Author: Bitget

Today's Outlook

1. Cathie Wood: Bitcoin is entering a new phase with smaller pullbacks; institutional adoption may help prevent significant price declines.

2. The U.S. Senate version of the crypto market structure bill is expected to be released this week, with a vote scheduled for next week.

3. SEC Chair hints at accelerating crypto regulatory agenda in the new year, stating "the best is yet to come."

4. Trump: May reduce tariffs on some goods, immediate rate cuts will be the "litmus test" for the new Fed Chair.

Macro & Hot Topics

1. U.S. Bureau of Labor Statistics confirms December inflation and employment data will be released in January next year.

2. Trump will conduct the final round of interviews for Fed Chair candidates this week.

3. Hassett: The Fed has ample room to cut rates significantly.

Market Trends

1. Over the past 24 hours, the cryptocurrency market saw $432 million in liquidations, with short positions accounting for $308 million. BTC liquidations totaled $170 million, while ETH liquidations reached $136 million.

2. U.S. Stocks: Dow down 0.38%, S&P 500 down 0.09%, Nasdaq Composite up 0.13%. Additionally, Nvidia (NVDA) down 0.31%, Circle (CRCL) up 5.86%, Strategy (MSTR) up 2.89%.

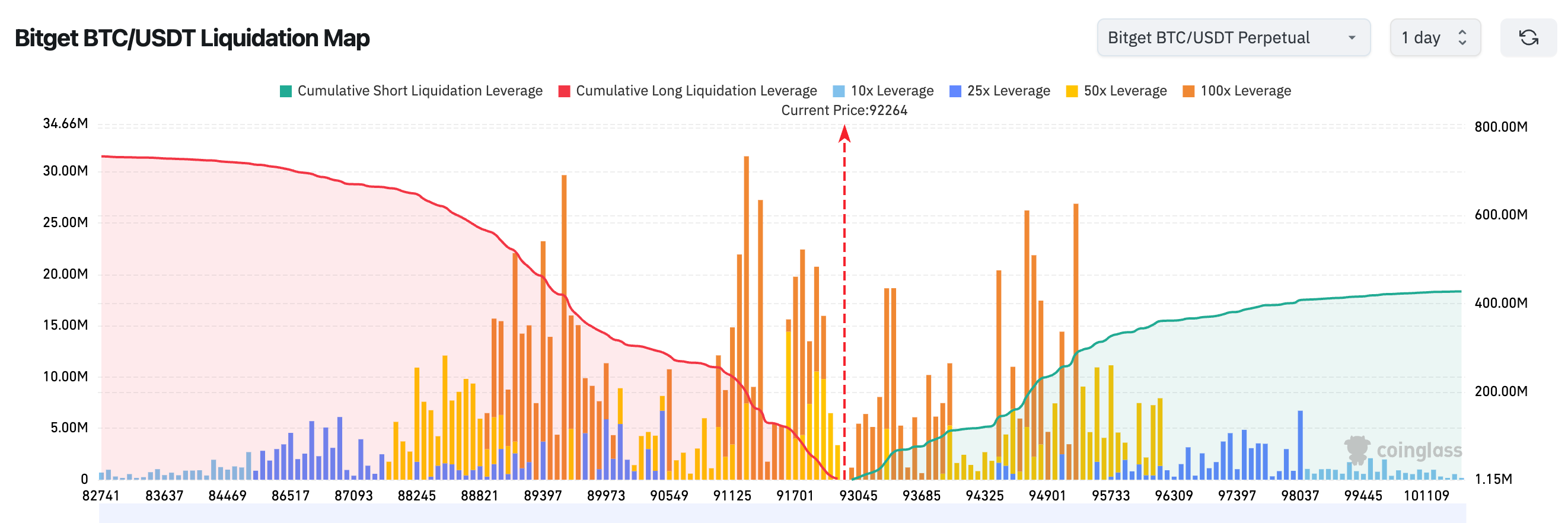

3. Bitget BTC/USDT liquidation map shows: The current price range (around $92,000–$93,000) is a high-density liquidation zone for longs, with cumulative long positions declining in this area, indicating concentrated risk for bulls. In the upward price range (above $95,000), short leverage is rapidly accumulated, suggesting that a breakout could trigger concentrated short liquidations.

