Bitcoin (BTC) should see a “shock move” that brings back BTC price upside — but not until 2026.

Key points:

The next Bitcoin price bottom will take until 2026 to hit, new analysis concludes.

Declining trading volume leaves little chance of a short-term bull market comeback.

Sell-side pressure is cooling, and price could rally to $99,000 as a result.

BTC price bottom: Not until 2026?

In his latest YouTube analysis Thursday, crypto commentator Jason Pizzino forecast up to a year of lower lows for BTC/USD.

Bitcoin may not reach its long-term bottom until as late as October 2026.

Summarizing current market trends, Pizzino referenced community expectations that BTC/USD will form a bounce zone at some point during the coming eleven months.

“As I said, we’ve got some time,” he said.

“I think it’s still too early to know whether this is going to be a low that then pushes to a new all-time high or a low that then pushes to a major lower high because of where we sit in the 18-year cycle.”

Pizzino referenced risk-asset behavior as it relates to the 18-year cycle theory involving real estate markets.

To get to its reversal zone, he specifically focused on Bitcoin trading volume grinding lower in a manner similar to the end of 2022 and into 2023 — the springboard for the current bull market.

“And that’s where these shock moves happen because the majority are not watching,” he argued.

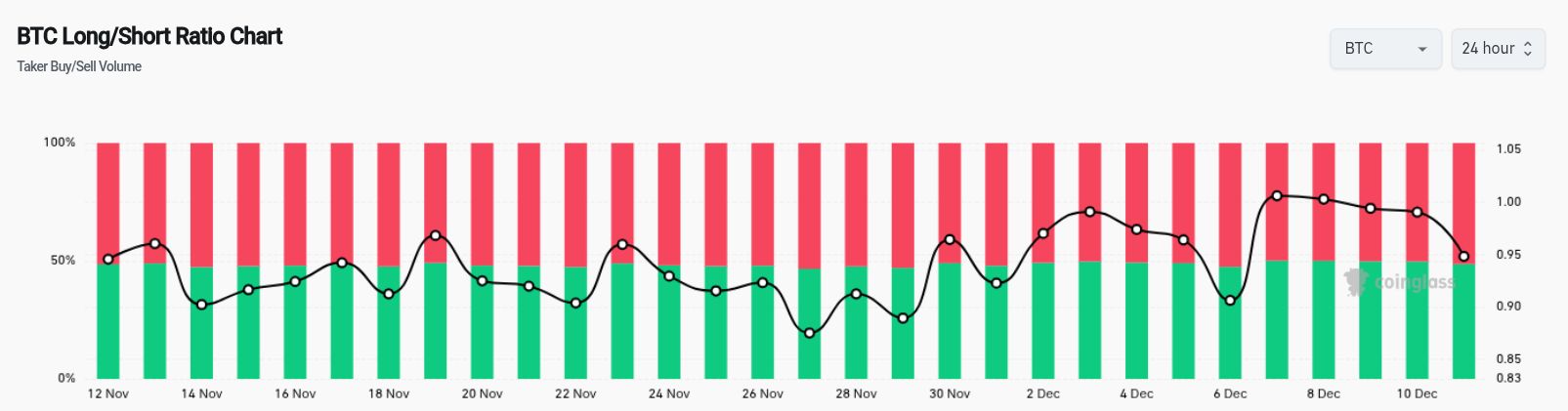

Pizzino saw even less chance of a major trend change occurring in the short term, with the 200-day simple moving average (SMA) forming stiff resistance overhead and trader risk appetite nowhere to be seen, as shown by a balanced long/short ratio.

Sellers hold the key to $99,000 rebound

On the topic of investor behavior, onchain analytics platform CryptoQuant sees a potential period of consolidation before a new market frenzy.

Related: Bitcoin retail inflows to Binance ‘collapse’ to 400 BTC record low in 2025

