Cryptoprinc

07/28 09:43

Open Interest Dump Could Boost SOL’s Next Move A

Open Interest Dump Could Boost SOL’s Next Move

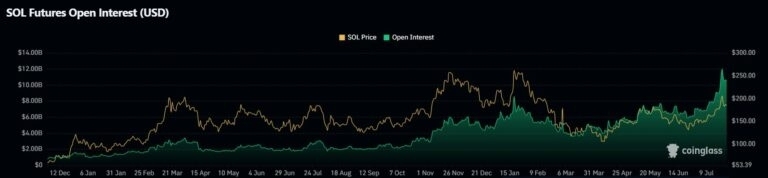

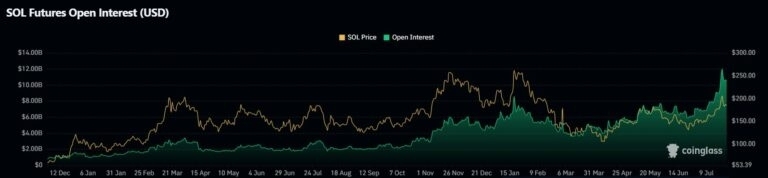

After a sharp rally to a yearly high of $12.01 billion on July 23, open interest has since declined to $10.56 billion at press time.

This flood of excess leverage showed that speculative junk is being cleared out, reducing the risk of a sharp liquidation in the event of a dip.

Despite the dip, open interest remains high, indicating strong market activity.

Dumps like these often set the stage for a more sustained rally, and with Solana shares still holding above critical support levels, we’re primed for renewed upward momentum.

#Justin Sun's 35th Birthday Bash#HTX 12th-Anniversary Carnival#ETH price breaks through $4,600, buy or sell?#Whose “child” is ES — Solana or Ethereum?#HTX DAO Listing Governance is LIVE!

LikeShare

All Comments0LatestHot

No records