Cryptoupdate999

2023/11/06 04:40

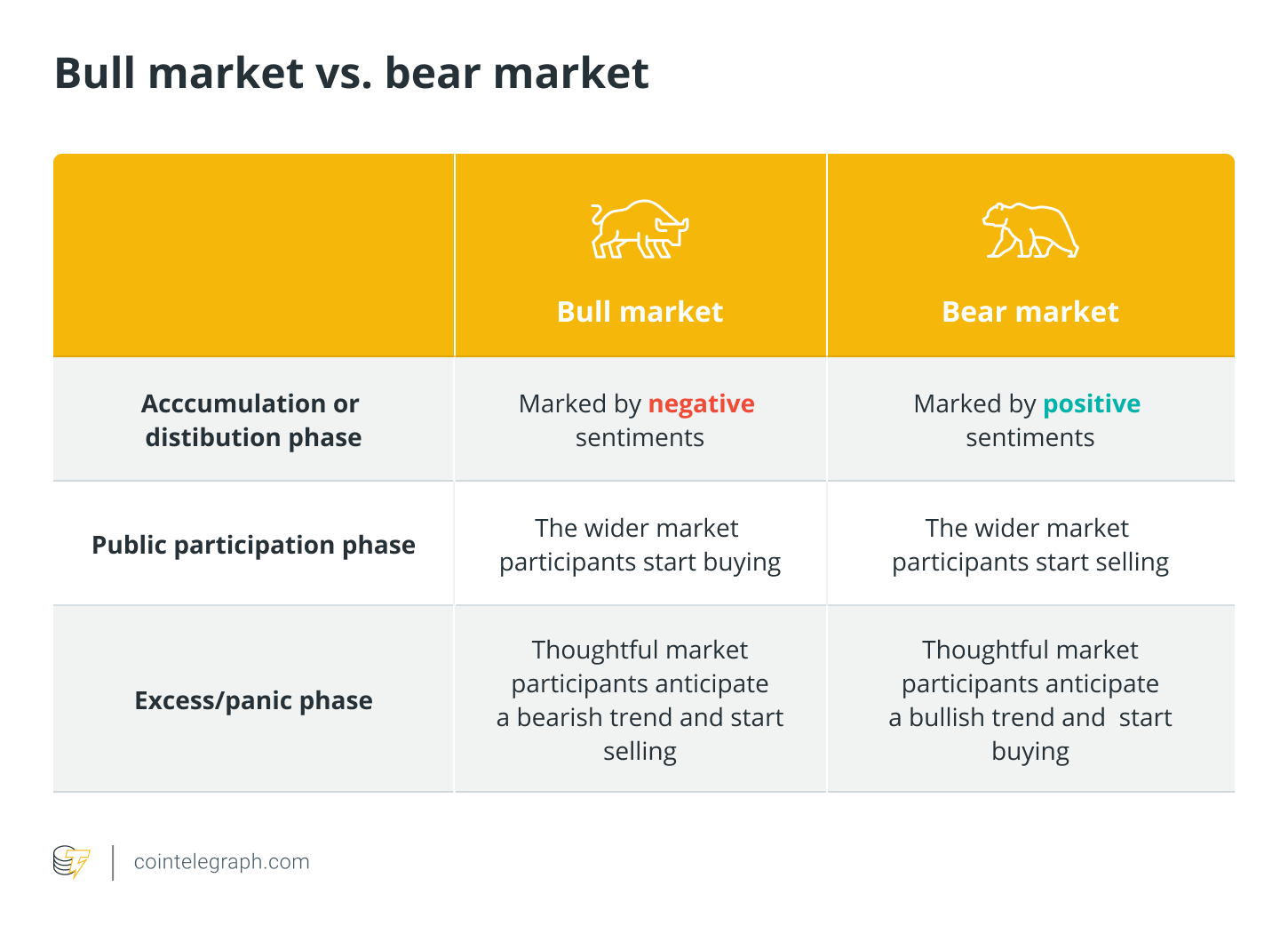

Primary trends have three phases

The first phase, the accumulation phase for a bull market and the distribution phase for a bear market, precedes a contrary trend and occurs when market sentiment is still predominantly negative on a bull market or positive during a bear market. During this phase, smart traders understand that a new trend is starting and either accumulate ahead of an upward movement or distribute ahead of a downward direction movement.

The second phase is called the public participation phase. During this phase, the wider market realizes a new primary trend has begun and either starts buying more assets to take advantage of upward price movements or selling to cut losses in downward movements. The second phase sees prices increase or decrease rapidly.

The final phase is called the excess phase during bull markets, and the panic phase during bear markets. During the excess or panic phase, the wider public continues to speculate while the trend is about to end. Market participants who understand this phase start selling in anticipation of a bearish primary phase or buying in anticipation of a bullish primary phase.

#BTC преодолел отметку в $120 000!#UNI surges, is DeFi boom coming?#Join Nov. Creation to share of 1,000 USDT

LikeShare

All Comments0LatestHot

No records