撰文:kkk

9 月 24 日,美联储 2025 年首次降息刚过一周,主席鲍威尔再次公开发声,传递出一个复杂而微妙的信号。他警告称,美国劳动力市场趋于疲软,经济前景承压,而通胀却仍高于 2%,这种「双向风险」令政策制定者左右为难,并表示「没有无风险的道路可走。」

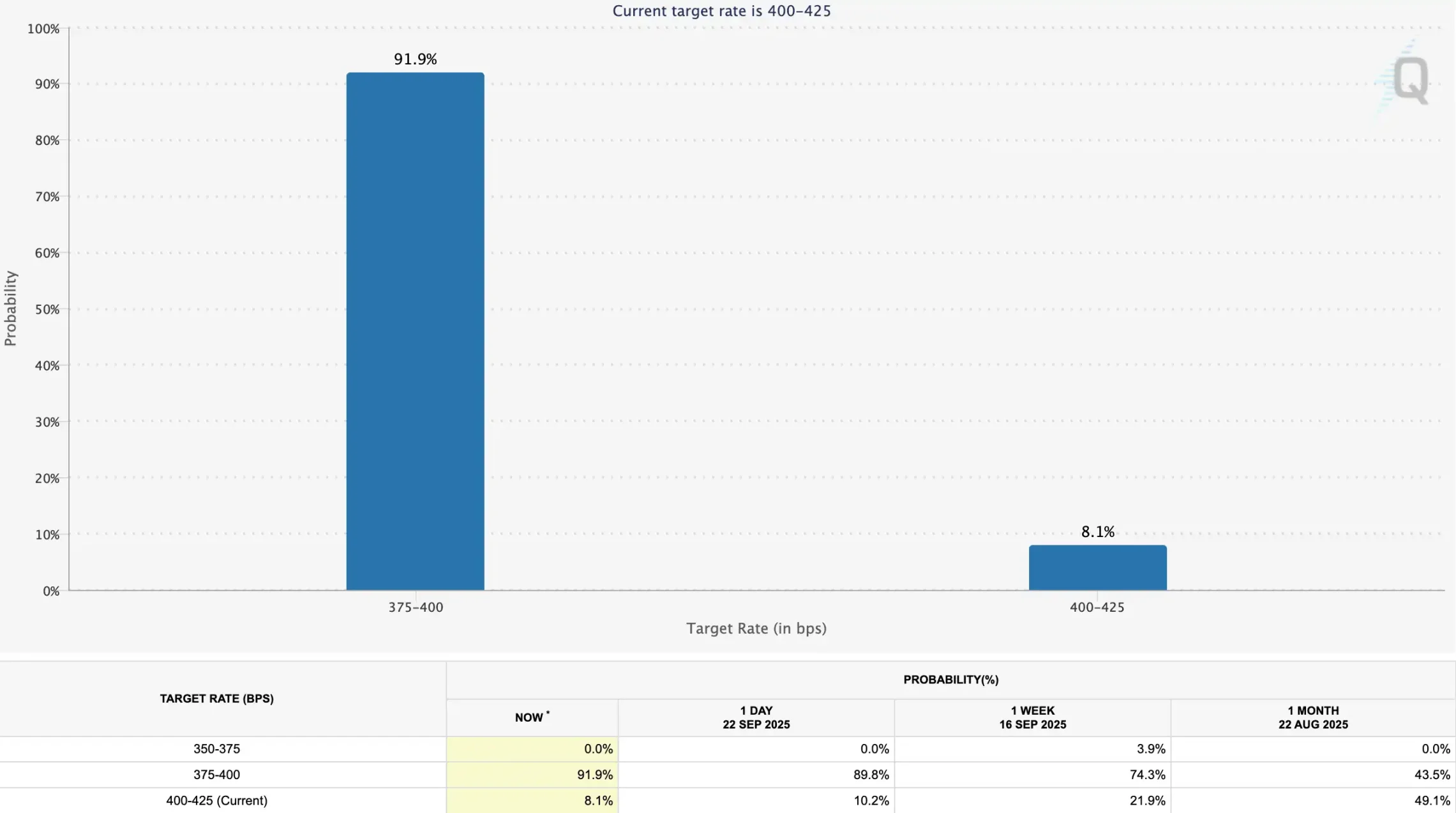

鲍威尔还评价股市的估值相当高,但也强调当前「并非金融风险上升的时期」。对于 10 月的议息会议,鲍威尔表示并没有预设的政策路线。市场将本次讲话解读为「鸽派倾向」:讲话发布后,10 月降息概率由 89.8% 升至 91.9%,市场已基本押注今年将落地三次降息。

