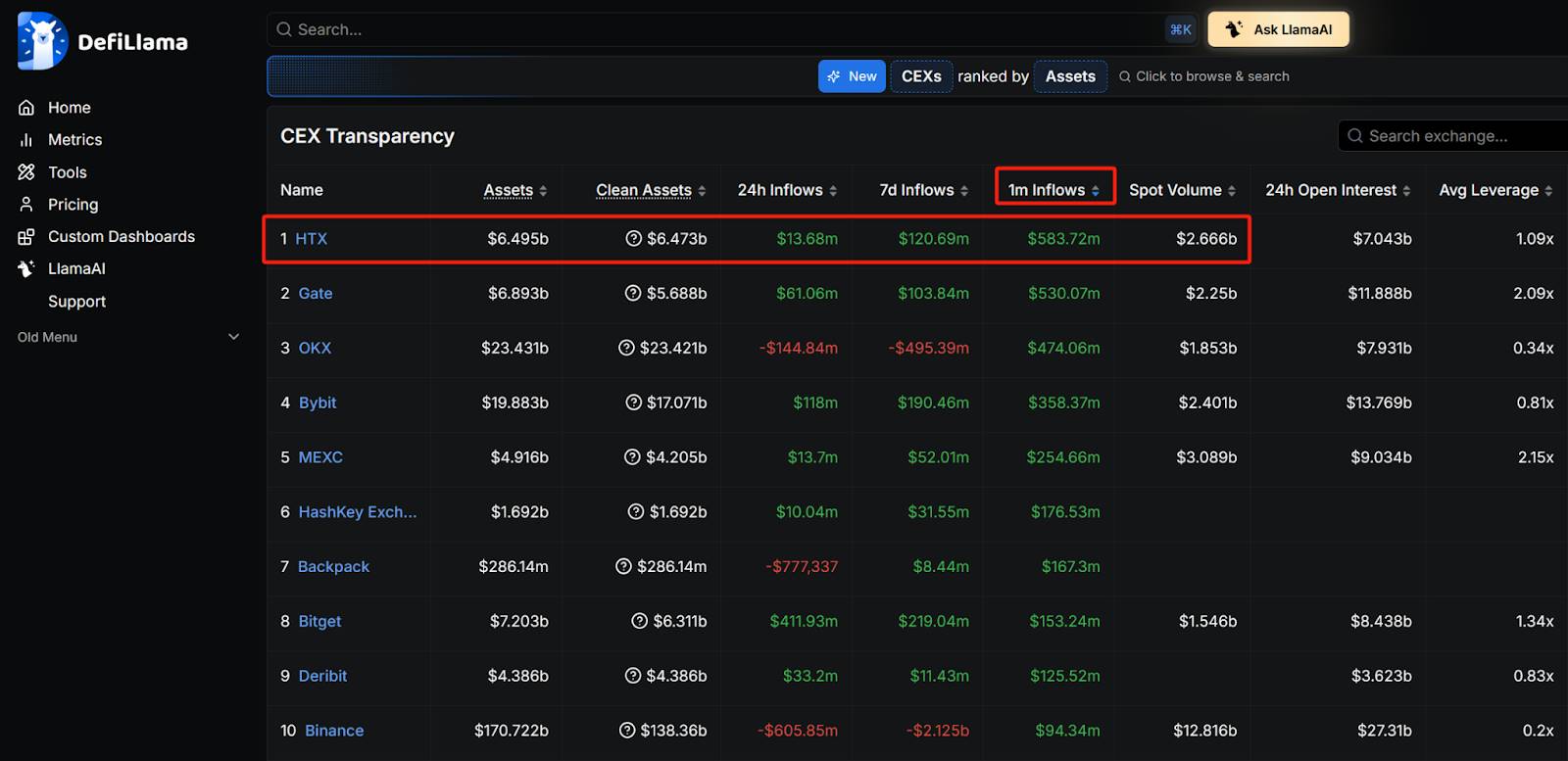

In the fiercely competitive and ever-narrative-shifting crypto industry, the one thing that never lies is capital flow. According to data from Defillama on December 5, Huobi HTX's net inflow over the past 30 days (1m inflows) reached $583.7M, ranking first among all CEXs. At the same time, Huobi HTX has maintained steady growth in total assets and a continuous increase in spot trading volume, forming a positive cycle of asset security, user growth, and capital inflow.

Defillama data shows Huobi HTX ranked first in net inflow over the past 30 days (December 5)

This is not a sudden surge but a reflection of a long-term trend: when market volatility intensifies, users place their assets on the most trustworthy exchange. Huobi HTX's leading net inflow is essentially a collective choice made by users.

Behind the Impressive Data: A Vote of Trust with Real Money

In the CEX arena, "net inflow" is the most direct indicator reflecting user behavior. CEXs with strong net inflows often have significant advantages in yield products, new token listings, user experience, and transparent operations. Users depositing funds into an exchange means they trust the platform's asset security is high enough, that the platform won't "face a run, halt withdrawals, or engage in underhanded practices," and that it will operate stably in the long term.

During turbulent periods of industry cycle shifts, Huobi HTX's leading position in net inflow indicates that its reputation for security and stability has been reestablished. Huobi HTX's core businesses—particularly Earn, C2C, and asset transparency—have genuine appeal. In other words, Huobi HTX is currently in an upward cycle of regained industry trust.

