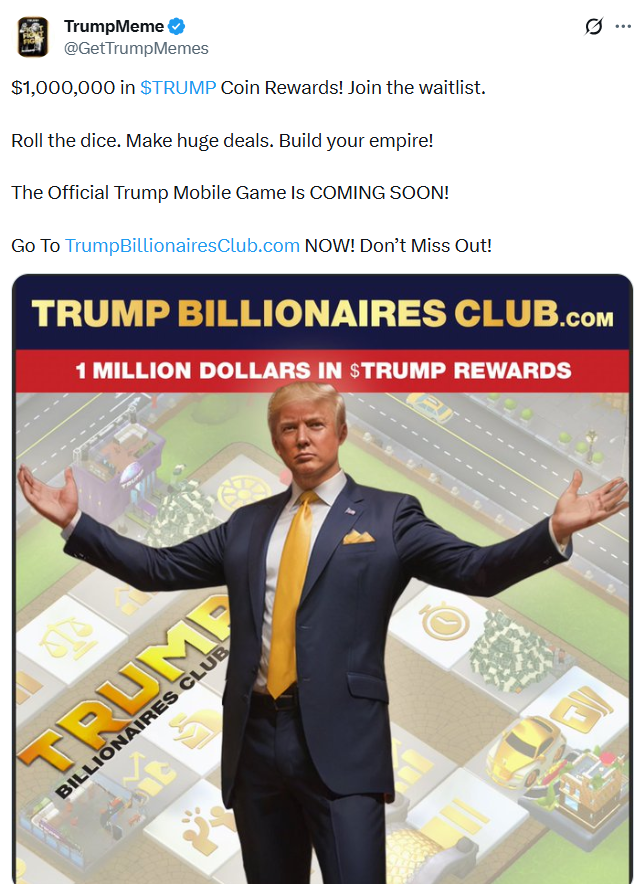

A Trump-themed crypto mobile game, created by Bill Zanker, a member of the team that helped launch the official Trump memecoin and various NFT collections, is reportedly set to be released on the Apple App Store before the end of the year.

The game uses Trump’s name under a licensing agreement and is being created by Freedom 45 Games, according to the game’s website. It is also tied in with the Trump Coin.

The Apple App Store has an expected release date of Dec. 30, and the app is currently in pre-registration.

Zanker was already linked to a project blending gaming and cryptocurrency elements in April, with the project reportedly bearing some similar aspects to MONOPOLY GO; however, at the time, a spokesperson denied any similarity to Monopoly.

On the game’s website, it lists cash, cryptocurrency, or TRUMP Coin as ways to fund a game account and mentions trading non-fungible token statues and pins that can be used in the game.

However, a disclaimer outlines that it’s not designed, manufactured, or distributed by US President Donald Trump or any of his businesses or affiliates.

The Trump Billionaires Club didn’t immediately respond to a request for comment.

Trump game features crypto elements

A demo of Trump Billionaires Club on its website appear to feature a digital version of New York and show a player using dice rolls to move around a Monopoly-style gameboard, earning funds for constructions and other activities.

The game also offers an air drop of Trump tokens to whoever earns the most points pre-launch, which can be gained by opening an account, holding the TRUMP coin, and referring new users to the project.

Related: Trump’s national security strategy is silent on crypto, blockchain

Trump memecoin is down 92% from ATH

The new Trump-themed crypto game comes at a challenging time for Trump’s memecoin holders.

The Official Trump memecoin launched days before Donald Trump took office on Jan. 20. It surged to an all-time high of over $73 a day after launch — with its value reaching over $14.5 billion — but has since dropped over 92% to trade at $5.89 as of Wednesday, according to CoinGecko. Over the last 24 hours, since the game announcement, the token has seen a 3.4% increase.

Under the disclaimer, the game collectibles are said to be for “enjoyment only,” not for “investment purposes,” and are not connected to “any political campaign.”

Trump’s crypto ventures, and those bearing his name, have come under scrutiny from Democrat lawmakers in the US who have previously demanded an investigation from the financial regulators and the government ethics office.

Magazine: When privacy and AML laws conflict: Crypto projects’ impossible choice