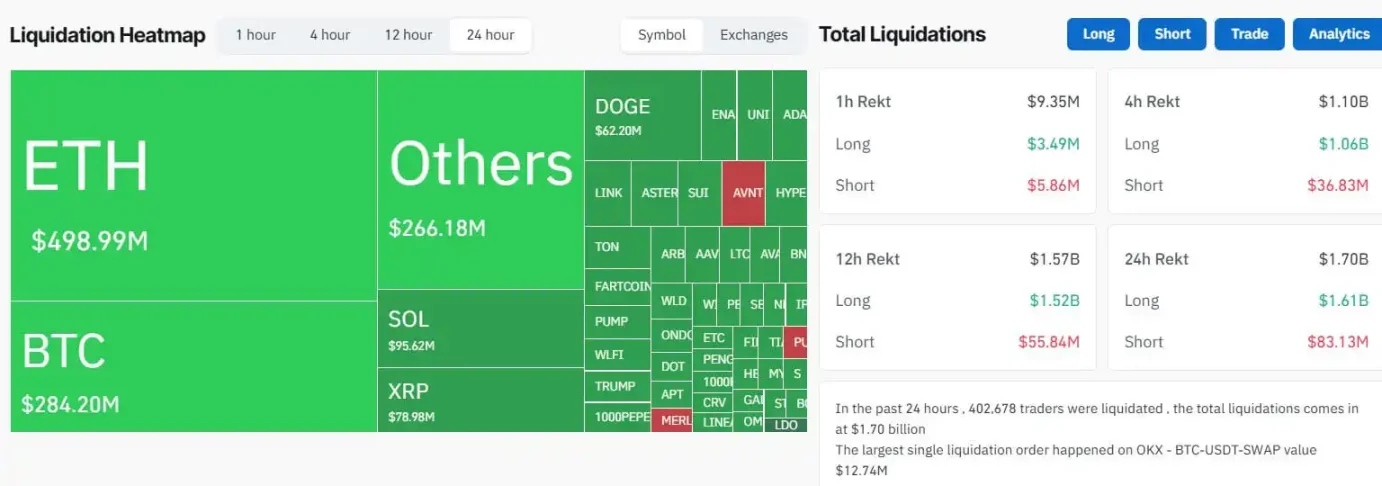

在宽松预期的推动下,美股屡创新高,而加密市场却呈现出截然不同的景象。9 月 22 日,加密市场单日爆仓金额高达 17 亿美元,创下自 2024 年 12 月以来的最大清算规模。接下来,律动 BlockBeats 整理了交易员们对接下的市场情况的看法,为大家本周的交易做出一些方向参考。

@0xENAS

交易员鸽子认为各种迹象都指明加密市场正在逐渐疲软。

当我在休息两周后重新入场时,正赶上今年最大规模的清算回调,结果那些在历史上八成能带来反弹的「清算买单」,这次却依旧继续下跌——这种错位,是个非常明确的危险信号。那 20% 失效的情形,往往意味着:市场上已经没有足够的边际买家了,反弹的接力棒没人愿意接。

我怀疑接下来我们会越来越脱离美股等「风险资产」的联动逻辑,开始失守几个关键支撑位。我的观察点在:BTC 10 万美元结构破位、ETH 跌破 3400 美元、SOL 跌破 160 美元。

@MetricsVentures

我们认为全球资产泡沫周期已经大概率进入了暖胎圈,启动看似只是时间问题。这一泡沫周期发生于 AI 冲击下的失业与社会割裂之大背景下,受全球财政主导经济周期与政治经济生态支持,加速于世界两极化态势进一步明确后的两大国共同期待输出通胀解决内部矛盾意愿,预计将在未来几个月内进入大众讨论视野。

向前看,除了已经将近一年没有大波动的数字货币市场是潜在巨大赢家外,全球的周期矿产及 AI 衍生投资链将持续创造超额收益。币股方面,ETH 的币股成功将带来系列的仿盘出现,预计强庄大市值币 + 强庄股的组合将在未来数月成为最亮眼的细分。

随着竞争优势国纷纷开始考虑给新生儿设立投资账户、将养老金进一步放宽投资限制、将历史上长期作为融资通道的资本市场捧上新高度,金融资产的泡沫化已经成为大概率事件。

我们也乐于看到美元市场开始欢迎数字货币的原生波动,并为此提供充裕的流动性定价,这在 2 年前是不可想象的,正如 MSTR 的成功也是 2 年前我们无法预测的金融魔法一般。

