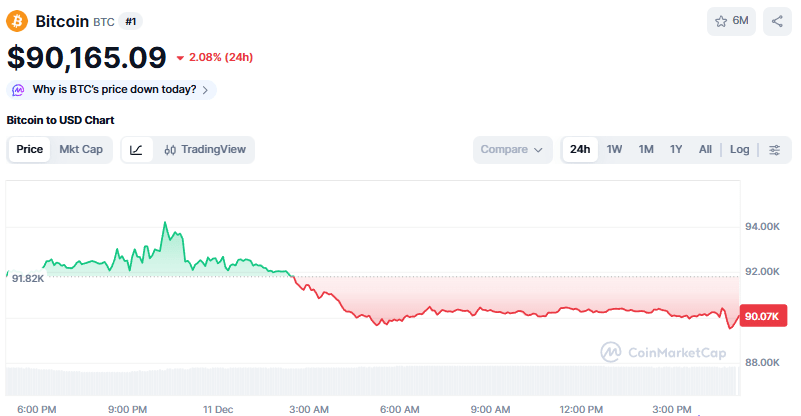

Bitcoin's price after the FOMC has once again demonstrated how unstable leverage is at this stage of the cycle. The world's largest cryptocurrency fluctuated between $92,000 and $89,500 hours after the Federal Reserve's announcement, liquidating billions in open positions on major derivatives markets. However, despite volatility reaching extreme levels, capital continued to flow into compelling cryptocurrency projects like Bitcoin Hyper ($HYPER)—a Bitcoin Layer-2 solution that combines Solana-level transaction speeds with BTC-backed security.

US traders added over $38 million in new Bitcoin exposure ahead of this week's macroeconomic catalysts—the Producer Price Index (PPI) and unemployment claims data. Both indicators could determine whether the Federal Reserve maintains its current policy or begins a more moderate approach to interest rate cuts.

The sentiment remains cautiously optimistic. BTC has managed to hold the $90,000 level, which analysts consider a critical psychological and structural support. A sustained close above $92,000 would reopen the path to the $100,000–$110,000 resistance range, while a drop below $89,000 could trigger a new wave of liquidations.

Visit Bitcoin Hyper

Bitcoin Price Dynamics and Market Forecasts

Following the FOMC meeting, Bitcoin's price fluctuations liquidated long and short positions, effectively resetting the derivatives market. Open interest plummeted as leveraged traders were wiped out. Funding rates normalized, returning to nearly neutral levels, indicating a healthier environment for spot accumulation.

American institutional flows remain strong. ETFs continued to register moderate inflows, indicating that long-term investors are not abandoning the market despite short-term volatility. Meanwhile, macro traders are preparing for another potential breakout when inflation data confirms the disinflation trend. Historically, Bitcoin performs best when real yields begin to fall, liquidity increases, and the dollar weakens—a scenario that could partially unfold in 2026.

Several analysts believe Bitcoin could still reach new all-time highs this cycle. Bernstein analysts project a potential move to $200,000 in a prolonged upward phase continuing into 2026 if ETF inflows maintain their pace. Others, like Matrixport, remain more conservative, predicting a mid-cycle consolidation around $120,000–$150,000 before the next growth wave.

Bitcoin Hyper: A Layer-2 Solution Leveraging Bitcoin's Strengths

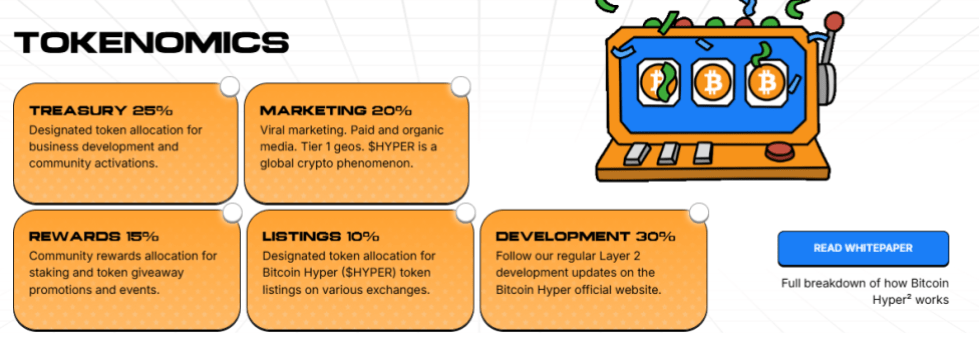

Alongside the broader BTC narrative, Bitcoin Hyper ($HYPER) is gaining attention as one of the cycle's most ambitious Layer-2 projects. It aims to combine Bitcoin's security with Solana-level throughput, enabling instant transactions with low fees for decentralized applications. The whitepaper outlines a vision for a Bitcoin-based ecosystem supporting payments, DeFi protocols, and cross-chain liquidity via a canonical BTC bridge.

The presale has already attracted over $29 million, driven by investors seeking early exposure to infrastructure that expands Bitcoin's real-world utility. Token buyers are also attracted by the 40% staking reward, allowing for passive income during the project's rollout phase. The current token price is $0.013405, making it accessible to both private and institutional participants.

Beyond monetary appeal, Bitcoin Hyper's architecture represents a technical response to one of Bitcoin's oldest problems—scalability. By enabling BTC to move seamlessly between chains using a verified bridge mechanism, Hyper unlocks transaction speeds and composability previously unavailable on the Bitcoin base layer.

Any investor can purchase Bitcoin Hyper by visiting the project's official presale portal, connecting their crypto wallet (e.g., Best Wallet or MetaMask), and exchanging ETH, USDT, or BNB for HYPER tokens.

Why Bitcoin Hyper is Relevant Post-FOMC Decision

Post-FOMC market turmoil has forced traders to reassess their risk allocation. Due to increased Bitcoin volatility and the underperformance of traditional "altcoins," capital has begun rotating into infrastructure projects directly tied to the BTC ecosystem rather than speculative meme coins. In this context, Bitcoin Hyper positions itself as a "high-beta play on Bitcoin's success"—leveraging BTC's adoption benefits while building independent technical utility.

Bitcoin Hyper Key Advantages:

These features make Bitcoin Hyper one of the most progressive Bitcoin-oriented projects this cycle.