Trading King

07/30 16:04

Solana longs surge 91%, but can SOL hold above $18

Solana longs surge 91%, but can SOL hold above $180?

Solana bulls are crowding near resistance—what's next?

Solana retail bulls are crowded, which often signals market volatility if momentum stalls. With prices consolidating near key resistance levels, will bulls seize the opportunity to push it above the upper limit?

After surging to $206, Solana [SOL] has given back nearly half of its monthly gains and retreated sharply over the past week. Typically, such pullbacks would trigger renewed short interest, weakening the rally.

But instead, retail investors are going long.

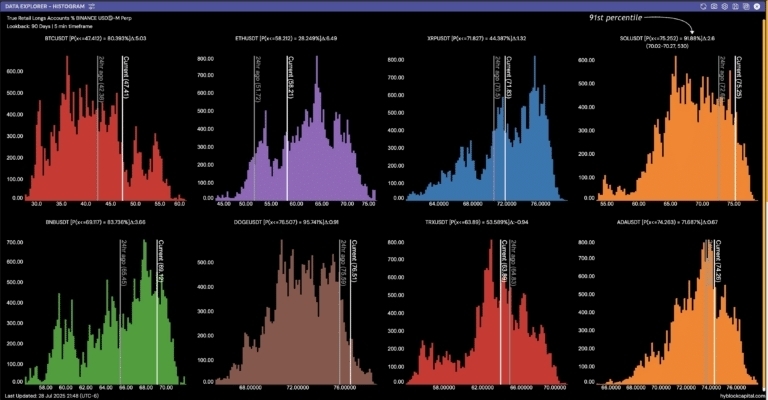

The chart shows that retail long positions in SOLUSDT are at the 91st percentile, with positions jumping from 72.68 to 75.25 in 24 hours.

This is a sharp increase in directional bias, with retail investors clearly favoring long positions.

In contrast, the rest of the market appears less nervous. For example, ETHUSDT saw only a slight increase from 57.12 to 58.21 over the same period, placing it at 28 percentage points and well below any congestion threshold.

This divergence puts Sol at a technical inflection point. The price is testing local resistance around $180, and traders have liquidated nearly 80% of their long positions over the past 24 hours.

With retail investors piling into long positions, the structure is beginning to appear top-heavy. Does this pave the way for another influx of open interest, or is it a volatility trap that will trap late-stage shorts on a breakout?

#HTX 12th-Anniversary Carnival#Justin Sun's 35th Birthday Bash#Claim1,200 USDT in the Monthly Creation Challenge#Do you think MemeCore is promising?#HTX Crypto Gifts Carnival Is Live!

14Share

All Comments0LatestHot

No records