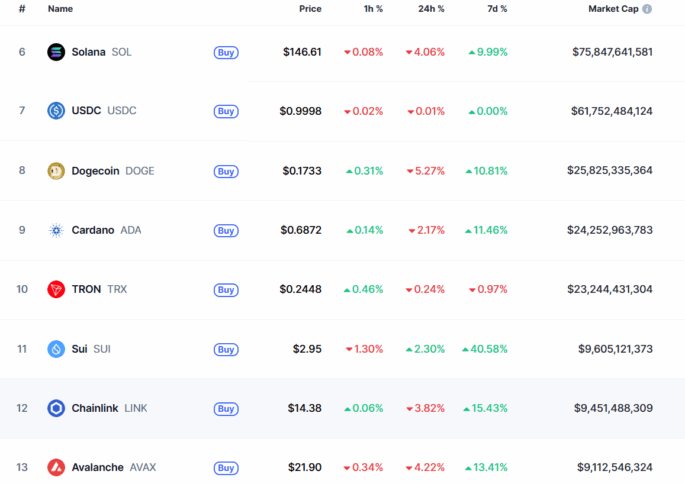

The high-performance layer 1 blockchain network, Sui has flipped Chainlink in market cap as its price pumps over 44% in the past 7 days. With this shift, Sui is now the 11th largest crypto asset while being positioned in rows of Tron and Cardano.

Chainlink’s market cap, which is currently $9.46 billion, has been swiftly surpassed by that of Sui today following the recent push in SUI price. The market cap of Sui firmly touched the $10 billion mark before it pushed back in a decent decline with it now sitting at $9.76 billion.

As per latest market data, SUI price has pumped 43.58% in the past 7 days with it now trading at $3 with a 24 hour trading volume of $2.68 billion.

The increased attention on the Sui network in the past few weeks is attributed to some major developments in recent times. Earlier this month, the CBOE filed for a spot SUI ETF with the SEC which marked a turning point for this altcoin.

Meanwhile, memecoins like MUI, LOFI and BLUB and DEEP token – which all are deployed on the Sui network – have also helped SUI price spikes rapidly in the past 7 days.

Can SUI Enter in the Top 10 Crypto List?

Sui currently sits at the 11th position among largest crypto assets by market cap. To enter the top 10 crypto club, it will need a push of more than double of is current market cap in order to surpass Tron, which is at 10th number.

While it seems hard for as of now, the crypto industry is full of surprises and a continued surge could make it possible for Sui to break into the top 10 positions.

Also read: Ethereum won’t survive in 10 years: Charles Hoskinson of Cardano