WLFI could enter price discovery, led by bears.

WLFI has seen massive liquidity outflows in the past day, driven by derivative investors, as overall trading volume declines. The asset could face further outflows as sentiment weakens.

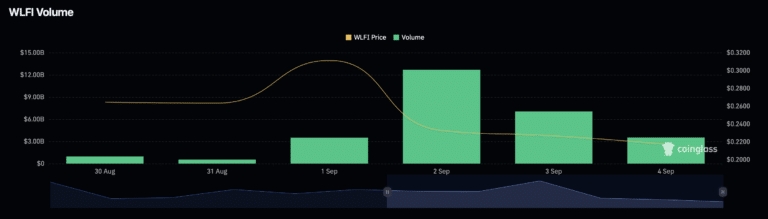

World Liberty Finance [WLFI] has been on a downtrend over the past day, leading the market decline with a 9.9% drop.

Liquidity outflows remain the major driver of the decline, with short traders taking profit while longs bear the heat.

The recent decline in WLFI, analysis shows, has been driven by derivative investors. Open Interest data indicated an outflow of $139 million in the past day, following a 20% drop.

This type of outflow from the derivatives market suggests investors are deliberately closing positions as they see the market as highly volatile and want to avoid liquidation risks.

At the same time, overall trading volume has seen a steep decline. Volume dropped by $994 million in the past day, down to $5.14 billion.

When price and volume decline simultaneously, it signals weak momentum in the market and raises the likelihood of further price drops in upcoming sessions.

All Comments0LatestHot

No records