American fast food chain Steak ‘n Shake has announced that all hourly employees will receive a Bitcoin bonus starting on March 1st.

Steak ‘n Shake Integrates Bitcoin Bonus Payments

Steak ‘n Shake will pay all hourly employees at its company-operated restaurants a bonus in Bitcoin for every hour of work, as revealed by the company’s official X handle. Steak ‘n Shake, primarily based in the United States, is a fast food chain that mainly serves burgers and milkshakes, with its flagship item being the Steakburger. Back in May 2025, the firm opened itself to Bitcoin, allowing customers to pay at all its locations using the cryptocurrency.

Last Friday, Steak ‘n Shake provided an update on the scheme, noting that same-store sales have dramatically increased for the company since it started accepting BTC. The firm added that all of its BTC sales go into its Strategic Bitcoin Reserve (SBR) and announced that it expanded this reserve by an additional $10 million in notional value in that same update.

“We have created a self-sustaining system — growing same-store sales that grow the SBR,” wrote the company. “Improving food quality expands Steak n Shake’s reach and leverages Bitcoin into a new and delicious dimension.” Now, it seems Steak ‘n Shake has taken its BTC acceptance a step further with the employee bonus integration.

According to the announcement, all hourly employees will receive $0.21 BTC for every hour worked. However, only workers who have passed a two-year vesting period will be able to collect their digital asset pay.

Steak ‘n Shake credited Fold for providing assistance on the initiative. Fold is a financial services platform that offers, among other features, a debit card allowing users to earn BTC rewards on payments.

The Bitcoin bonus program is set to go live on March 1st. “We take care of our employees; they, in turn, take care of customers; and the results take care of themselves,” said Steak ‘n Shake.

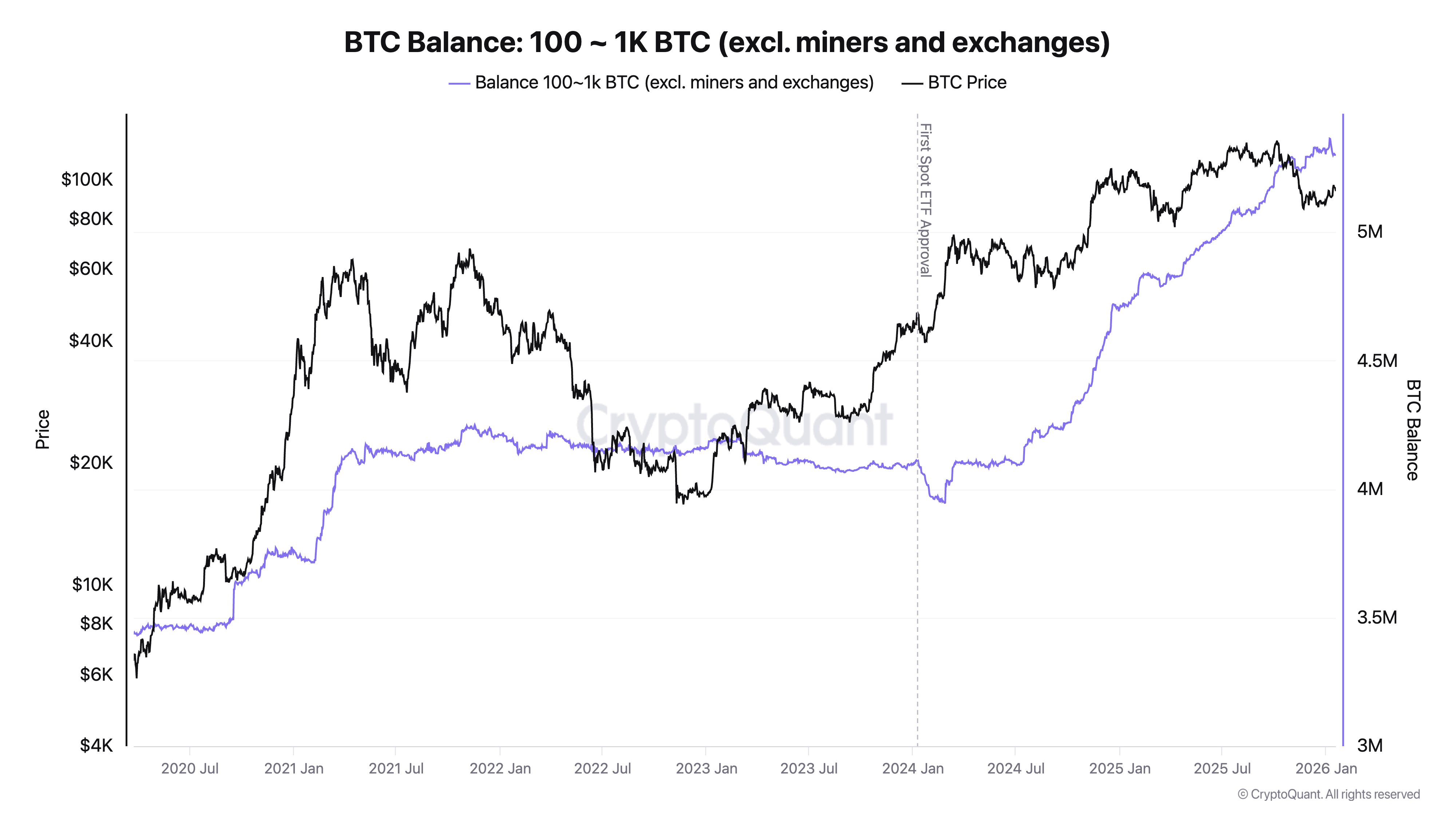

In some other news, institutional demand for Bitcoin has remained strong recently, according to CryptoQuant founder and CEO Ki Young Ju. To track the behavior of these large entities, Young Ju has referred to the supply of addresses carrying between 100 and 1,000 BTC.

“US custody wallets typically hold 100-1,000 BTC each,” explained the CryptoQuant founder. “Excluding exchanges and miners, this gives a rough read on institutional demand.” As the chart below shows, the supply of this investor segment has shown significant growth in recent months.

The trend in the combined balance of institution-sized wallets | Source: @ki_young_ju on X

In total, Bitcoin wallets in the 100 to 1,000 tokens range have collectively added 577,000 BTC (roughly worth $51.5 billion) to their holdings over the past year. So far, this accumulation hasn’t shown signs of slowing down.

BTC Price

At the time of writing, Bitcoin is floating around $89,200, down 6% in the last seven days.

The price of the coin seems to have plunged over the past few days | Source: BTCUSDT on TradingView