Bitcoin (BTC) could remain pinned below $100,000 for the remainder of 2025 as the market weakened following the US Fed rate cut decision on Wednesday.

Key takeaways:

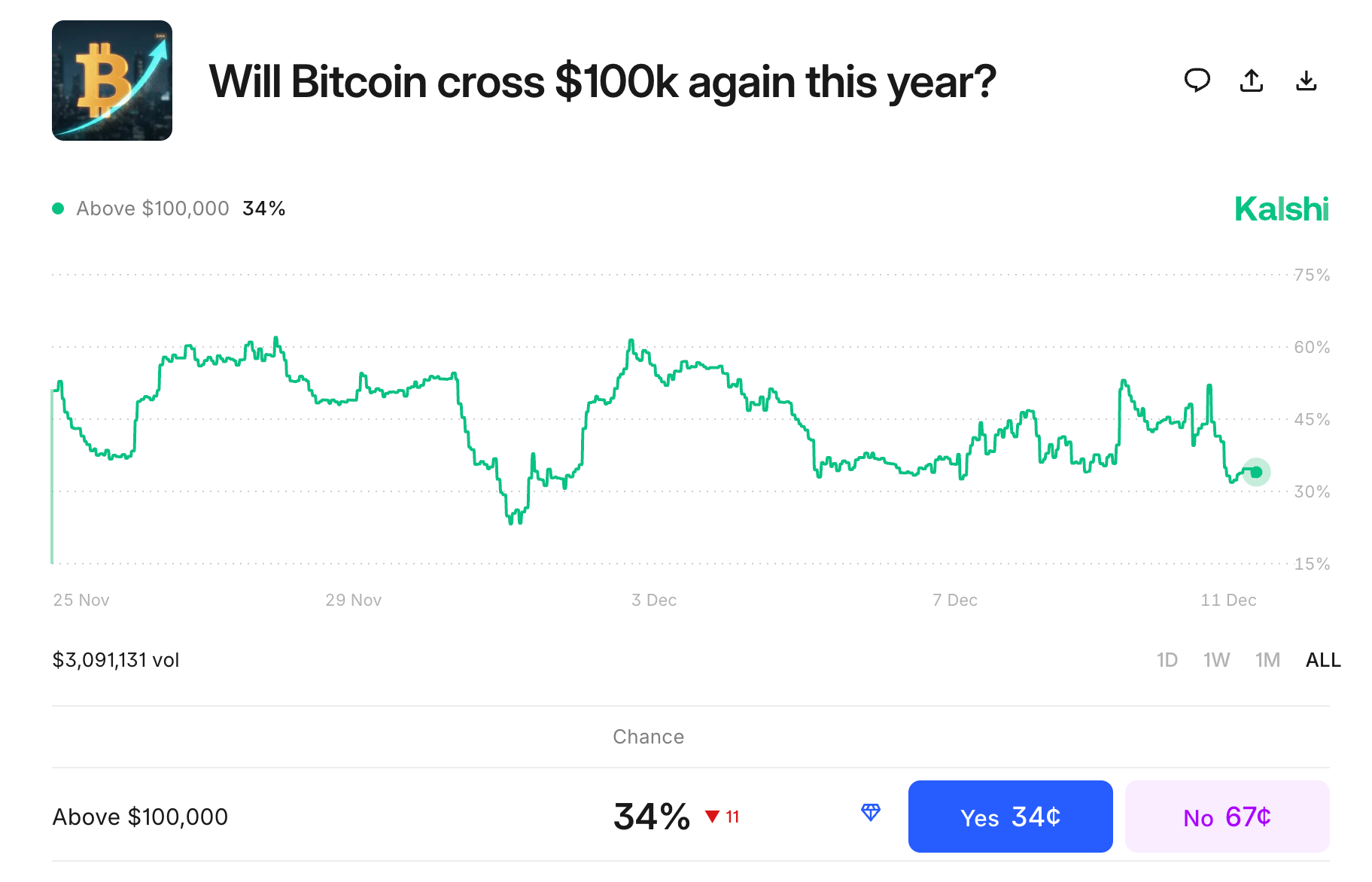

BTC price has only a 30% chance of hitting $100,000 before Jan. 1, according to prediction markets.

Bitcoin treasury buying has slowed significantly, hindering short-term recovery attempts.

Bitcoin faces resistance at $94,000, with an ascending triangle breakout possible to the $98,000 liquidity zone.

30% chance BTC reclaims $100,000 before New Year

The majority of traders on Polymarket and Kalshi expect Bitcoin to remain below the $100,000 mark for the next 21 days.

As of Dec. 11, Kalshi bettors are pricing in about 34% odds of BTC crossing $100,000 before Dec. 31. Polymarket sets 29% odds of BTC touching $100,000 before the end of 2025.

Bitcoin’s high for December sits at $94,600, reached on Tuesday, and the last time the BTC/USD pair traded above $100,000 was on Nov. 13.

Related: Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

Several factors have capped Bitcoin’s rebound attempts in the short term, including growing macroeconomic uncertainties and a slowdown in Bitcoin treasury buys.

Data from reveals that the rate of companies purchasing Bitcoin per day continues to fall, a sign that institutions could be exhausted.

Despite the reduced Bitcoin treasury demand, Polymarket odds for Strategy selling Bitcoin remain marginal before the end of the year, while expectations for routine small buys stay elevated.

Additionally, Polymarket traders still see routine Strategy purchases this week as a high-probability event, with a 65% chance of buying over 1,000 BTC.

Last week, Strategy expanded its Bitcoin treasury to 660,624 BTC after buying 10,624 coins for roughly $962.7 million, and is on course to match last year’s Bitcoin purchases.

Bitcoin’s upside could be capped at $98,000

Data from Cointelegraph Markets Pro and TradingView shows that the BTC/USD pair has been consolidating within an ascending triangle in lower time frames.

The price is “now pushing against this resistance again,” said analyst Daan Crypto Trades in an X post on Wednesday, referring to the supply zone between the $93,300 yearly open and $94,000.

A break and hold above $94,000 should lead to a move toward the measured target of the triangle around $108,000, but Daan Crypto Trades said it may only go as high as “retesting the previous support area around ~$98K,” adding:

“This is also where a good amount of liquidity is located.”

As Cointelegraph reported, buyers will have to drive Bitcoin above $94,589 to open the gates for a retest of the $98,000-$100,000 zone.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.