Usage of the Polygon Network token bridge keeps growing as traders move assets over to the Ethereum sidechain to benefit from cheaper gas and transaction fees. Polygon is no newcomer, and EVM compatible networks such as Fantom, Solana, and Avalanche keep making noise and increasing their respective TVL. Polygon has been going about things calmly, diversifying its dapp ecosystem into GameFi and reaching $4.4 billion in TVL at writing.

A token bridge is a set of contracts that help move assets from one chain to another. There are primarily two bridges to move assets between Ethereum and Polygon. The first is the Plasma bridge, and the second is called the PoS Bridge or Proof of Stake bridge. The Plasma bridge provides increased security but has a 7-day withdrawal period, hence the popularity of the PoS Bridge, which has no restrictions.

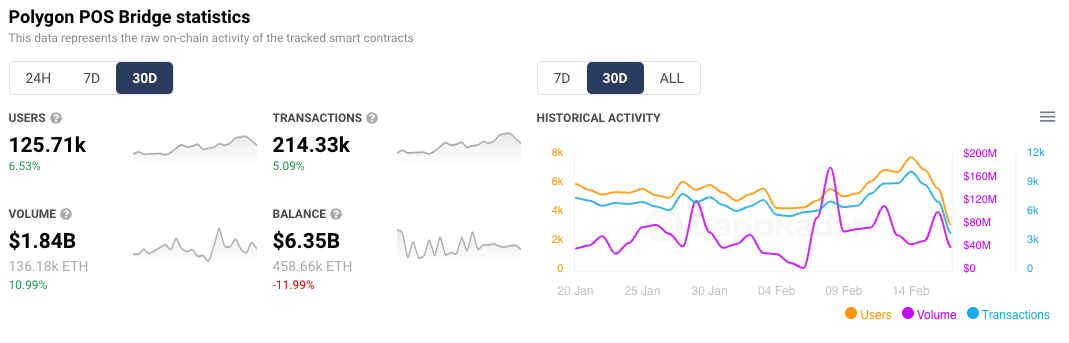

More than 125,000 wallets have connected to the Polygon PoS Bridge In the last 30 days, sending 214,330 transactions which generated a $1.84 billion volume. Interestingly we can see that an average transaction in the last 30-days through the bridge is worth around $8,500.

A much higher number than previously observed as traders move larger chunks of capital into the network to continue trading on the much cheaper sidechain network. For reference, gas fees on Ethereum can be as high as $100 for a token swap right now. On Polygon, traders will pay less than $0.50.

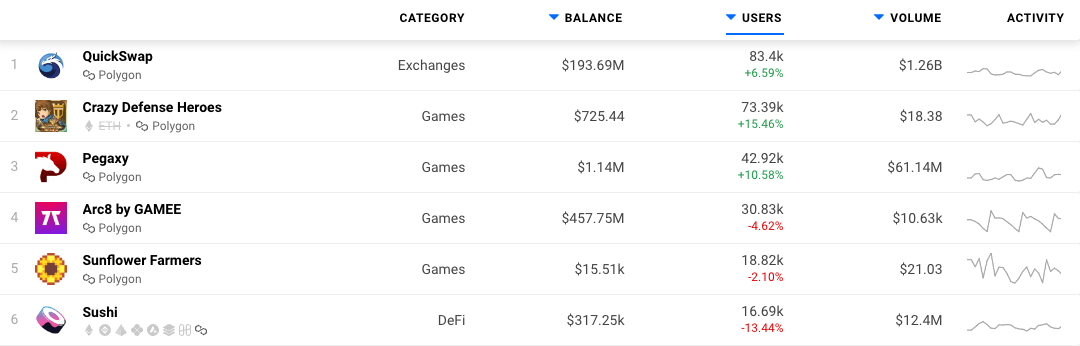

The uptick in usage can also be seen across several leading Polygon dapps. While Ethereum has Uniswap, Polygon has QuickSwap and a complete dapp ecosystem. Most interesting is that two of the top-performing dapps on Polygon this week are in the games category. Of course, these games lean heavily on DeFi mechanics, and it looks like Crazy Defense Heroes, a tower defense game where players can earn tokens, might overtake QuickSwap. This further shows the impact of gaming dapps in 2022.

