原文作者:Nancy,PANews

在经历区块大小路线之争的小插曲后,Ordinals 的比特币 NFT 叙事正获得主流认可。近日,国际拍卖巨头苏富比宣布拍卖 Ordinals 项目 BitcoinShrooms,这是其首次对比特币 NFT 进行拍卖。BitcoinShrooms 为何能成为首个被顶级拍卖行拍卖的 Ordinals 艺术品?

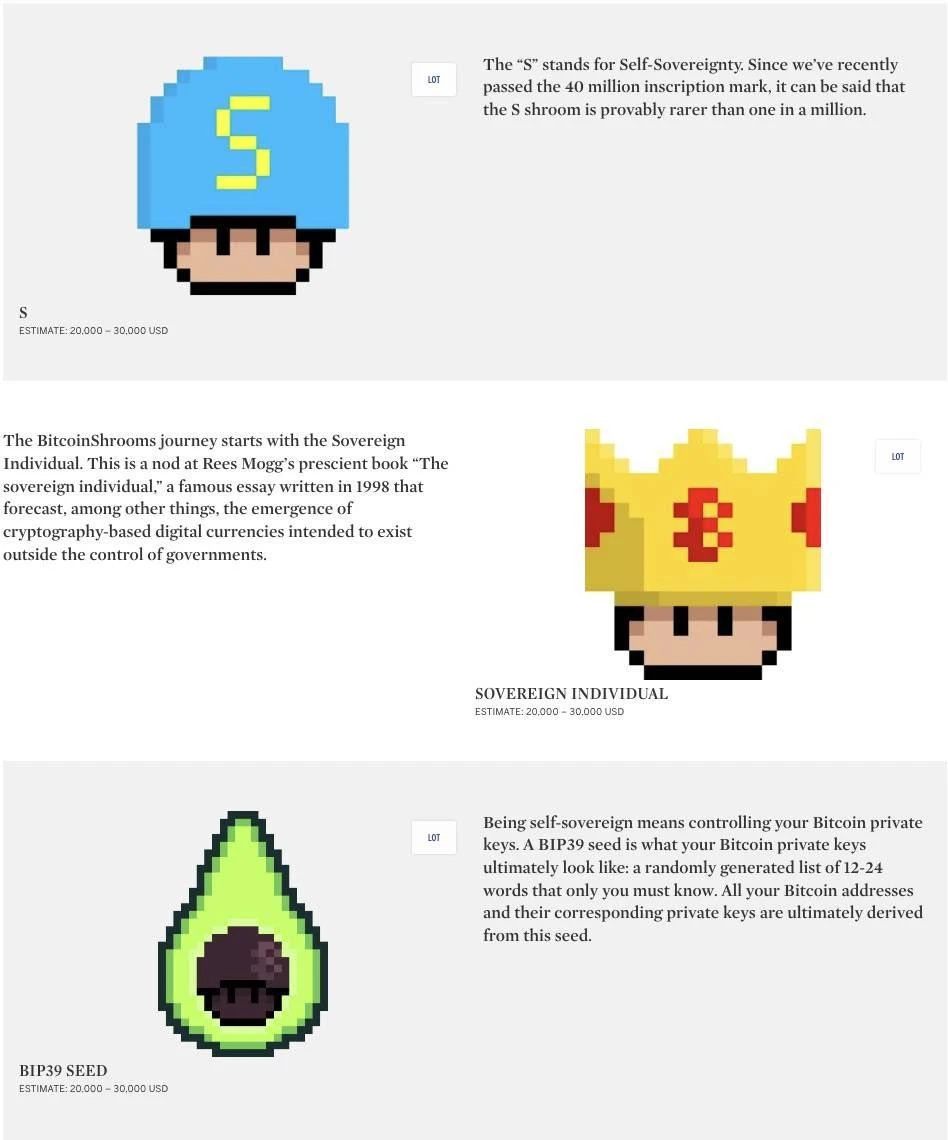

根据苏富比官方消息,Ordinals 项目 BitcoinShrooms 将于 12 月 6 日至 13 日(美国东部时间)进行在线拍卖,目前有三件作品可供竞拍,包括两个蘑菇个体和一个像素化的牛油果种子,预计售价约为 2 万至 3 万美元,可接受加密货币出价。

其中,名为“S”作品是 Inscription 38 ,代表着自我主权,已获得 45 次出价,竞标价已达 3.8 万美元;Sovereign Individual 是 Inscription 715 ,灵感来自于 Rees-Mogg 在 1998 年的经典著作《The Sovereign Individual》,该书预测了为不被政府控制出现了基于密码学的数字货币,这也是当前三件作品中出价最高的,获得 25 次出价;BIP 39 Seed 是 Inscription 679 以创建种子短语所需的助记码的共同标准来命名的,即自我主权意味着掌控自己的比特币私钥,已获 31 次出价。

BitcoinShrooms 由匿名艺术家 Shroomtoshi 设计,旨在通过怀旧和超参考模式捕捉了加密货币的时代精神,并教育和激发人们对比特币的文化和技术革命的欣赏。BitcoinShrooms 对外声称是首个 Ordinals NFT 合集,最初于 10 月 22 日在链上铸造,整体采用了像素风,前 1000 个铭文中有超 200 件作品属于 BitcoinShrooms。根据 Ordinals 设计规则,该协议给每个“聪”都分配了独一无二的编号,排名越靠前越稀有,当前已突破 4000 万个铭文。

值得一提的是,今年 2 月,BitcoinShrooms 面向 discord 活跃社区用户在比特币拍卖平台 Scarce.City 进行拍卖,其拍卖价格被一路推高至 2.5 BTC(当时价值约 6 万美元)后,BitcoinShroom 提前一天紧急取消拍卖,并向比特币开发工具包 Bitcoin Dev Kit 进行了捐赠。

而 BitcoinShrooms 之所以能登上苏富比拍卖,该拍卖行似乎也给出了理由,“BitcoinShrooms 藏品中蕴藏着大量参考文献,从标志性的比特币 Meme 到先进的技术概念,每件作品展示了比特币的历史、文化和核心计划,像是一首视觉交响乐,从早期人们的角度捕捉了比特币的本质。”