Bitcoin (BTC) bulls appear to be back in control of the short-term trend, pushing the BTC price above $94,000, despite underlying liquidity indicators raising a red flag.

Key takeaways:

Bitcoin has reclaimed $94,000, strengthening the short-term bullish structure after a few days of indecision.

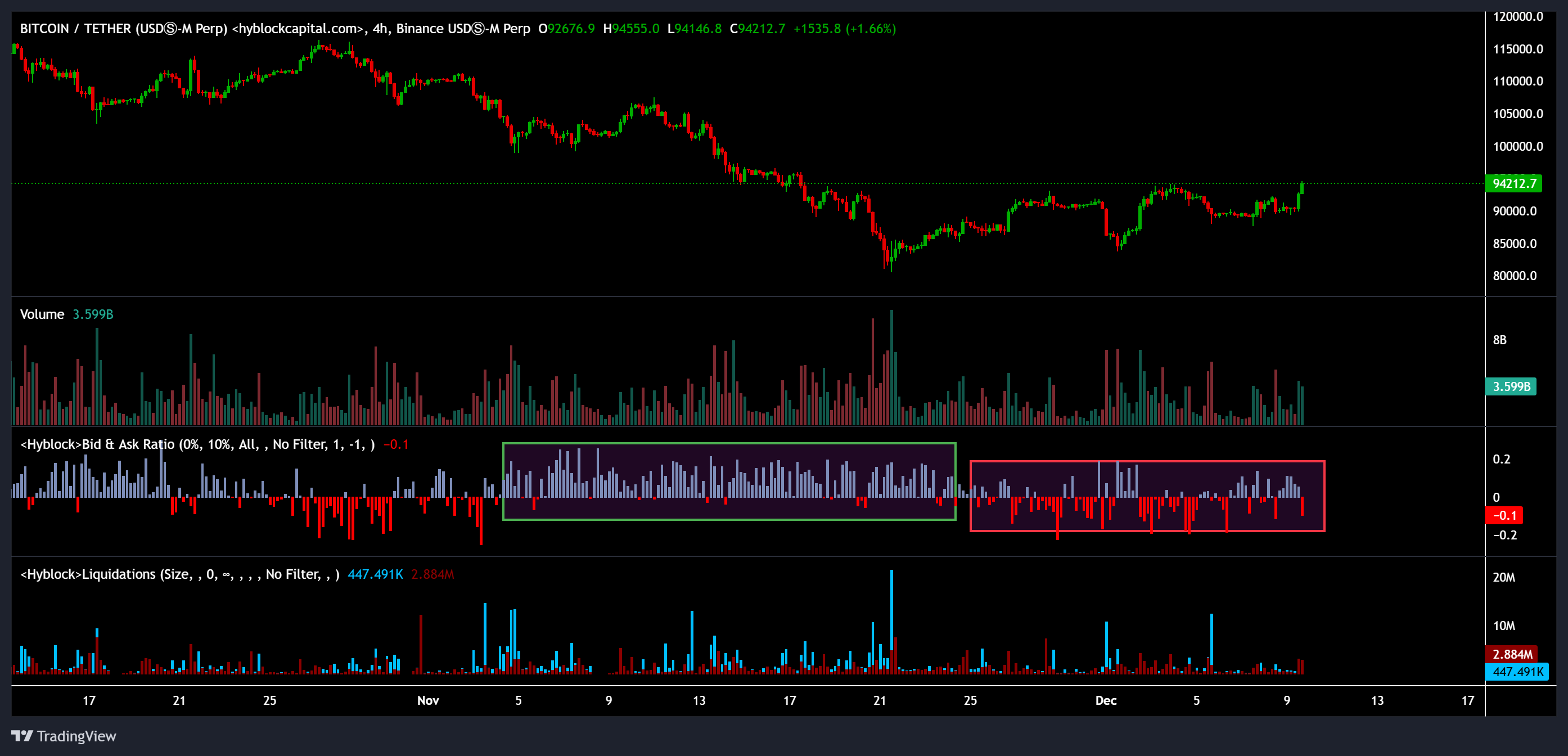

Bid-ask liquidity remained muted despite the breakout, indicating that buyers are stepping in but not yet in sufficient size.

Bitcoin maintains uptrend ahead of FOMC meeting

Bitcoin struggled to secure a decisive daily close above $93,000 following the initial break in structure on Dec. 3. With the broader market bracing for the upcoming FOMC meeting, traders had largely adopted a wait-and-see stance, resulting in a few days of sideways consolidation.

That changed on Tuesday as BTC pushed cleanly through $93,500, producing the higher high needed to restore short-term bullish momentum.

On the four-hour chart, BTC had previously absorbed the entire fair value gap (FVG) between $87,500 and $90,000, but was unable to trigger a follow-up impulse. The latest breakout invalidated that hesitation and signals renewed strength despite the volatility of macroeconomic events.

Even with the upside shift, BTC still traded near the monthly VWAP (volume-weighted average price) on both the four-hour and one-day timeframes. A sustained hold above the monthly VWAP following the FOMC would further confirm a momentum-backed trend reversal.

Trader Jelle, reflecting on recent sideways movement, noted:

“Pretty boring day so far, with $BTC still chopping around the monthly open... Watch for a lower low below 87.6 or a clean break of the grey box at 93k.”

With $93,000 now cleared ahead of the FOMC event, market bias leans toward the upside, though traders may remain sensitive to any post-meeting volatility.

Related: Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025

Bitcoin price rallies but liquidity remains in question

Despite Bitcoin’s bullish price shift, liquidity metrics are not yet flashing full confidence. Bitcoin’s bid-ask ratio has stayed relatively low and inconsistent. During November’s steep drop from $100,000 to $80,000, the ratio turned positive as large bids absorbed the sell-off. But the current rebound has not shown the same aggressive bidding, implying that the move above $93,500 is price-led, with new demand still catching up.

This underscored a market where buyers are acting, but not in the heavy, committed clusters typical of strong uptrends. For now, price strength outpaces depth strength.

Bitcoin’s exchange pricing premium data revealed an equally nuanced story.

The Korea Premium Index, a key gauge of retail sentiment, has cooled sharply. Earlier this year, Korean markets regularly traded at premiums during rallies; however, that enthusiasm has since faded to near-flat or slightly negative territory, a sign that retail speculators are not yet chasing the move.

Meanwhile, the Coinbase Premium Index, a proxy for US investors, has turned positive again. Historically, modest positive readings point toward spot accumulation during early-stage trend reversals.

Related: Bitcoin Hash Ribbons flash ‘buy’ signal at $90K: Will BTC price rebound?

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.