言简意赅的说,我们明确的看好未来 6 个月的数字货币市场、未来 1-2 年的全球矿产和顺周期市场和 AI 衍生产业链。此时此刻,经济数据已经不再那么重要,正如加密圈很多人戏谑的「经济数据永远是好消息」,在轰隆向前的历史火车面前,此刻顺应趋势拥抱泡沫可能已经成为了我们这代人最重要的课题。

@Murphychen888

按照「三线合一」的走势,在今年 10 月 30 日后,mvrv 将会进入长期震荡下行的趋势,即完全对齐 btc 过往 4 年周期的时间规律。

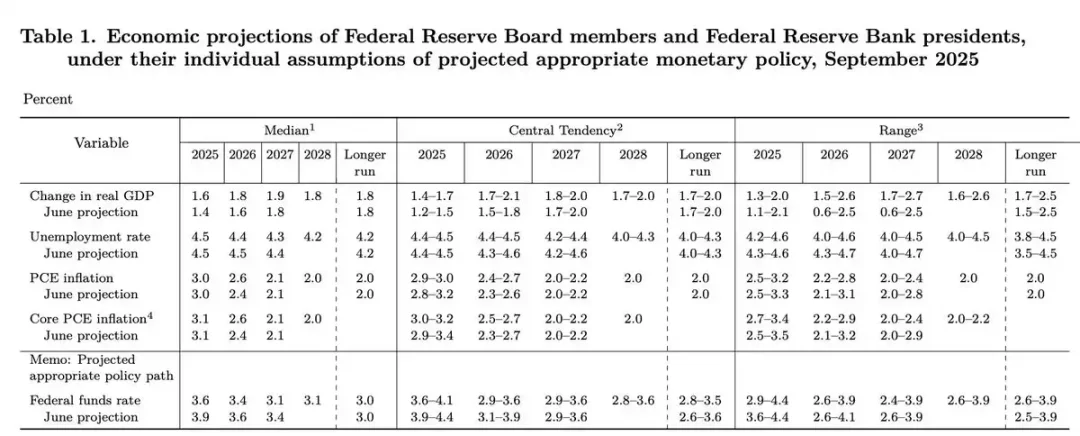

然而按照这份宏观预期数据,则整体传递的信号是「软着陆 + 通胀回落 + 货币政策逐渐宽松」。

虽然未来都是未知的,但如果真是这样,那么 4 年周期论可能真的要被打破,比特币可能会进入「永恒牛市」。

@qinbafrank

大级别宽幅震荡里美股表现优于币的逻辑在于:市场整体还是隐隐担心通胀未来走势的,美股强在于基本面强 AI 在加速,让美股能抗住对通胀的走势的担忧继续高歌猛进。币的问题在于靠资金和预期推动,对宏观的担忧会影响外部资金的流速。

当下的币市深层次的就是以 ETF 和上市公司采购的传统资金进场作为买方,远古巨鲸、趋势投资波段止盈选作为卖方,市场的价格波动、上蹿下跳绝大部分都是来自这两股力量的博弈。短期看经济强弱、通胀走势和利率预期都会影响买方资金的流入速度,预期好流速加快预期差流入停止甚至反向流出。

而当下联储重回降息,但是通胀还在缓慢抬头,市场自然担心联储降息未来会被通胀再度打断,这种情况下买方资金流入是会被影响的,从 ETF 净流入规模的变化就能看出来。而美股核心主线 AI 渗透率马上要触及 10%,一旦跃过会进入渗透率快速提升的黄金时期,还是一直说的 AI 正在加速被加速。从这个角度强弱自然就体现出来了

后续行情的走势需要参考宏观经济数据:

1)最佳情况:通胀抬头的节奏和幅度低于预期,对币和美股都利好。

2)中等情况:通胀节奏符合预期,更利好美股因为美股基本面更强,币相对好但很可能是大级别宽幅震荡。

3)最差情况:未来出现某一次通胀大幅超预期,美股币市都要回调,美股可能是小级别币市就是中级别。

@WeissCrypto

美联储降息带来流动性的影响要到 12 月中旬才能注入加密市场。其模型显示,横盘波动可能持续 30 至 60 天,10 月 17 日可能出现明显底部。值得注意的是,Weiss Crypto 最近预测 9 月 20 日左右将出现峰值。