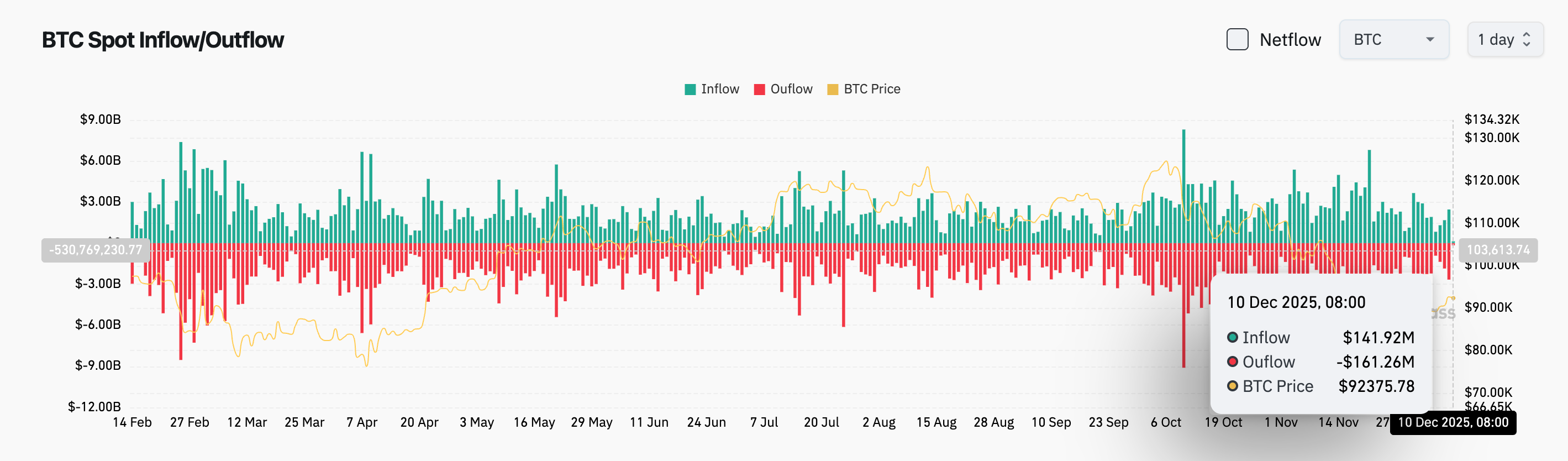

4. Over the past 24 hours, BTC spot inflows were approximately $142 million, outflows were about $161 million, resulting in a net outflow of $19 million.

News Updates

1. Bitcoin treasury company Twenty One’s stock fell 20% after merging with Cantor Equity.

2. SEC Chair: Many types of cryptocurrency ICOs fall outside the SEC’s jurisdiction.

3. Data: Corporate Bitcoin treasuries grew over 448% in two years, with total holdings exceeding 1.08 million BTC.

4. The Information: ChatGPT’s weekly active users approach 900 million.

Project Developments

1. U.S. company Nicholas Financial Corporation has filed with the SEC to launch a Bitcoin ETF that holds Bitcoin assets only overnight, completely avoiding U.S. trading hours.

2. RWA tokenization network Real Finance announced a $29 million private funding round.

3. Strive launches a $500 million SATA stock ATM financing plan, with partial net proceeds to be used for Bitcoin purchases.

4. Ethena Labs withdrew 1.59 billion ENA from Coinbase Prime, worth approximately $443 million.

5. Octra will conduct a $20 million public token sale on Sonar on December 18 at a $200 million valuation.

6. TRUMP Official: To launch a mobile game "Trump Billionaires Club" using TRUMP tokens.

7. Legacy privacy project Horizen reboots as a Layer 3 network on Base.

8. Standard Chartered revises its "Bitcoin 2025 forecast" down to $100,000, delaying long-term target to 2030.

9. Yesterday, an Ethereum Foundation-linked address deposited 5,748 ETH to Kraken.

10. Linea (LINEA) will unlock approximately 1.38 billion tokens today at 7 PM (UTC+8), representing 6.67% of the circulating supply, valued at around $111 million.

Disclaimer: This report is AI-generated, with human verification for information only, not investment advice.