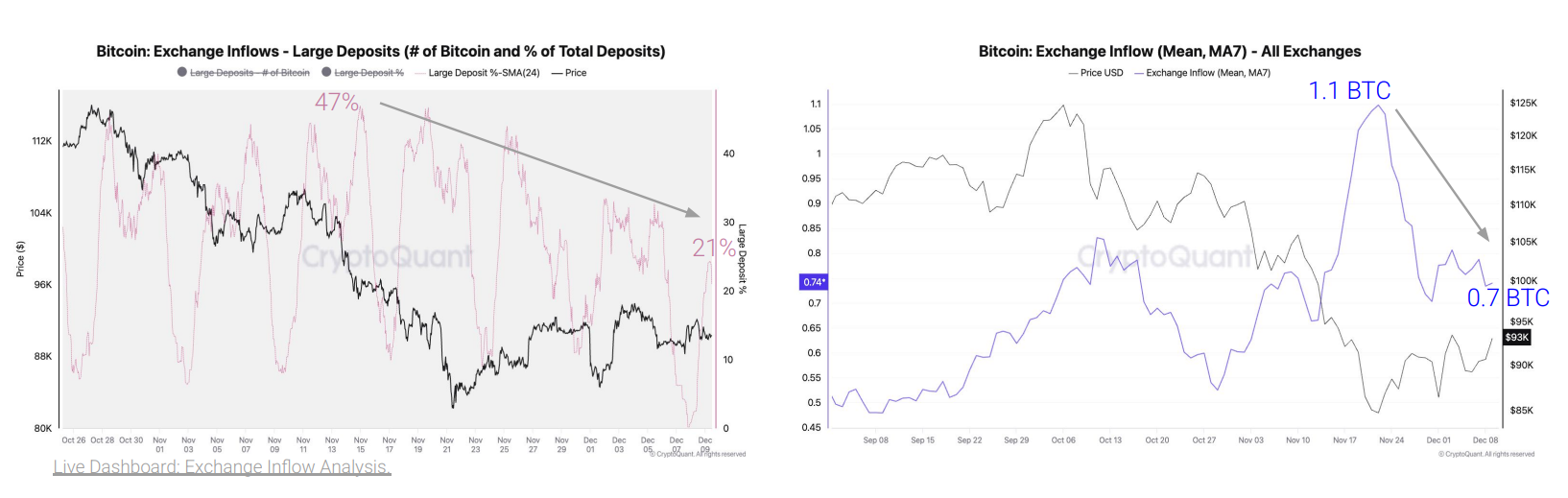

In its latest weekly report sent to Cointelegraph on Tuesday, titled “The Calm Before The Vol,” researchers flagged declining exchange inflows from large-volume entities.

“The share of total deposits from large players has declined from a 24-hour average high of 47% in mid-November to 21% as of today,” it reported.

“At the same time, the average deposit has shrunk 36% from 1.1 BTC in November 22 to 0.7 BTC currently. The selling pressure eases when large players decrease their transfers into crypto exchanges.”

CryptoQuant predicted that sustained reductions in selling pressure could send BTC/USD back to $99,000.

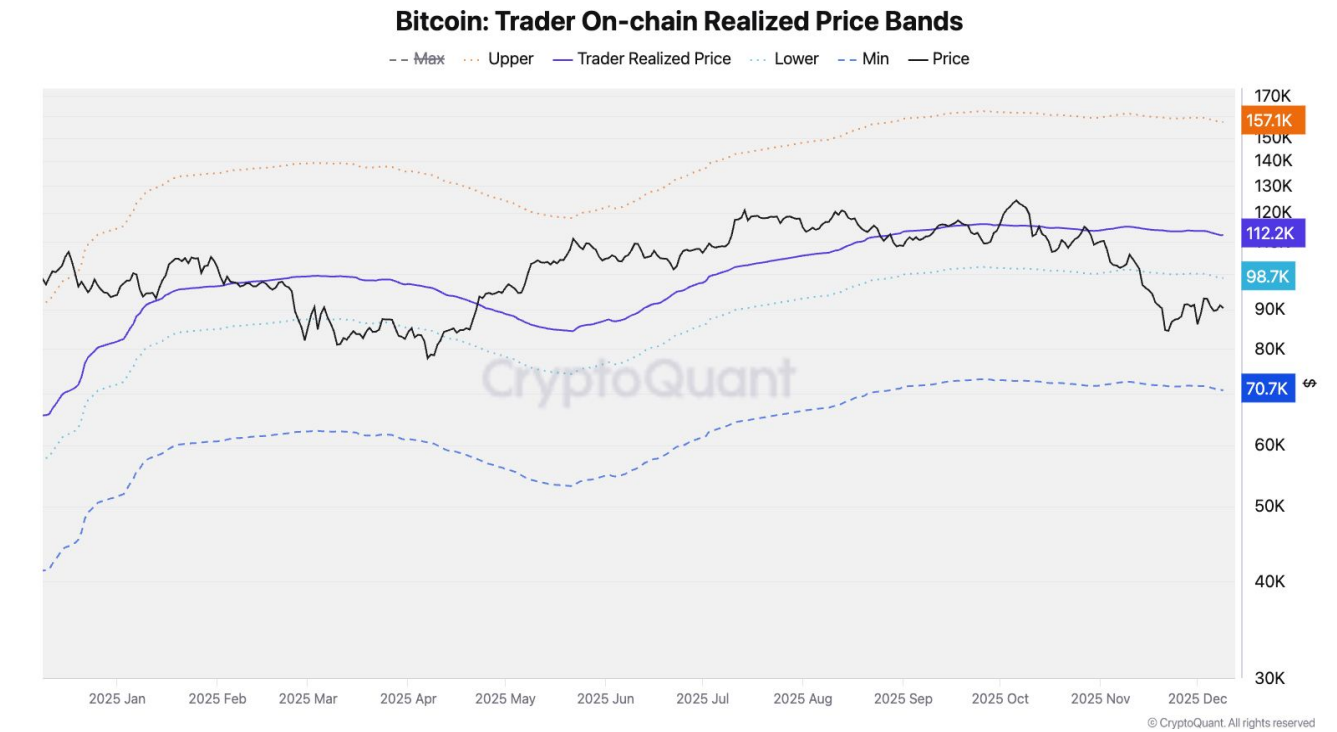

“This level is the lower band of the Trader On-chain Realized Price bands, which is a price resistance during bear markets. After this level, the key price resistances are $102K (one-year moving average), and $112K (the Trader On-chain Realized price),” it added.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.