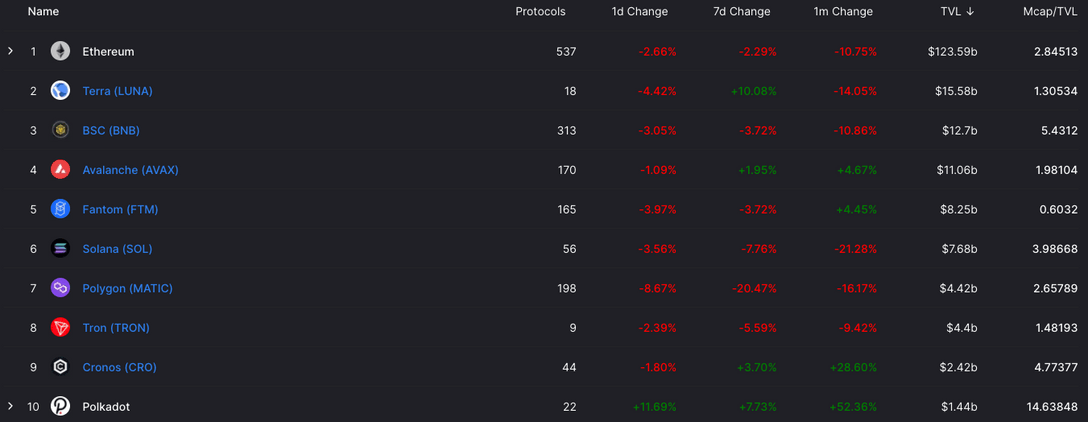

Value locked in Polygon

TVL is the primary metric by which a blockchain is currently judged. The figure tells how much value is now locked into a blockchains smart contracts. This can indicate how well used the blockchain is as it shows that value is flowing in from traders, investors, and now, players. Ethereum sits atop the pile with a commanding lead but has been losing market share bit by bit over the last year.

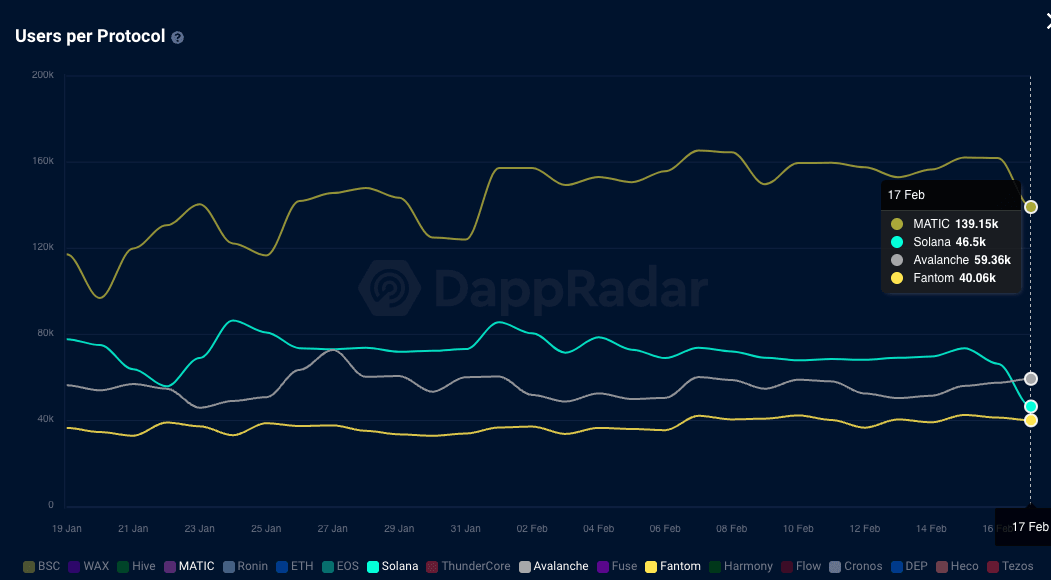

Arguably after Ethereum, the gap between the other top 9 ranked by TVL is wide open. For example, if Polygon doubles its TVL, it will hop into the top 5 to start working its way towards Terra. A goal that could be very achievable when considering that more than 145,000 wallets connected to Polygon dapps in the last month. A figure that almost surpasses Solana, Avalanche, and Fantom’s numbers combined.

Will Polygon Become the Real Alternative to Ethereum?

Some key strengths of the Polygon Network are that it offers more than one way for developers to provide high-speed, low-cost transaction processing in their dapps by providing a platform where private and individual dapp projects can interoperate. At the same time, developers choose the scaling tool or tools that best suit their needs without completely abandoning Ethereum.

The rise of GameFi and Play-to-Earn dapps on Polygon also indicates its user base will continue to expand. The Polygon game ecosystem already looks stacked with Pegaxy, Aavegotchi, Fear, Phantom Galaxies, REVV Racing, Zed Run, Doctor Who: Worlds Apart, and the upcoming Galaxy Fight Club, Riot Racers, among others.

The network is continuously revamping its gaming perspective with strategic investments and partnerships. What is more, the Polygon team launched Polygon Studios with the help of a list of partners that include Animoca Brands, The Sandbox, Decentraland, and other leading dapps.

Polygon certainly stands a shot at becoming a major multi dapp category blockchain but has stiff competition currently from the recently rebranded BNB Chain. Another network that’s broadened its horizons to embrace dapps outside of DeFi to help grow its audience.

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research.