BitBroo

08/24 16:21

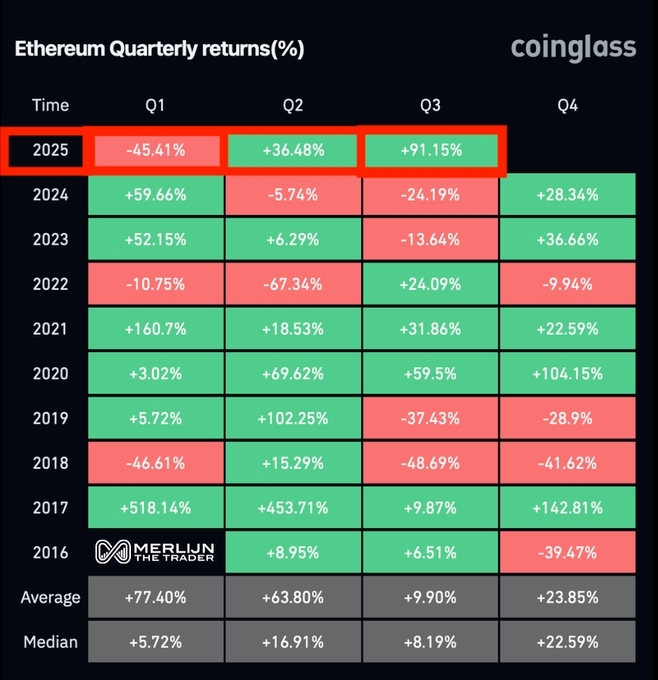

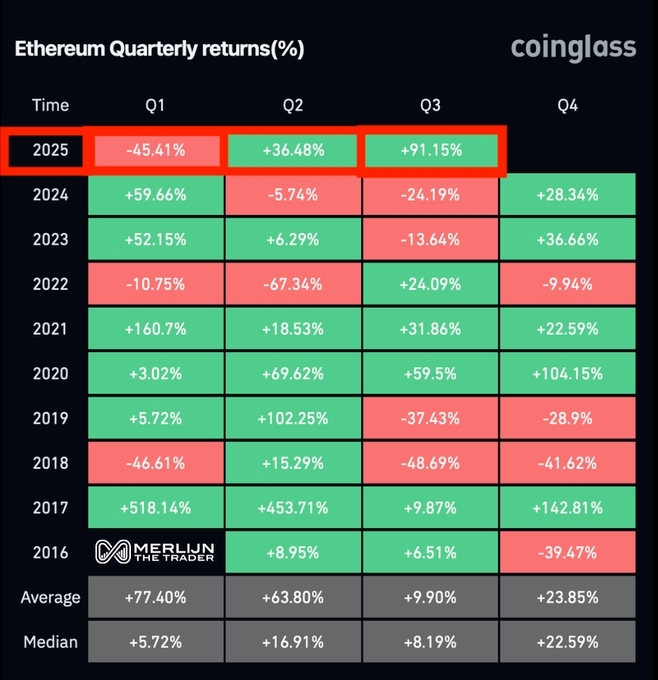

Ethereum Quarterly Returns Signal Major Momentum

Ethereum Quarterly Returns Signal Major Momentum

- Ethereum dropped 45% in Q1 2025 but rebounded strongly.

- Q3 2025 delivered an explosive 91% gain.

- Historical patterns suggest more volatility ahead.

Ethereum (ETH) has had a rollercoaster year in 2025. Investors felt the sting early, with a painful -45% drop in Q1, a classic capitulation phase that shook out weak hands. But history has shown that such heavy losses often set the stage for a major rebound — and that’s exactly what happened.

In Q2 2025, ETH bounced back with a 36% gain, marking the positioning phase. Accumulation quietly picked up as confidence slowly returned. But the biggest surprise came in Q3 — a staggering 91% rally, taking even seasoned traders by surprise.

This kind of surge isn’t just impressive — it follows a familiar rhythm in Ethereum’s price behavior: Capitulation → Positioning → Eruption.

What History Tells Us After +90% Moves

Looking back, when Ethereum delivers a quarterly return of 90% or more, the next phase usually brings continued volatility — and not a sideways drift.

These explosive quarters often act as launchpads for further momentum, whether that’s a sharp continuation or a volatile correction. Either way, the market rarely sits still after such powerful moves.

#HTX 12th-Anniversary Carnival#HTX community ✖ SUNPUMP Creator Championship#Claim1,200 USDT in the Monthly Creation Challenge

LikeShare

All Comments0LatestHot

No records