Strategy chair Michael Saylor has hinted at his firm’s next Bitcoin buy as the markets tanked again late on Sunday, with some observers blaming the Bank of Japan for the selling pressure.

Bitcoin (BTC) fell to a two-week low of $87,600 on Coinbase in late trading on Sunday, according to TradingView. The quick Sunday wick down has become a common trait over the last few weeks.

It is the lowest price the asset has seen since Dec. 2, when it was recovering from a fall to $84,000. It had recovered back over $89,000 at the time of writing, however.

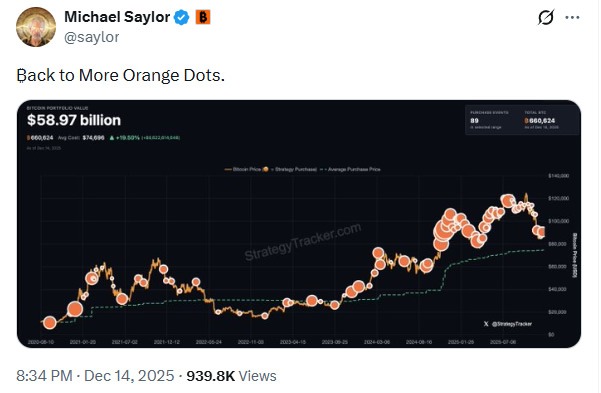

Saylor posts more “orange dots” indicating Bitcoin buy

Meanwhile, Michael Saylor hinted at another Bitcoin purchase, posting “Back to More Orange Dots” on X with the accompanying portfolio chart on Sunday.

Its last Bitcoin buy, and its largest since late July, was 10,624 BTC on Dec. 12, according to SaylorTracker.

The firm currently holds 660,624 BTC worth around $58.5 billion at current prices. Strategy’s average cost per coin is $74,696, so the company is still up on its investments, for now.

Analysts eye Bank of Japan as source of selling pressure

Some analysts speculate that the increased selling pressure is coming from an imminent interest rate decision by Japan’s central bank.

“People are seriously underestimating what Japan is about to do to Bitcoin,” said analyst “NoLimit” on Sunday. They pointed out that previous rate hikes in Japan were followed by significant Bitcoin crashes, as Japan is the largest holder of US debt.

Polymarket’s predictions platform has a 98% chance that the Bank of Japan will hike rates by 0.25% on Friday.

Related: Rising Japanese bond yields could shake global carry trade, crypto

Justin d’Anethan, head of research at the market advisory firm Arctic Digital, told Cointelegraph that while prices have recouped from the lows of November, the move down to $88,000 “feels like a defeat.”

“In Japan, rate expectations instilled fear of yet another carry trade unwind, which would weigh on risk assets and so push macro funds and day-traders to take some money off the table, expecting some further downside.”

Markets have priced it in already

Analyst “Sykodelic” said that Japan’s move was already known and already expected, therefore priced in. “Markets are forward-thinking, forward-moving. They move in anticipation of events, not when those events happen,” they said.

“We do expect prices to stay range-bound, though, very much in this $80K to $100K zone, as traders wait for a catalysis that may not come,” d’Anethan predicted.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?