@joao_wedson

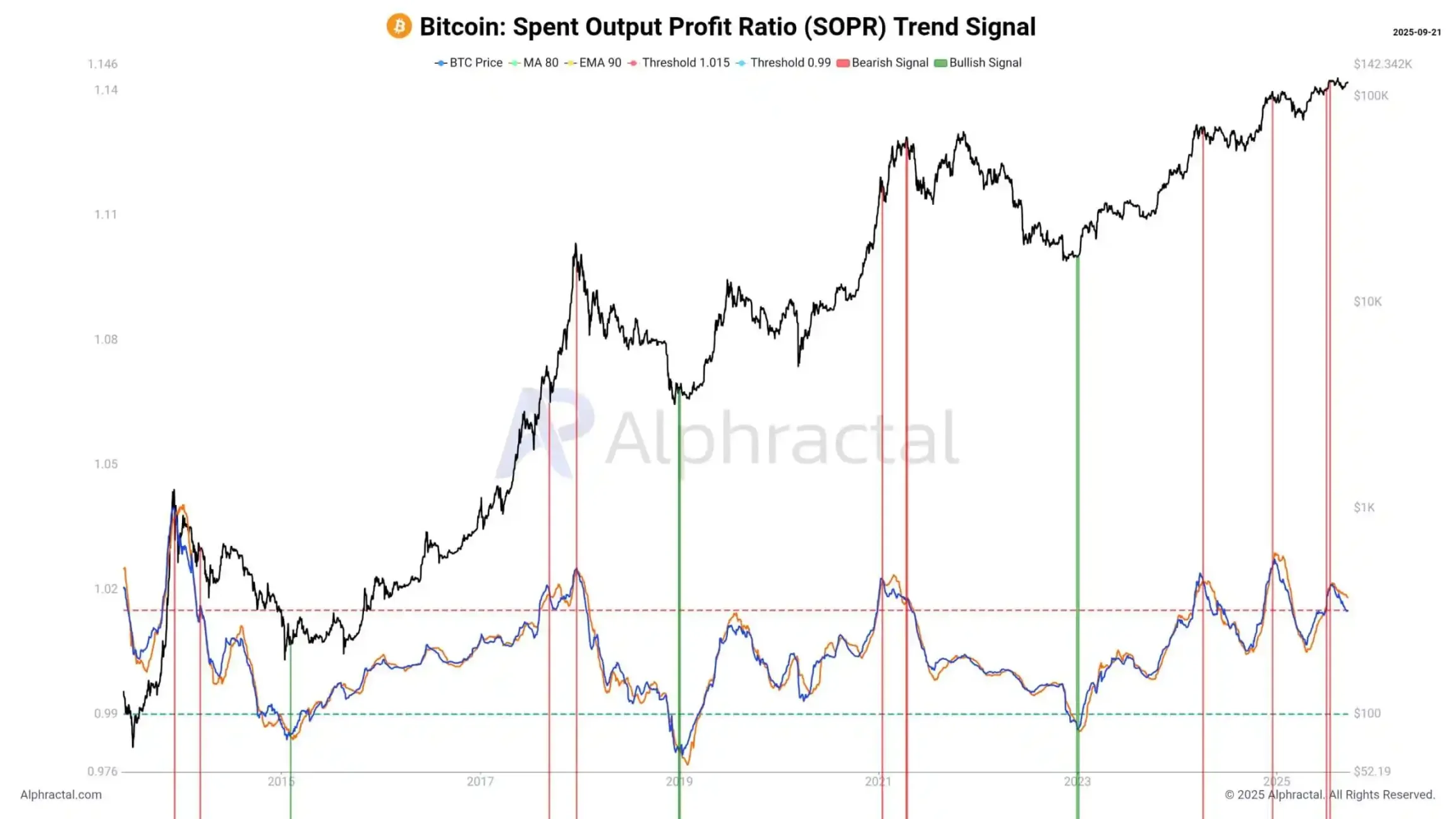

区块链分析平台 Alphractal 的创始人 Joao Wedson 表示,比特币正显示出明显的周期衰竭迹象。他指出,追踪链上已实现盈利能力的 SOPR 趋势信号表明,投资者正在历史高位买入,而利润率已经在缩水。比特币的短期持有者实际价格目前为 111,400 美元,机构投资者本应更早地达到这一水平。他还指出,与 2024 年相比,比特币用于衡量风险收益的夏普比率有所减弱。

他提出「那些在 2022 年底购买 BTC 的人对 +600% 的收益感到满意,但那些在 2025 年积累的人应该重新考虑他们的策略,」而做市商倾向于卖出 BTC 并买入山寨币,在未来山寨币将具有更好的表现。