Why Huobi HTX? Three Strategic Approaches at the Company and Product Levels

Since the second half of 2025, Huobi HTX's implementation of strategies in asset transparency, C2C experience upgrades, and security and compliance has全面提升 (comprehensively enhanced) the platform's operational capabilities, laying the foundation for this large-scale net inflow.

In terms of asset transparency, as one of the first CEXs in the industry to publish proof of reserves, Huobi HTX has regularly disclosed Merkle Tree reserve (PoR) data for 38 consecutive months, with mainstream assets maintaining a reserve ratio of 100% or higher long-term. Users can随时 (at any time) visit the "Assets - Proof of Reserves Report" page on Huobi HTX's official website to view the monthly updated proof of reserves report. Letting users "see their money." Transparency itself is the best risk control.

C2C is a core entry point for users into the crypto ecosystem. Huobi HTX continuously optimized the C2C experience in 2025. As a pioneer in innovating the C2C industry, Huobi HTX launched the Selected Station on April 7 and率先提出 (was the first to propose) "100% Full Compensation" on August 20. Since its launch, Huobi Selected Station has received praise from KOLs, advertisers, and users alike thanks to its 0 freezes, "100% Full Compensation" mechanism, new-user-friendly policies, and diverse activities—earlier risk control intervention reduces abnormal order risks; faster matching shortens user wait times; the Selected Station mechanism further筛选 (screens for) high-quality merchants. Everything revolves around a "worry-free" user experience, making C2C more efficient, risk-controlled, and纠纷 (dispute)-free. This means "depositing money" becomes smoother and more reassuring.

Continued increased investment in security and compliance has brought the old-school exchange's foundation back into the spotlight. With upgrades to its compliance framework and security team, Huobi HTX's capabilities in anti-money laundering, on-chain monitoring, and account risk control have been comprehensively enhanced. As an established exchange founded in 2013, Huobi HTX's "twelve years" of积累 (accumulation) in risk control and security systems make users more inclined to choose the "stable" option during critical cycles.

When Funds Are Flowing to "Huobi Earn": What Are Users Choosing?

Huobi HTX Earn data shows comprehensive improvement

The underlying logic behind Huobi HTX's return to the "industry's number one" position is that Huobi HTX better understands what users "truly need."

Crypto users in 2025 are more pragmatic, focusing not on stories but on yield, experience, and security. Huobi HTX's upgrades to its main business lines正好对上 (precisely address) these three points.

Taking Huobi Earn as an example, data from the past 7 days clearly shows: both the amount held and the number of holders continue to grow, including a 25.5% increase in the amount of USDD held and a 12.4% increase in holders; a 17.2% increase in the amount of ETH held; a 6.7% increase in TRX holders. This means users are entrusting more funds long-term to Huobi Earn's yield products.

During periods of market volatility where making profits from going long or short is difficult, many users prioritize "stable returns," which is the core reason for the爆发 (explosion) of Huobi Earn's business. The advantages of Huobi Earn can be summarized in three words: stable, user-friendly, high yield.

Huobi HTX's Earn experience is "user-centric." As more and more people choose Huobi Earn, user consensus is becoming evident:

- Simple and easy to understand, one-click subscription, flexible redemption, no tricks, suitable for long-term holding;

- More transparent yields on core assets, avoiding complex derivative designs, no hidden terms;

- Yields are stable enough, with stablecoin and mainstream coin yields优于 (better than) the industry average.

Many users have even expressed on social platforms: "With unstable market conditions, I only dare to put my stablecoin yields on HTX." A large number of users are proving with their real actions: the more uncertain the funds, the more they flow to Huobi HTX. The number one net inflow is the best validation.

Conclusion: Asset Flow Doesn't Lie, Huobi HTX is Reshaping Industry Trust

Judging from its market performance in 2025, Huobi HTX's growth is not an偶然事件 (accidental event) but an inevitable result brought about by the enhancement of systemic capabilities. From asset transparency and risk control security upgrades to industry-leading C2C experience and the爆发 (explosion) of the Earn business, user trust has rebounded, and Huobi HTX continues to demonstrate稳健表现 (steady performance) during periods of market volatility.

This ultimately汇聚成 (converges into) the most convincing data point: on December 5, Huobi HTX's 30-day net inflow ranked first among CEXs.

As the industry enters a "trust premium cycle," capital will spontaneously seek out exchanges that are more stable, more transparent, and更能提供 (better able to provide) real value. Users have given us the answer: Huobi HTX is the most值得 (worthy) place to put your money.

About Huobi HTX

Huobi HTX was founded in 2013. After 12 years of development, it has evolved from a cryptocurrency exchange into a comprehensive blockchain business ecosystem encompassing digital asset trading, financial derivatives, research, investment, incubation, and other businesses.

Huobi HTX, as a leading global Web3 gateway, adheres to a development strategy of global expansion, ecological prosperity, wealth effect, and security and compliance, providing comprehensive, secure, and reliable value and services to global virtual currency enthusiasts.

To learn more about Huobi HTX, please visit https://www.htx.com/ or HTX Square, and follow us on X, Telegram, and Discord. For further inquiries, please contact [email protected].